Article by: ETO Markets

Sentiment in currency markets this week has suggested that fears of a US recession have eased. Still, traders widely expect the Fed to cut rates by 50 basis points at its September meeting. The latest ISM services PMI report, which showed the US economy continues to grow at a healthier pace, provided some comfort to market participants. However, the market's attention was focused on the upcoming jobless claims data. It is expected to fall to 240K from 249K previously, which will give further clues on the state of the US economy.

In addition, Richmond Fed President Thomas Barkin will officially take office on Thursday, which has the market's attention. Despite last week's decision to leave interest rates unchanged, the Fed said it could act if future inflation data held up well and the labor market weakened further. According to the CME FedWatch tool, there is a 63.5 percent chance that the Fed will cut rates by 50 basis points at its September meeting, down slightly from 68 percent a day earlier. This expectation has put some pressure on the dollar, while having an impact on market sentiment.

Geopolitically, tensions in the Middle East have also had an important impact on the forex market. The conflict between Israel and Hamas has intensified, and U.S. intelligence has warned that Hamas could retaliate against Israel. In addition, Iran's relations with Israel are strained, and Egypt has advised its airlines to avoid Iranian airspace. These geopolitical risks have increased the market's safe-haven demand, driving up the price of safe-haven assets such as gold. However, despite the increase in risk aversion, the market's focus on the US economic data and the Fed's policy path remained the main factors influencing the FX market.

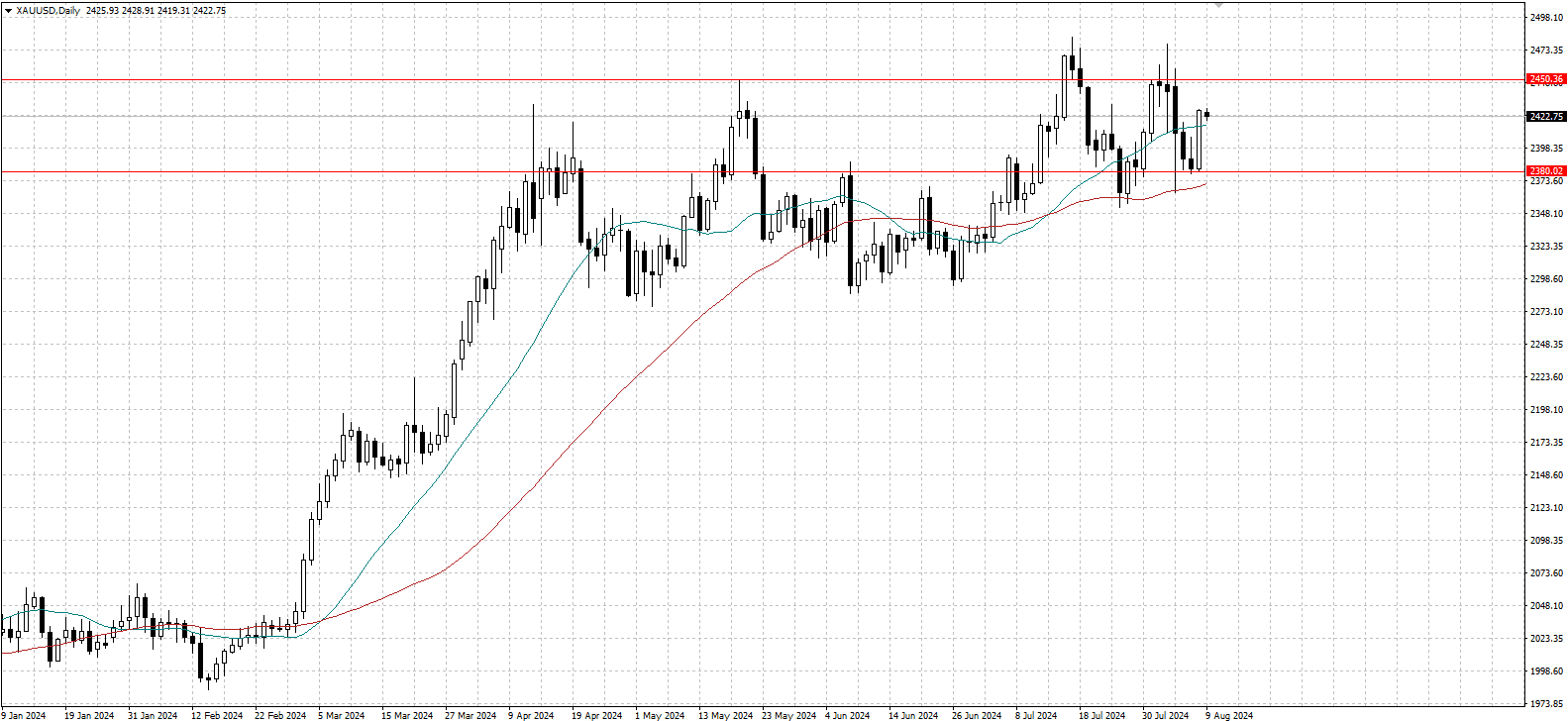

Gold prices fell slightly in Asian trading on Friday, giving up strong gains of nearly 2% the previous day. Still, a number of factors are expected to limit further declines in gold. The positive tone in global equity markets has dented demand for safe-haven assets, putting gold under pressure. However, expectations that the Fed could cut interest rates by 50 basis points in September, as well as ongoing geopolitical tensions in the Middle East, could provide support for gold prices. In particular, the risk of retaliatory attacks triggered by the assassination of the Hamas leader in Tehran further increased risk aversion in the market. In addition, the moderate strength of US Treasury yields and the US dollar also put some pressure on gold. However, with the Federal Reserve widely expected to cut interest rates in September and recession fears easing, these factors are expected to support gold prices. Investors are now closely watching U.S. consumer inflation data next week, which will provide important guidance on the Fed's next monetary policy move

From a technical point of view, gold has found support near the 50-day simple Moving average (SMA) and is showing bullish signs. Oscillators on the daily chart are also starting to regain positive momentum, indicating that the path of least resistance for gold is upward. If gold can break through the $…-… zone, further gains to the all-time high of $…-… hit in July, or even the psychological $… level, are possible. Conversely, if gold breaks below the $…- $… support level, the round $… mark below and the $…-… area near the 50-day SMA will be key support areas. These support levels could attract bargain hunters and limit further declines in gold prices. If these support levels break down, gold could push further down to last week's lows in the $…-… area and possibly even test the 100-day SMA support at the $… area.

This week, West Texas Intermediate (WTI) prices rose to near $75.10 in Asian trade on Friday, largely benefiting from a sixth straight weekly decline in U.S. crude inventories and positive U.S. jobs data. According to the weekly report from the U.S. Energy Information Administration (EIA), U.S. crude oil inventories fell by 3.728,000 barrels in the week ended August 2, exceeding market expectations for a 400,000-barrel decline. This continued inventory drawdown reflects strong domestic demand for crude oil in the United States, which has provided support for WTI prices.

In addition, U.S. jobless claims data on Thursday pointed to improving labor market conditions, reducing concerns about economic weakness. Data showed 233,000 Americans filed for unemployment benefits in the week ended August 3, below market expectations of 240,000. The improvement in this data has boosted market confidence and brought upward momentum to WTI prices

From a technical point of view, WTI prices are currently consolidating above $…, showing some support. In the short term, if the price can sustain a break above the $… mark, the next target may be the upper resistance level of $… Bollinger band mid-track area. However, affected by weak demand in China and easing geopolitical risks, WTI prices may face downward pressure. If the price breaks below $… support, further downside targets point to the key support area near $….