Article by: ETO Markets

From a fundamental perspective, gold prices retreated slightly during the Asian session on Thursday, mainly under pressure from a slightly stronger dollar and rising US Treasury yields. Market expectations of a smaller interest rate cut by the Federal Reserve, coupled with concerns about the US fiscal deficit, continue to support the rise in Treasury yields, which has posed an upside limit to non-yielding assets such as gold. However, with political uncertainty approaching the US presidential election on November 5 and tensions in the Middle East, gold's safe-haven demand remains strongly supported. Investors may remain on the sidelines ahead of the release of this week's PCE price index and Friday's non-farm payrolls data to get more clues about the Fed's future interest rate path, thereby better judging the further trend of gold.

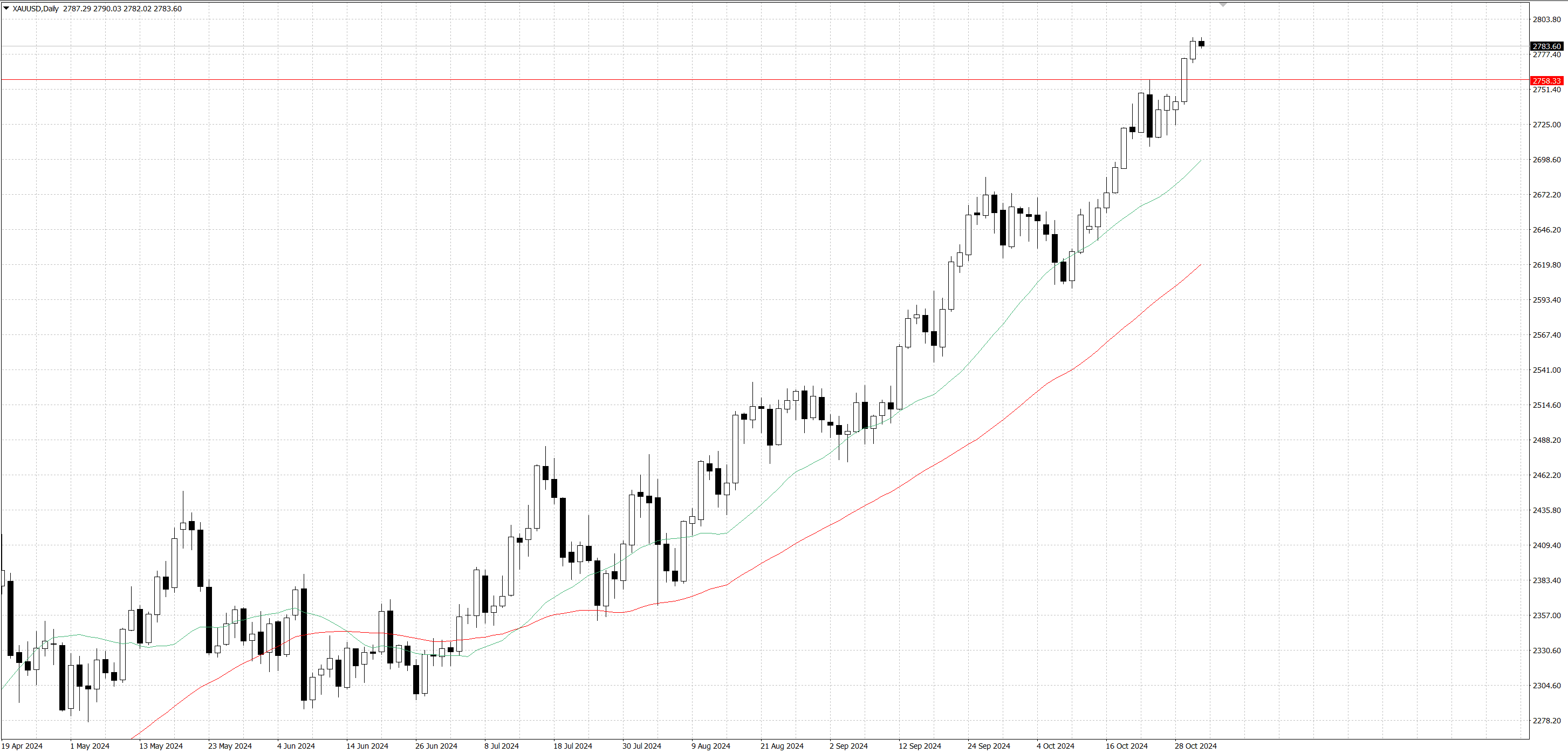

Technically, gold prices remain within the rising channel since August, showing a short-term bullish trend. However, the relative strength index (RSI) on the daily chart is close to overbought conditions, indicating that the upward momentum may be limited, especially when approaching the upper limit of the $… channel. A break above this resistance level will be a strong signal for bulls and is expected to push gold prices further higher. On the contrary, if there is a pullback, the initial support is at $…-$…, below which it may further test the $…-$… and $… support levels, followed by the $… key support level. If it falls below this level, gold may further fall to $… or even $…-$….