Article by: ETO Markets

Gold (XAU/USD) remains near its weekly high, benefiting from falling US Treasury yields and heightened risk aversion due to US President Donald Trump’s tariff threats, which bolster demand for safe-haven assets. Market sentiment is mixed as expectations for future Federal Reserve rate cuts, fueled by easing inflation and Trump’s calls for lower rates, support gold’s upside. However, the Fed’s decision to hold rates steady and signal no urgency for cuts strengthens the US Dollar, capping gains. Fed Chair Jerome Powell reaffirmed a cautious stance, stating that rates will remain restrictive until inflation and labor market conditions justify a shift. While the 10-year US Treasury yield struggles to sustain post-FOMC gains, limiting USD strength, concerns over Trump’s protectionist trade policies and their inflationary impact add to gold’s appeal. Traders now await the European Central Bank’s policy decision, which could introduce market volatility, followed by the US Personal Consumption Expenditures (PCE) Price Index on Friday, the Fed’s preferred inflation gauge, which may influence the outlook for monetary policy and gold prices.

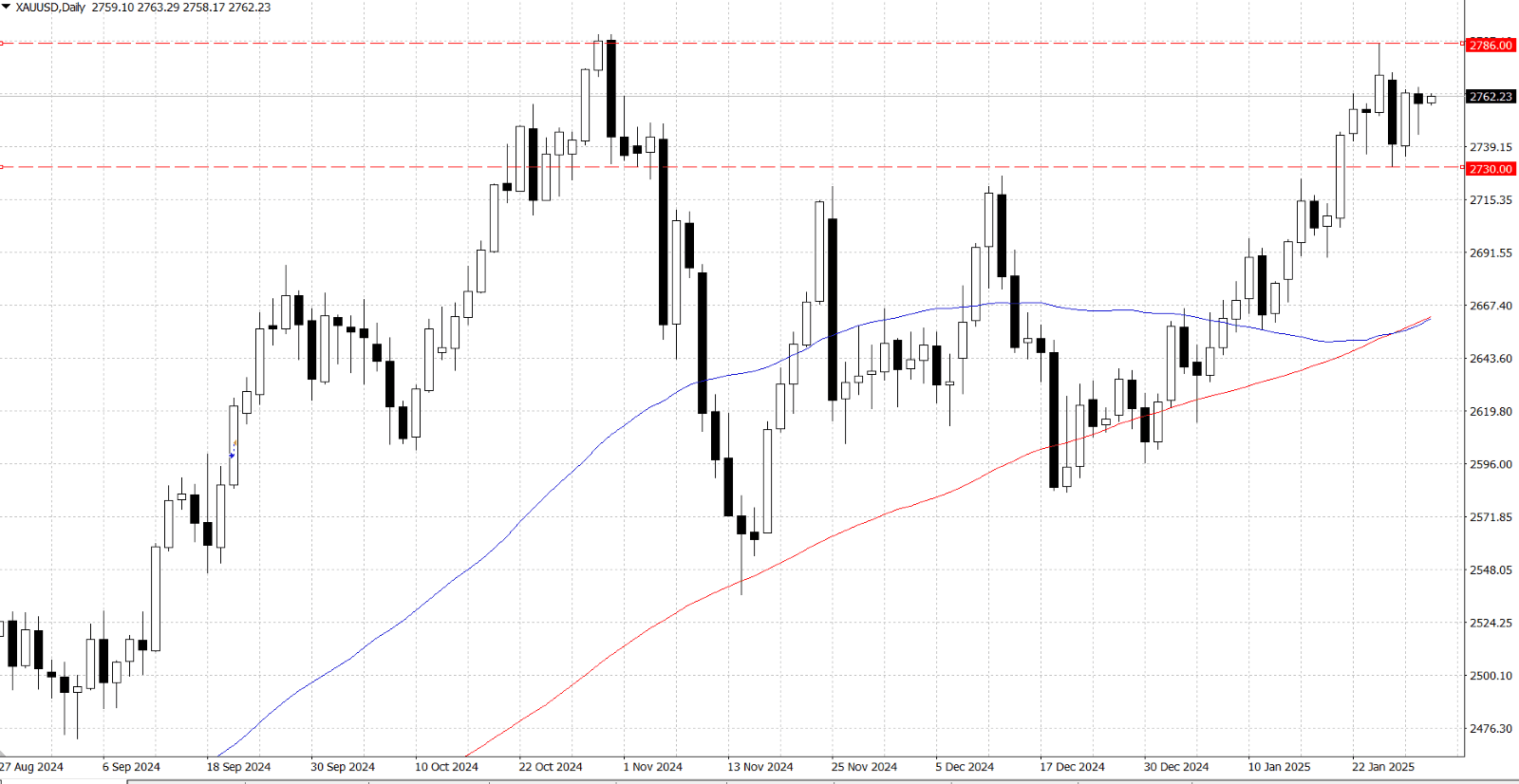

From a technical perspective, gold’s recent breakout above the $…-$… resistance zone, supported by positive daily chart oscillators, reinforces a bullish outlook. However, sustained strength above the $…-$… hurdle is needed for a move toward $…, last week’s high, with potential for further gains toward the all-time peak near $… and a breakout above $… triggering additional bullish momentum. On the downside, dips below $…-$… may offer buying opportunities, with support near $… and the $…-$… zone. A break below these levels could accelerate declines toward $…-$… and $….