Article by: ETO Markets

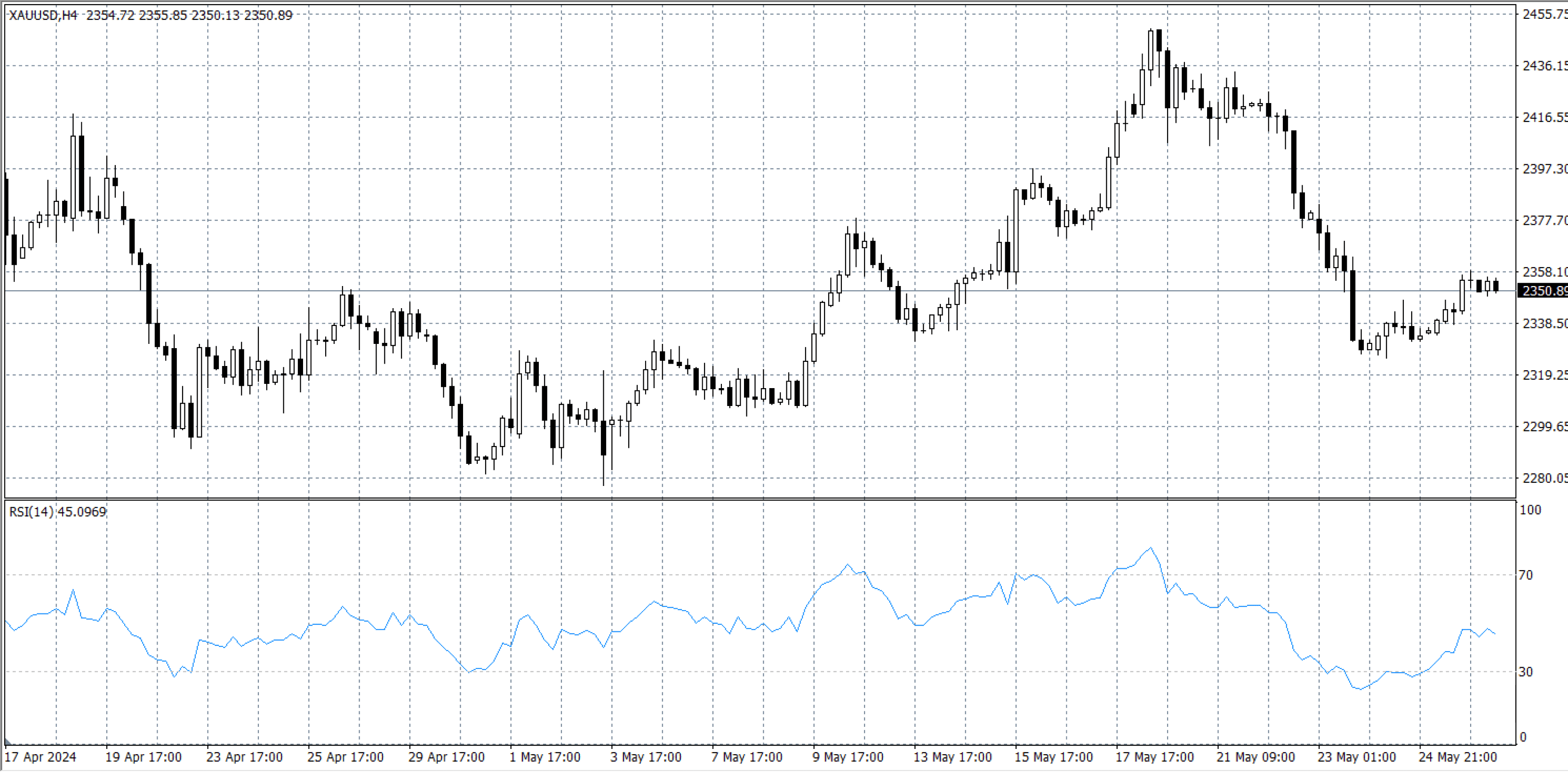

Gold prices (XAU/USD) edged higher on Tuesday, rebounding from a two-week low of $2,325. This rise is supported by a softer US Dollar (USD) and increased safe-haven demand due to geopolitical tensions in the Middle East. However, stronger short-term US Treasury yields, influenced by hawkish Federal Reserve (Fed) minutes and robust US economic data, may bolster the USD in the near term. Many traders are adopting a cautious stance ahead of key US inflation data later this week.

Hawkish comments from Fed officials and indications of persistent inflation could delay expectations for the first Fed rate cut, potentially boosting the USD and applying pressure on USD-denominated gold prices.

Key Events to Watch:

- US Consumer Confidence: Scheduled for release on Tuesday.

- Fed Speeches: Neel Kashkari, Mary Daly, and Lisa Cook will speak on Tuesday.

- Core PCE Index: The Fed’s preferred inflation gauge, due on Friday.

Gold traders should monitor upcoming US economic data and Fed commentary closely. Persistent inflation or more hawkish Fed signals could strengthen the USD, affecting gold prices. However, geopolitical uncertainties and safe-haven flows continue to provide underlying support for gold.