Article by: ETO Markets

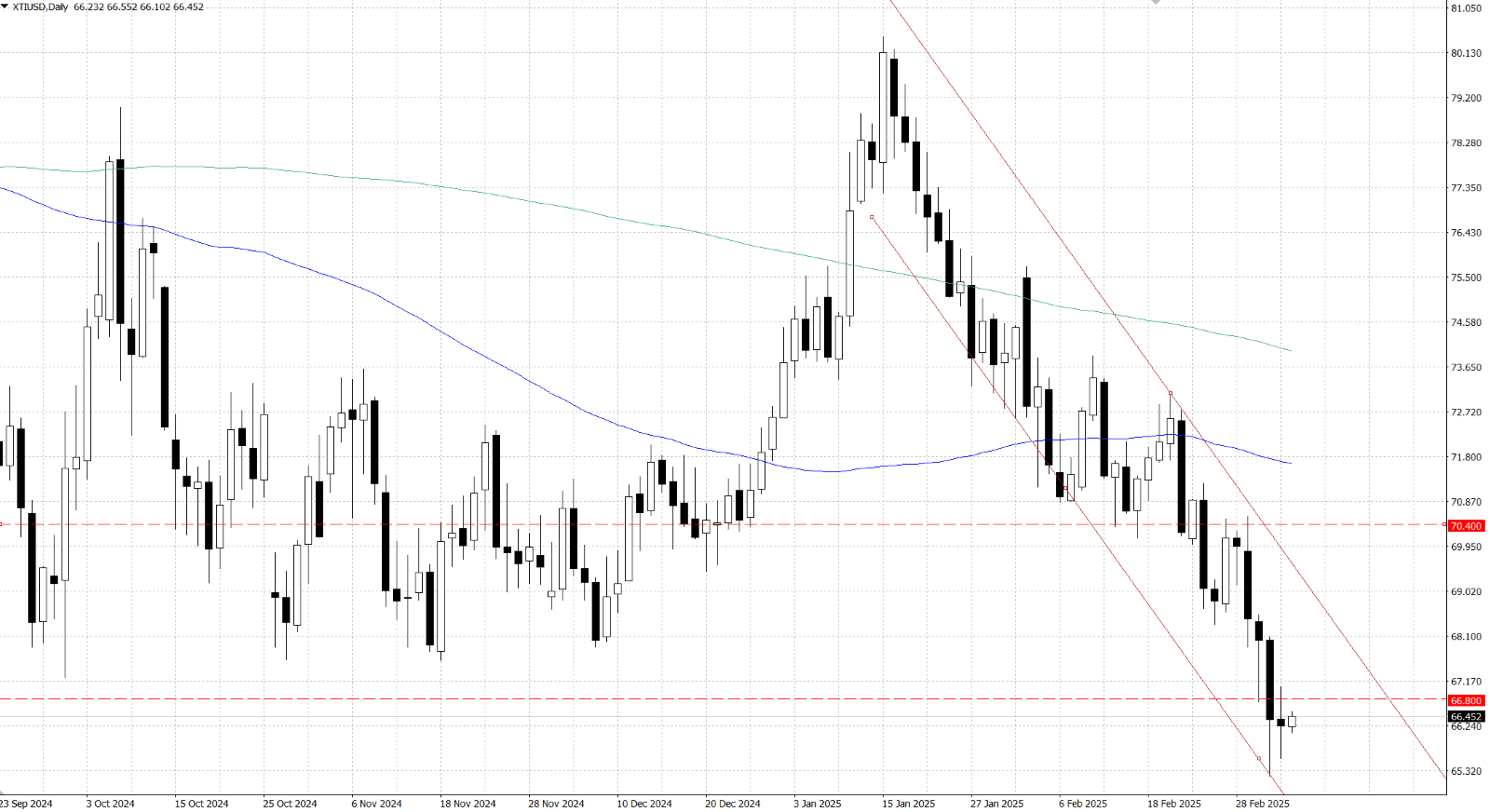

In the oil market, oil prices are maintaining their bearish momentum this week amid a confluence of mixed US market signals, escalating trade tensions, and supply-side pressures. On the demand front, the US oil market presents conflicting data: Baker Hughes reported a modest decline in active rigs—signalling a potential shift away from the previous five-week upward trend—while divergent inventory reports, with API noting a sharp drawdown against the EIA’s surprising build, have raised concerns about future demand. Simultaneously, escalating trade wars, marked by President Trump’s imposition of a 25% tariff on imports from Mexico and Canada (and additional duties on Chinese goods) coupled with retaliatory measures from Canada, have heightened worries about dampened economic activity, potentially curbing oil consumption. On the supply side, OPEC+ has signaled a move to increase production gradually starting April 2025, a decision that could further add to the bearish outlook if implemented. Complementing these fundamental factors, technical analysis of the WTI daily chart underscores the prevailing downward pressure, reflecting a market bracing for further declines unless mitigating factors—such as easing trade disputes or a more consistent demand signal—emerge.

