Article by: ETO Markets

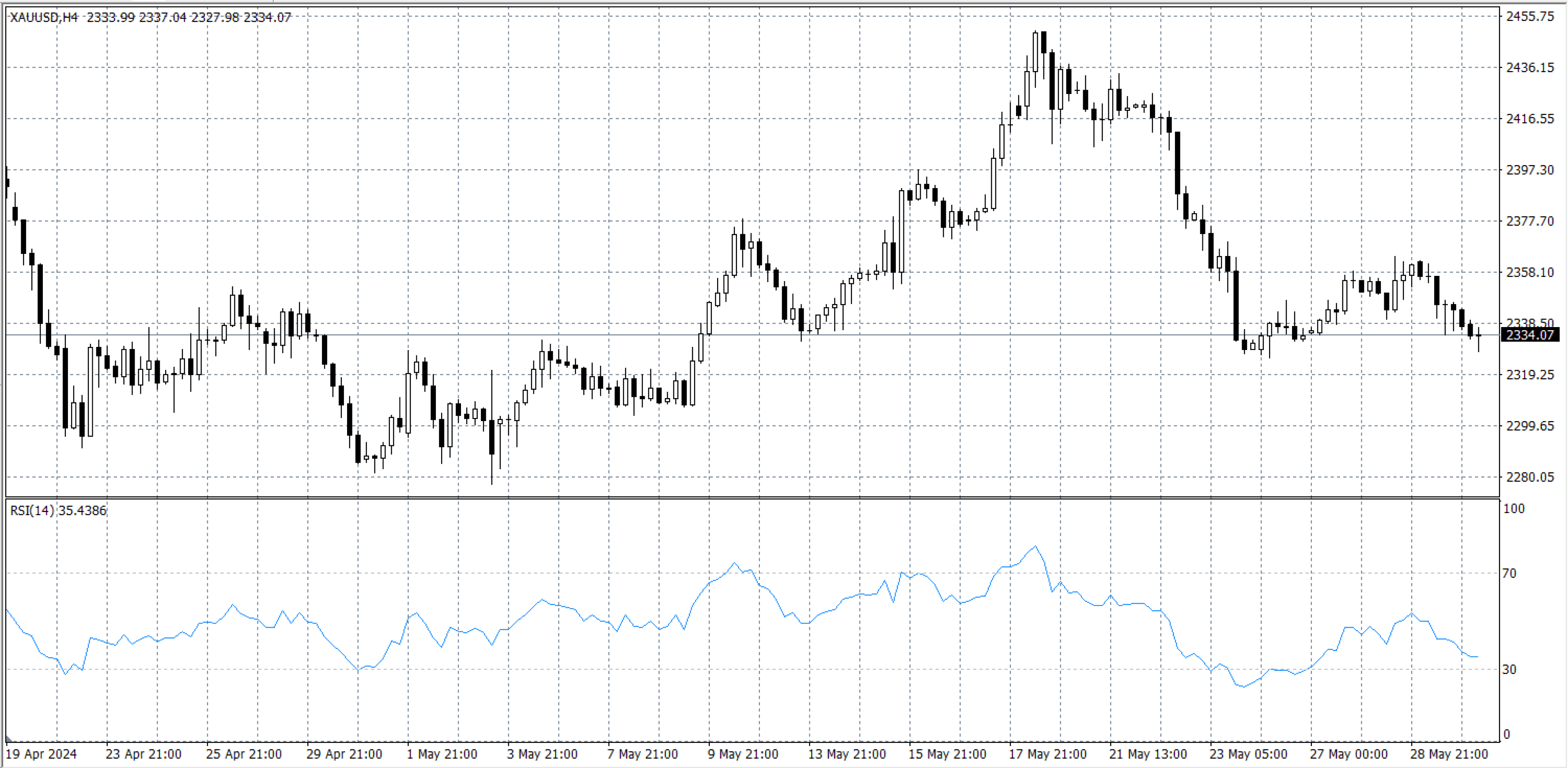

Gold (XAU/USD) is trading lower on Thursday due to a stronger US Dollar (USD) and rising US yields. The decreasing likelihood of a Federal Reserve rate cut in September is putting pressure on gold, as higher interest rates increase the opportunity cost of holding non-yielding assets like gold.

Key Factors to Watch:

1. US GDP Data: Investors are closely watching the second estimate of the US Q1 2024 GDP, due on Thursday. A stronger-than-expected GDP could boost the USD, further weighing on gold prices.

2. Geopolitical Tensions: Ongoing conflicts in the Middle East could support gold prices, as investors seek safe-haven assets during times of uncertainty.

3. Central Bank Demand: Rising demand for gold from central banks may limit the downside for gold prices in the near term.

Gold prices remain vulnerable amid strong US economic data and rising yields. However, geopolitical tensions and central bank demand may provide some support. Traders should keep an eye on US GDP data and Fed signals for further direction.