Article by: ETO Markets

The Japanese yen gets some momentum and somewhat recovers from its recent steep losses, which have brought it to its lowest level since November 2023 when compared to the US dollar the day before. The Bank of Japan is reportedly considering raising rates in July, although an increase in October is thought to be the most likely. Furthermore, the positive domestic data gives the JPY a little boost despite rumours that Japanese authorities may step in to stop any further decline in the value of the national currency. The USD/JPY pair is heavily pressured downward by this as well as the selling bias in the US dollar following the FOMC meeting.

the Australian dollar gained ground for the second straight day, most likely helped by encouraging jobless figures out of Australia. In parallel, the Federal Open Market Committee's decision to keep interest rates at 5.5% during Wednesday's policy meeting resulted in a notable decrease in the value of the US dollar. The AUD/USD pair gained support from this decision. The US Federal Reserve Chair Jerome Powell's dovish statements during the press conference following the meeting further put further negative pressure on the currency.

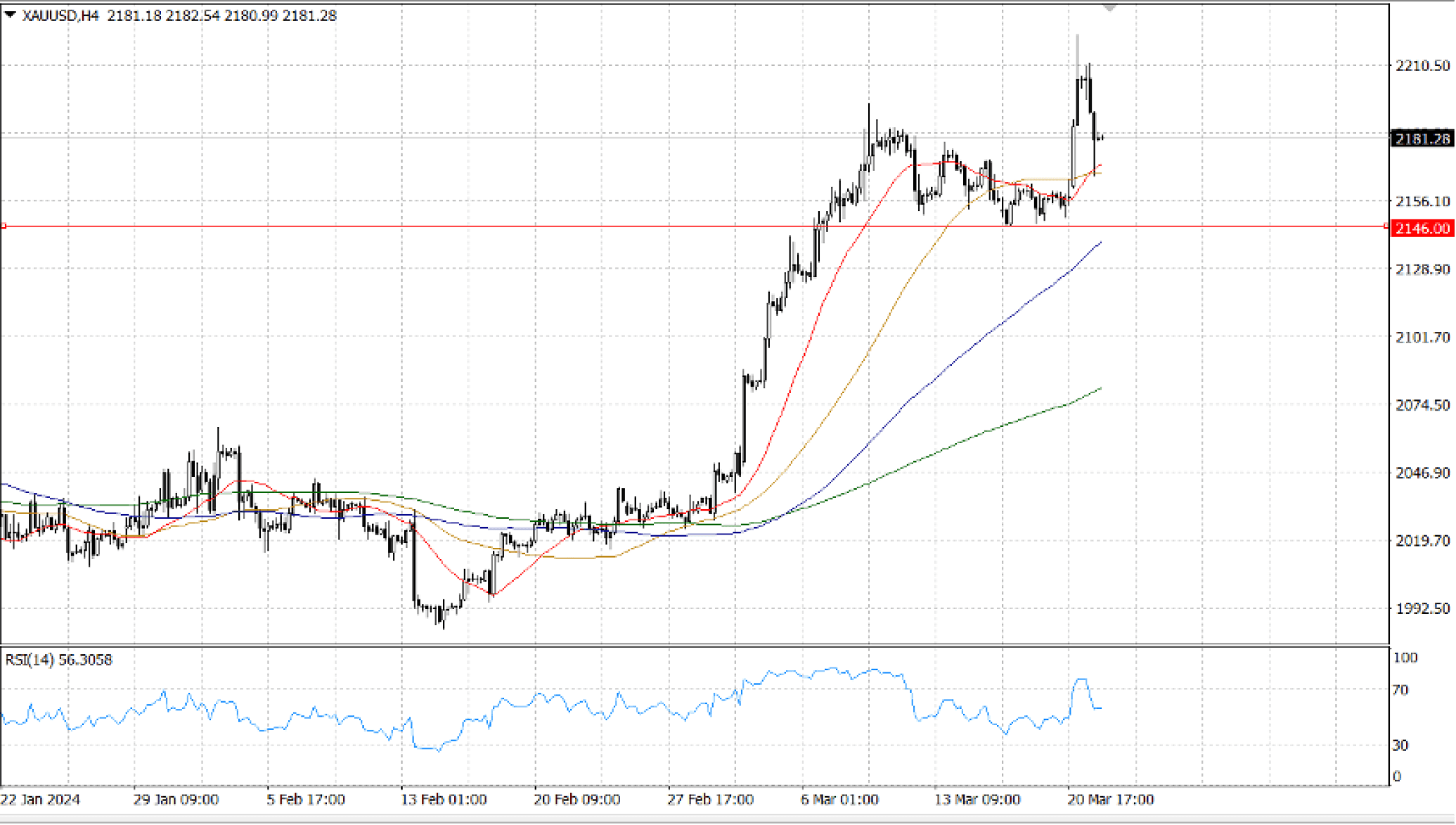

After setting a new record high earlier on Thursday, the price of gold declines but remains positive for the second day in a row, trading just over the $2,200 round-figure mark in the first part of the European session. Profit-taking in the safe-haven precious metal is prompted by the broad risk-on climate, which is reflected in the generally bullish tone surrounding the equity markets. In addition, the commodity is being undermined by a tiny increase in the yields on US Treasury bonds, which is occurring in the context of somewhat overbought conditions on short-term charts.

