Article by: ETO Markets

Currency markets have been active this week amid mixed US economic data. The ISM manufacturing PMI showed a contraction in economic activity, with the index at 48.5, below the 50 level, indicating contraction, which further supported the dollar. Meanwhile, JOLTS data released on Wednesday showed the number of job openings at 8.14 million, higher than the 7.96 million expected.

The weaker-than-expected ISM services PMI supported the dovish stance of the Fed, with the market pricing in the possibility of a rate cut in September and December 2024 at 66.5% and 44.8%, respectively. The dollar index pulled back after four straight weeks of gains. The yield on the 10-year Treasury note fell 8 basis points to 4.35%, while the two-year yield also fell 3 basis points. The market is awaiting the release of the Non-Farm Employment Change on Friday, which could significantly impact the direction of the dollar. The unemployment rate is expected to fall to 3.8%, which could add downward pressure on the dollar if it misses expectations, potentially providing short-term support for the greenback.

On Wednesday, USD/JPY closed with a slight gain of 0.14%, mainly trading at 161.62, after falling to a low of 160.77 during the session. This move was largely driven by a rise in US Treasury yields, with the 10-year yield rising nearly 14 basis points to 4.479%, further widening the spread with Japan. In the short term, the yen is likely to continue weakening, but potential intervention by the Bank of Japan could provide support.

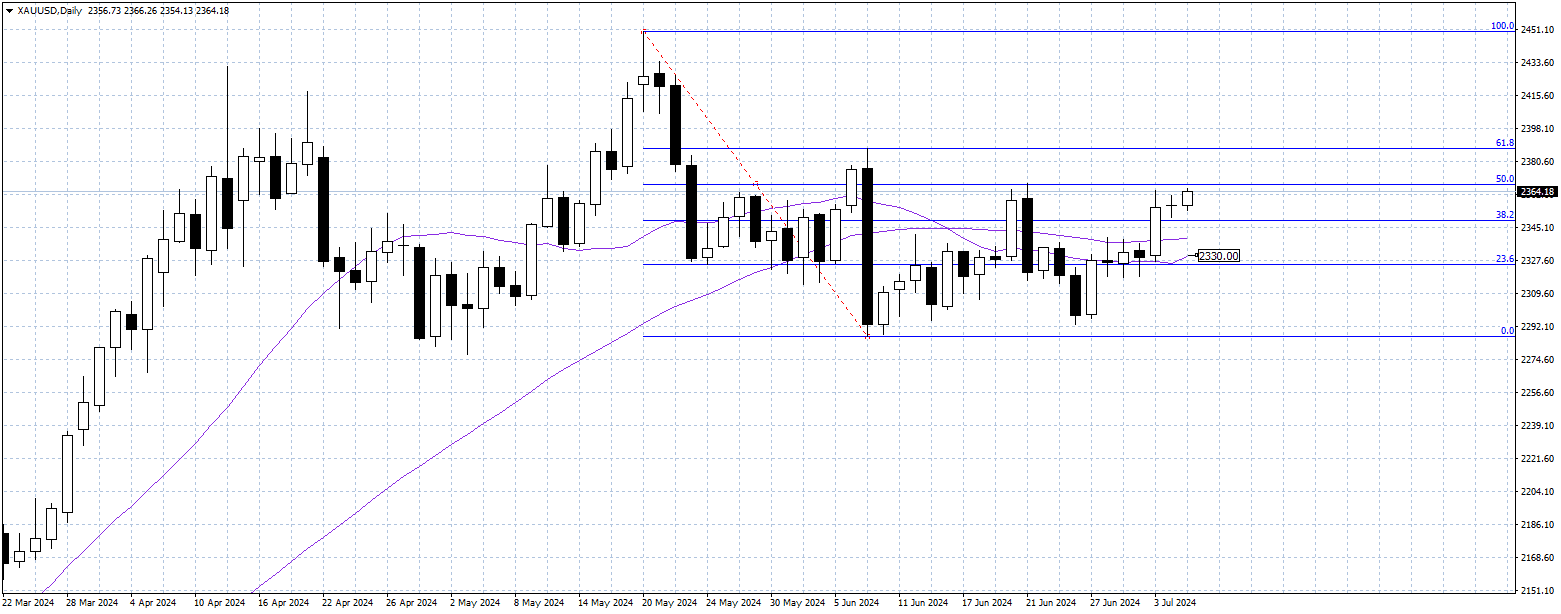

Gold prices (XAU/USD) consolidated near a two-week high, with the market focused on the upcoming release of US non-farm employment change. Recent weak macroeconomic data in the United States has increased market expectations that the Federal Reserve will cut interest rates in September and December, which has weakened the dollar and provided support for gold. Specific data showed that the ADP report added 150,000 private sector jobs in June, which was lower than expected; initial jobless claims rose to 238,000; and ISM services PMI fell to 48.8. Investors are generally taking a wait-and-see attitude, waiting for the non-farm payrolls report to decide their next move. June payrolls are expected to show the creation of 190,000 jobs; the unemployment rate remains at 4 percent; and the annual growth rate of average hourly earnings is likely to decline slightly to 3.9 percent. These data will have important implications for the Fed's policy path and further determine the direction of gold.

From technical perspective, the price of gold (XAU/USD) rose to the 50% Fibonacci retracement level of $… during the Asian trading session on Friday. The next resistance level is the June 7 high of $…, which also corresponds to the 61.8% Fibonacci retracement level. The Relative Strength Index (RSI) at 56 indicates that there is potential for further upside movement. For gold sellers to push the price back into a bearish trend, they need to break below the 20-day Simple Moving Average (SMA) at $… to attract new sellers.

This week, WTI crude oil prices held firmly above $82.00, supported by a sharp drawdown in U.S. crude inventories and geopolitical tensions. The U.S. Energy Information Administration reported that crude inventories fell by 12.16 million barrels last week, much more than expected, indicating strong demand. U.S. economic data was weak, with an ADP report showing the private sector added 150,000 jobs in June, less than expected. Initial jobless claims rose, and the ISM services PMI fell to 48.8. The data increased market expectations of a Federal Reserve rate cut, causing the dollar to weaken and providing support for oil prices.

The technical level shows that the price of WTI crude oil is running above $…, with a clear upward trend. The current price is above $…, and a break above $… could lead to further gains towards $…. On the downside, initial support is at $…, a break below which could test $… or a drop to the 200-day moving average to around $….