Article by: ETO Markets

This week, the foreign exchange market has been significantly influenced by the expectation of a rate cut by the Federal Reserve. The Fed is widely expected to cut rates by 25 basis points at its September meeting. The Chicago Mercantile Exchange's Fed-Watch tool shows a 100 percent chance of a rate cut. That expectation has prompted investors to adjust their portfolios, boosting the dollar. Although the dollar index (DXY) has fluctuated this week, it has generally maintained a relatively strong position.

A slew of U.S. economic data this week has been mixed. S&p Global's services and composite PMI for July came in at 56 and 55, respectively, both beating expectations, while the manufacturing PMI fell to 49.5 from 51.6, below expectations of 51.7. The U.S. goods trade account for June is estimated at -$96 billion, an improvement from -$99.4 billion the previous month but still below market expectations of -$98 billion.

U.S. gross domestic product, meanwhile, is expected to grow 1.9 percent quarter-on-quarter, up from 1.4 percent in the first quarter. The data suggest an acceleration in US economic growth. In addition, the core personal consumption expenditures (PCE), which the Fed watches, is expected to decline from 2.6% to 2.5% year-on-year. The data reflect the resilience of the U.S. economy in some areas but also point to weakness in manufacturing and easing inflationary pressures.

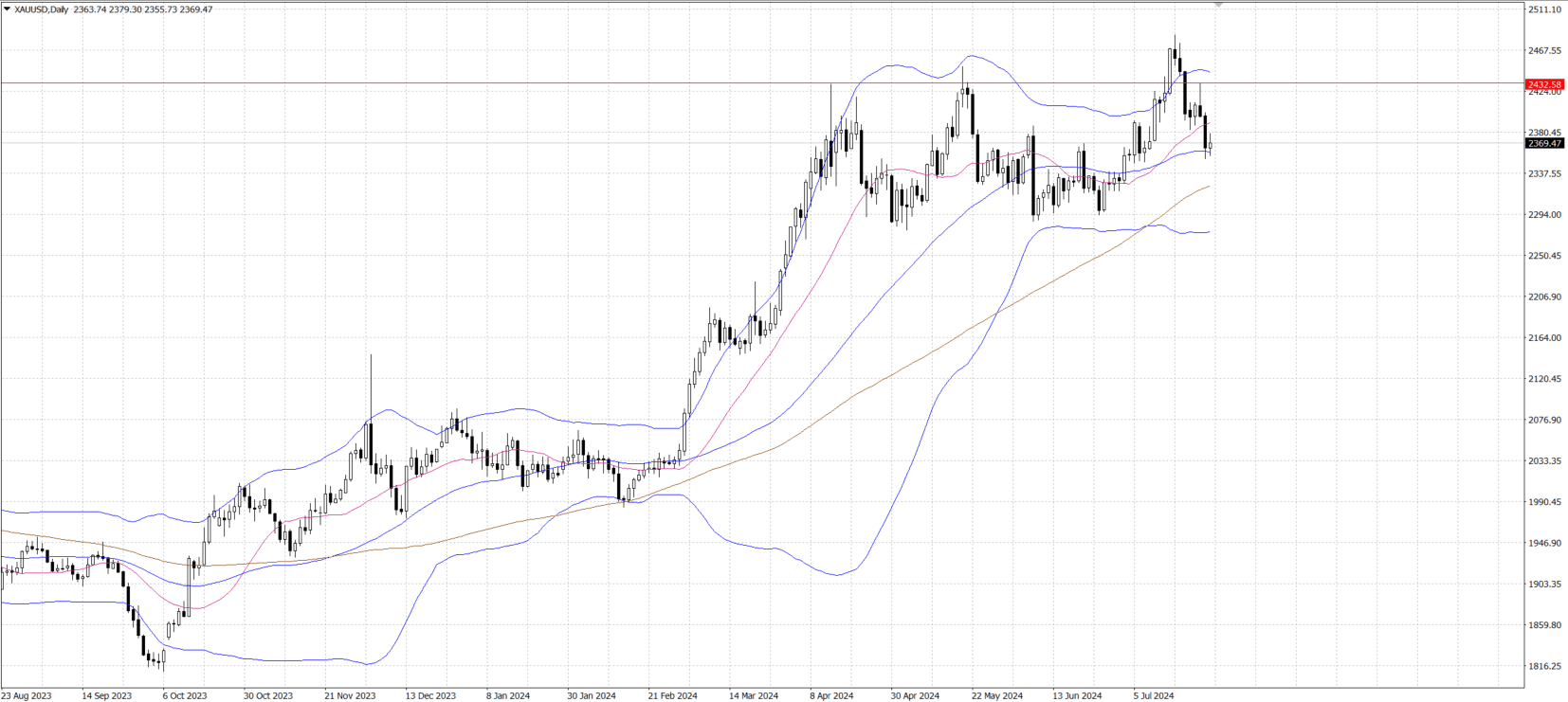

Global risk factors and geopolitical events have also had an important impact on the forex market. The US-China trade war, the Russia-Ukraine war, and the ongoing conflict in the Middle East have added to market uncertainty and prompted investors to seek safe haven assets. That sentiment has driven demand for safe-haven assets such as gold, which has held above $2,400 this week.

U.S. macroeconomic data released on Thursday beat expectations, sending gold prices to their lowest in more than two weeks. In the second quarter, GDP grew at an annualized rate of 2.8%, up from 1.4% in the first quarter. At the same time, the core personal consumption expenditures (PCE) price index, the Fed's preferred inflation measure, slowed to 2.9% from 3.7% in the first quarter. The number of Americans filing for unemployment benefits also fell to 235,000, below market expectations. Still, the dollar has weakened on expectations that the Fed will start cutting interest rates in September and make two more cuts before the end of the year, which has provided some support to gold prices. Traders are now looking to the upcoming U.S. PCE price index for June for more clues on the Fed's policy path, which could determine the short-term direction of gold.

From a technical point of view, gold prices are showing some rebound below the 50-day simple moving average (SMA), temporarily ending a two-day losing streak. However, the volatility indicator on the daily chart has just begun to turn negative, indicating greater downward pressure on gold prices. A break below the previous day's low of $… would confirm a continuation of the recent corrective decline. On the downside, key support lies in the $… - $… area near the 100-day SMA, and a break below this area could lead to a further dip to levels below $… or June lows. On the upside, gold needs to break through resistance in the $… area, followed by strong resistance at the $…-… and $… levels. A break through these resistance could see gold recover to its weekly high of $….

On Friday, West Texas Intermediate (WTI) crude oil prices rose slightly during Asian hours and currently remain above $78 per barrel. Still, crude prices were on track for a third straight weekly decline. Better-than-expected US gross domestic product data released on Thursday boosted demand expectations in the world's largest fuel consumer and was a key factor driving crude prices higher. In addition, the Federal Reserve is widely expected to start cutting interest rates in September, which has kept the dollar weak, further supporting crude prices. However, concerns about slowing economic growth in China have kept a lid on any significant rise in oil prices. The concern stems from data released last week showing that China's economy grew less than expected in the second quarter. As a result, traders stayed on the sidelines ahead of the release of the US Personal consumption expenditures (PCE) price index, waiting for more clear market signals.

From a technical point of view, WTI rebounded after finding support in the $… area and is currently hovering around $…. However, crude oil prices remain below the 200-day simple moving average (SMA), indicating caution for further gains. In the short term, an effective breakout and a firm position near $… above the 200-day SMA would pave the way for further gains. Conversely, if WTI fails to break through the $… mark, it may face pullback pressure. The key support level below is in the $… area, and a break below this level could trigger another round of selling.