Article by: ETO Markets

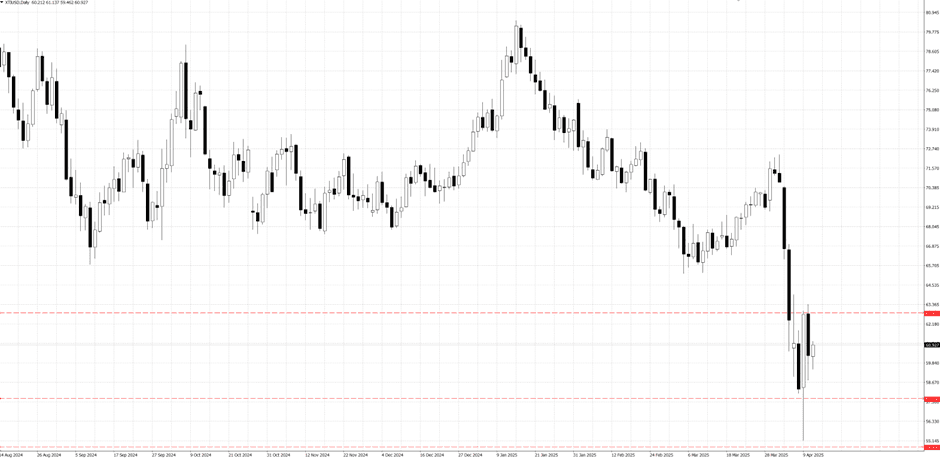

The recent oil market developments reflect a complex interplay of geopolitical and supply-demand factors. Initially, oil prices plummeted to levels last seen during the pandemic, driven by global economic concerns and particularly by the impact of Trump's tariffs that cast doubt over the future demand for oil. These tariffs, which initially threatened to undermine market sentiment by imposing steep charges on various imports and provoking retaliatory measures, have since been partially eased with a 90-day pause on many of the additional tariffs—though the blanket 10% tariff remains—allowing a short-term price correction amid ongoing trade tensions. Concurrently, OPEC+ had signaled an intent to increase production by 411,000 barrels per day in May, a move expected to intensify market oversupply pressures; however, production shortfalls in key member countries like Iran, Nigeria, and Venezuela have moderated this potential excess, even as Kazakhstan's record production has added nuance to the supply picture. In the United States, the industry has sent mixed signals: an uptick in active rigs and an unexpected drawdown in inventories pointed to rising demand, while a later report of a smaller-than-expected inventory draw suggested that production still outpaced consumption. These divergent indicators underscore the delicate balance influencing oil prices, with future market moves hinging on further developments in trade policy, OPEC production trends, and domestic US oil dynamics.

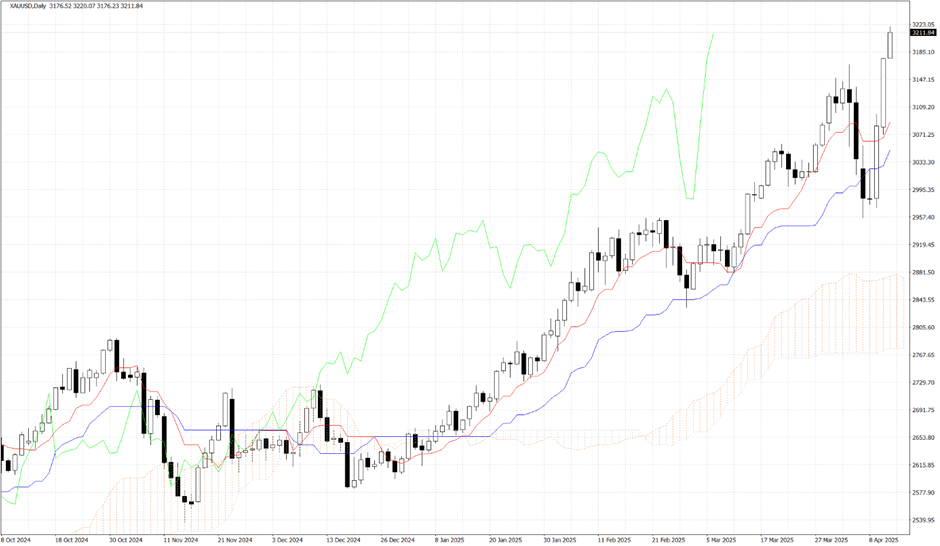

Gold prices have rocketed higher, smashing through the $3,200.00 mark to post fresh record highs, driven primarily by escalating US-China trade tensions and growing expectations for US Federal Reserve interest rate cuts. Concerns surrounding US economic stability, fuelled by the imposition of a confirmed 145% effective tariff rate on Chinese goods and China's retaliatory measures, have significantly dented the US Dollar and bolstered gold's safe-haven appeal. Softer-than-anticipated US March Consumer Price Index (CPI) data further solidified market bets on aggressive Fed easing, adding considerable upward thrust to the precious metal, despite normally being a headwind. However, the sheer speed of the ascent raises the prospect of profit-taking, particularly given potential end-of-week market repositioning. Market sentiment remains overwhelmingly bullish, underpinned by fears of a trade war-induced global slowdown and anticipation of looser US monetary policy, though some caution is creeping in after the sharp rally.

Technically, Gold (XAU/USD) is trading strongly near its recent peak, currently around $… after reaching an intraday high of $…. This fresh record high acts as immediate resistance, with the next significant psychological barrier potentially sitting at $…. Despite the powerful uptrend confirmed by price trading well above all key moving averages – like the SMA(20) at $…– several indicators suggest the rally might be overextended in the near term, hinting at potential for a bearish pullback. The Relative Strength Index (RSI-14) at 69.69 is approaching overbought territory, and the Stochastic oscillator (%K at 86.46) is deeply overbought. Initial support lies at the day's low of $…. Below that, the psychological level of $3,150.00 could offer some footing before a more substantial support zone emerges around the $… mark, roughly aligning with the EMA(9) at $…and the SMA(10) at $….

WTI crude oil fell for a second consecutive session, trading around $60 per barrel during Asian hours on Friday amid escalating US-China trade tensions. The decline came in the wake of a sharp tariff hike on Chinese imports, where a new 125% levy was added to an existing 20% duty, culminating in an unprecedented 145% tariff, a move that intensified concerns over fuel demand from China and overshadowed President Trump's recent 90-day pause on tariff hikes for most other countries. The prolonged trade dispute threatens to dampen global trade, disrupt supply chains, and slow economic growth, all of which could suppress oil consumption in the world’s two largest energy markets. In response, the US Energy Information Administration (EIA) has reduced its global economic growth and oil demand forecasts, now expecting an increase of just 900,000 barrels per day this year—down from 1.2 million—and a 1 million bpd growth in 2026, while also lowering its oil price outlook amid worries of weaker global growth and a potential surge in supply. These concerns are further compounded by the OPEC+ alliance, including Russia, planning a production increase of 411,000 bpd in May, and additional supply risks stemming from new US sanctions on Iranian oil networks, as well as the ongoing shutdown of the Keystone pipeline following a spill in North Dakota.

From a technical perspective, WTI's price experienced a steep decline that brought it down to the $… support level before rebounding and encountering resistance at $…, after which it corrected downward again. This behaviour has led to a relative stabilization in the commodity's movement, yet the market sentiment appears to lean bearish, particularly as the RSI indicator remains near the oversold threshold at 30 despite the brief recovery. For the bearish case to gain further traction, WTI would need to breach the $… support and potentially break the deeper support level at $…. Conversely, a bullish turnaround would require a move above the $… resistance and ideally extend toward, or even break past, the $… resistance.