Article by: ETO Markets

Gold prices (XAU/USD) continue to trade with a positive bias around the $2,820 region during the Asian session on Tuesday, staying close to the all-time high reached the previous day. Safe-haven demand for gold remains strong amid investor concerns over the economic fallout from US President Donald Trump's trade tariffs, which have fueled fears of a global trade war and rising inflation. Expectations that Trump's protectionist policies could lead to higher inflation further bolster gold’s appeal as a hedge against price increases. Meanwhile, speculation that the Federal Reserve will cut interest rates twice by the end of the year supports the bullish outlook for the non-yielding metal. However, the employment and new orders indexes showed improvement, reinforcing speculation that the Fed may not rush to cut interest rates further. Comments from Fed officials highlight the uncertainty surrounding monetary policy, with warning that Trump's trade policies could delay rate cuts, while Atlanta Fed President Raphael Bostic noted that despite a resilient labor market, tariff threats create economic uncertainty. The US Dollar has also found some support, limiting fresh bullish bets on gold. Traders will now look to upcoming US economic releases, including JOLTS job openings and factory orders data, for further direction.

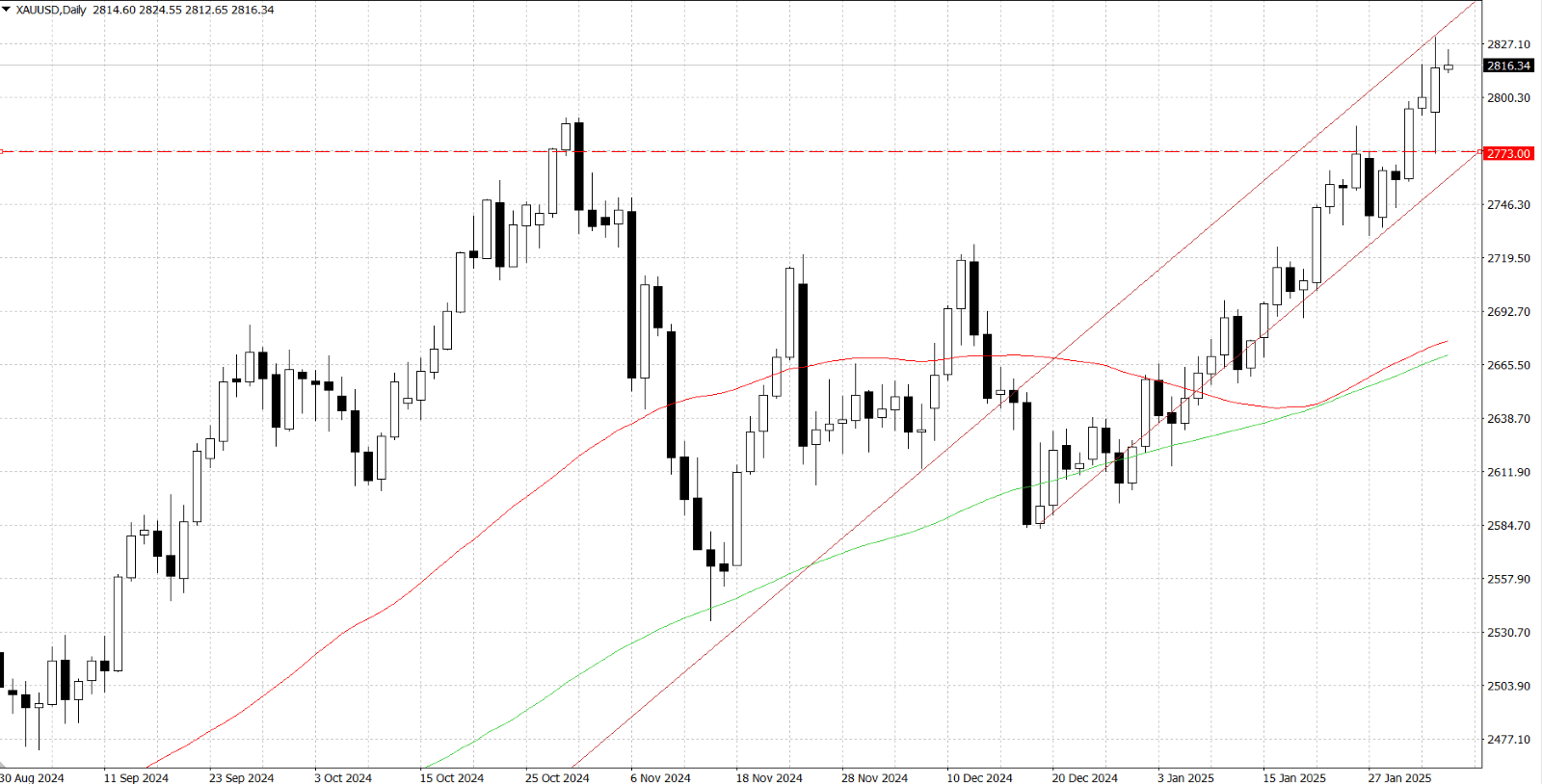

From a technical perspective, the RSI indicates slightly overbought conditions, suggesting a potential near-term consolidation or pullback. However, any dip below the $... support may be viewed as a buying opportunity, with downside limited to the $...-... zone. A break below this level could trigger further declines toward $... and potentially $...-..., with $... as a key support. On the upside, resistance is expected near $..., the recent record high, but sustained buying could extend the uptrend from the December 19th. After that, the psychological resistance level could be at $....