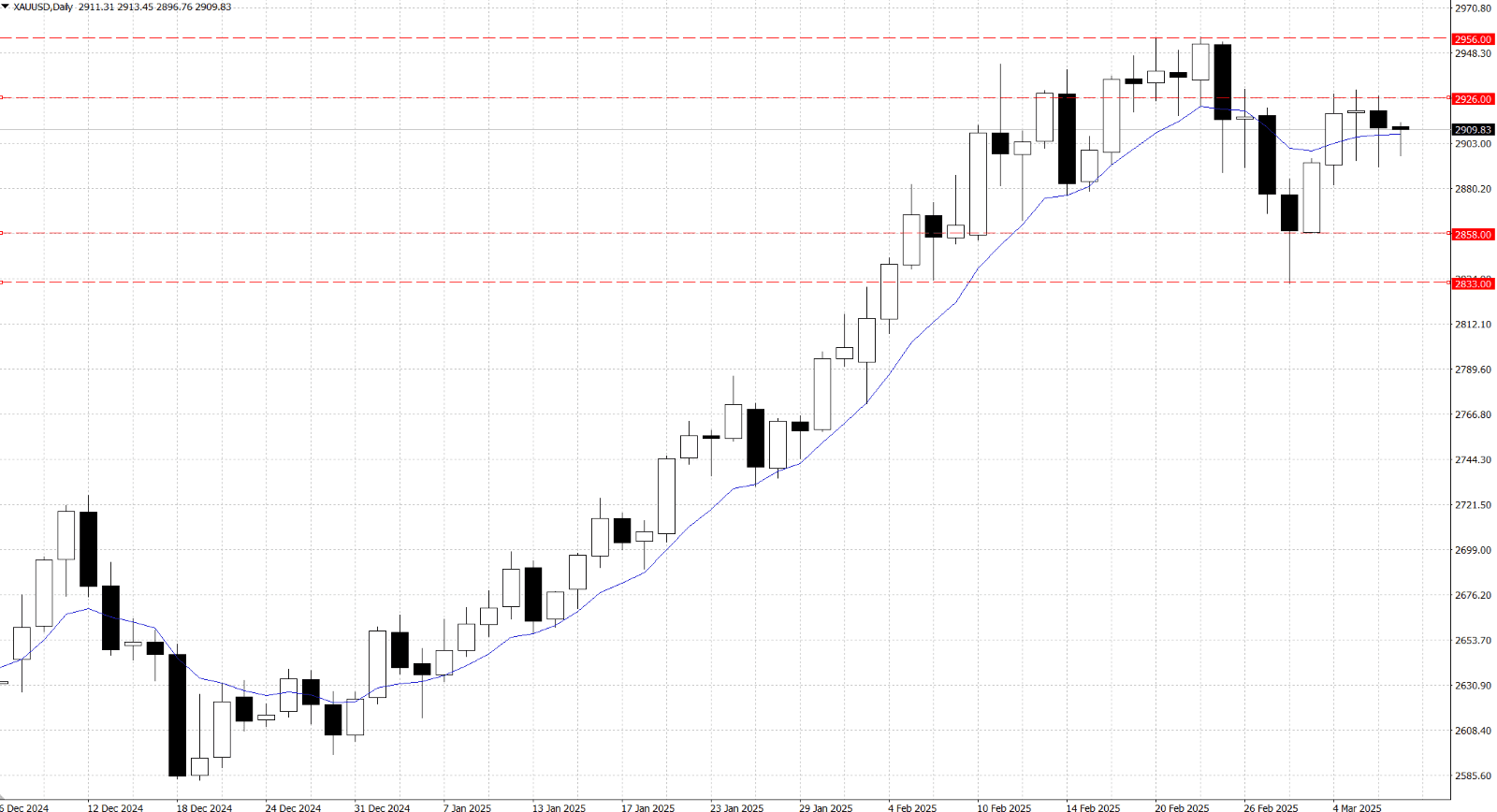

Gold prices have managed to hold above the $… mark during the Asian session on Friday despite a lack of strong buying interest, as traders remain cautious and await the crucial US Nonfarm Payrolls (NFP) report. This key employment data is expected to influence near-term US Dollar dynamics and potentially provide fresh momentum to gold. Meanwhile, growing concerns over a slowing US economy have spurred expectations that the Federal Reserve might implement multiple rate cuts in 2025, which has helped depress the dollar to near multi-month lows. Investor sentiment is further weighed down by uncertainties surrounding US President Donald Trump's trade policies—highlighted by his recent move to temporarily exempt Canadian and Mexican goods compliant with the US–Mexico–Canada Agreement from steep 25% tariffs—thereby reinforcing gold’s appeal as a safe-haven asset. Comments from Fed officials, including warnings of economic threats and inflation risks, along with a better-than-expected drop in US Initial Jobless Claims to 221K, have added to the overall cautious market outlook as traders brace for the upcoming employment data.

From a technical standpoint, Gold has been resiliently hovering below the $… level, signalling a cautious stance for bearish traders as positive daily oscillators continue to support the commodity. The price may fail to hold this key level, it could slide towards the $… range, with intermediate support around $…, and potentially test last week’s swing low near $… before ultimately falling toward the $… mark. Conversely, an upward breakout past the immediate hurdle of the $…–…zone could pave the way for a retest of the all-time peak around $…, which was last seen in February. Such a move, accompanied by follow-through buying, would likely trigger renewed bullish momentum and resume the three-month uptrend observed in recent trading sessions.