As sellers entered the market, the price of XAU/USD dropped below $… and is now below the previous all-time high of $... But before they can test the $… mark, they need to push prices back near the high on December 4, which turned into support at $... Conversely, if buyers drive prices up to $…, they will be forced to confront the all-time high of $… before attempting to reach $...

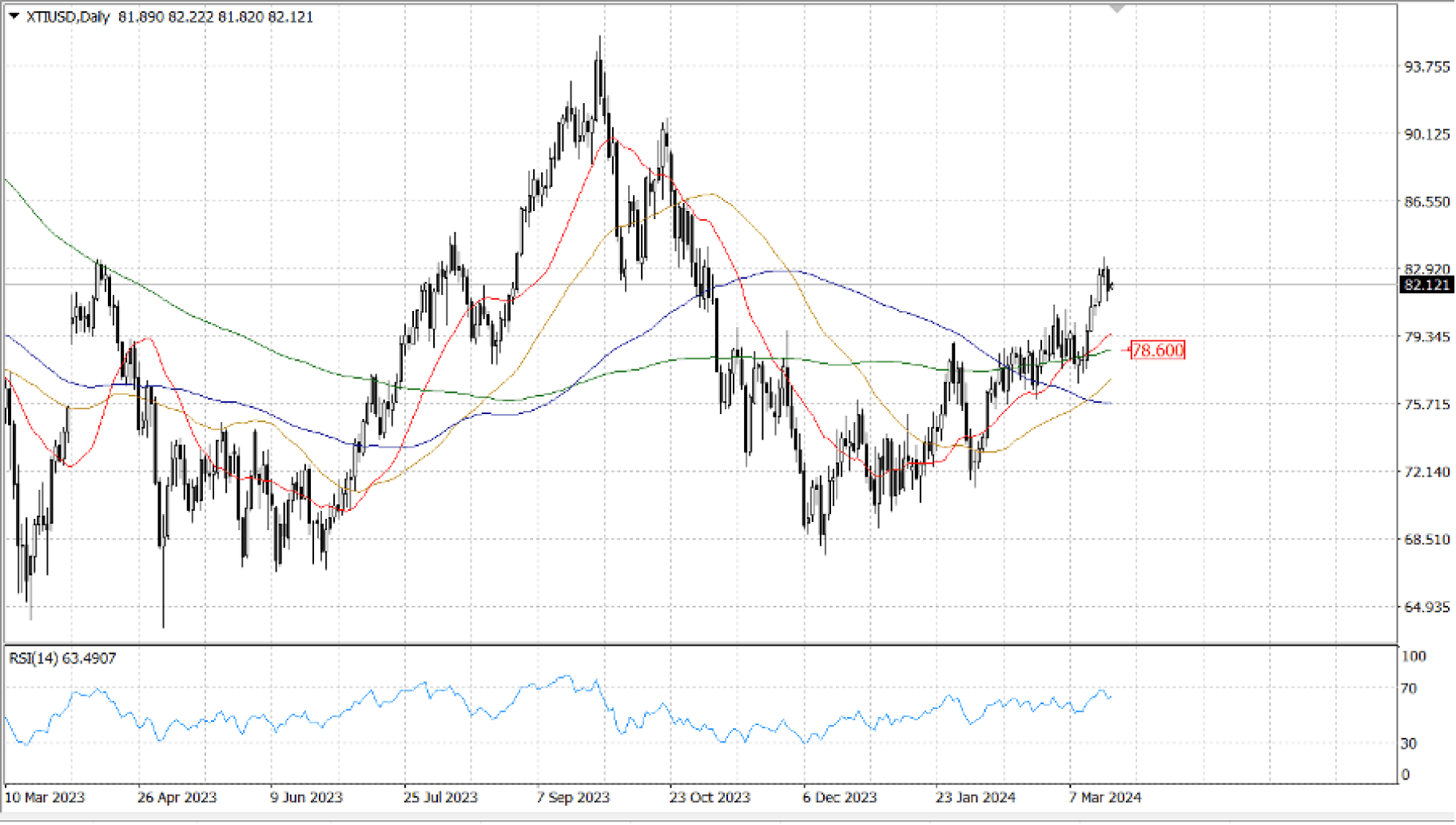

After the conclusion of its March policy meeting on Wednesday, the Federal Reserve maintained its projection of three interest rate reductions this year. This is perceived as weakening the US dollar and boosting the price of commodities denominated in USD, such as crude oil. Additionally, Fed Chair Jerome Powell highlighted the health of the US economy, which is encouraging for the demand for oil and provides additional support for the black liquid.

For oil bulls, the next cap will show up at $... Ascending further, $… does likewise, with $… and $… as the ultimate targets. As for the downside, the 200-DMA is the key to catch any falling knives around $…, and both $… and $… should be functioning as support at this point.