West Texas Intermediate (WTI) is trading around $… during the early Asian session on Friday, hovering near a three-year low as market sentiment is dampened by tariff uncertainties and rising supply pressures. Despite President Trump's recent executive order exempting Canadian and Mexican goods under the USMCA from the imposed 25% tariffs—an effort that might offer temporary relief—the overall uncertainty surrounding these tariffs continues to undermine prices. Adding to the bearish outlook, US crude inventories surged by 3.614 million barrels for the week ending February 28, a stark contrast to both the previous week's decline and market expectations of a slight drawdown. Moreover, OPEC+ has decided to increase output for the first time since 2022, a move that energy analyst Scott Shelton of TP ICAP warns could compound the downside risks on oil demand. Market participants are now turning their attention to the upcoming US employment report for February, including Nonfarm Payrolls, the Unemployment Rate, and Average Hourly Earnings, as a weaker-than-expected outcome could further weaken the US Dollar and potentially support oil prices in the near term.

From a technical perspective, WTI has trended lower with its price now turning resistance at the $… level. The current bearish sentiment is reinforced by an RSI reading near 30 and a downtrend line established through one month. For the bearish case to persist, the price would need to break below the $… support level, potentially targeting the $… next level. Conversely, a bullish reversal would require a clear break above the $… resistance, with the next target being $…. Alternatively, a sideways market would develop if the price remains confined between the $… support and the $… resistance levels.