Article by: ETO Markets

The Federal Open Market Committee meeting minutes will then be released by the Fed. The latest remarks from Fed Chair Jerome Powell, who indicated that officials are not in a rush to reduce rates because inflation is still over target and the economy is resilient to higher rates, will probably limit the document's impact.

It is anticipated that US inflation will climb in March at an annual rate of 3.4%, which will be higher than the 3.2% increase in February. It is predicted that the core CPI inflation rate, which does not include volatile food and energy prices, will slightly decline to 3.7% from 3.8% for the same time period.

Despite threats of intervention from Japanese authorities, such as Finance Minister Shunichi Suzuki, who stated that he was monitoring the market with a high sense of urgency and wouldn't rule out taking action to address excessive moves, the USD/JPY sharply increased and reached a multi-year high, a level last seen in June 1990.

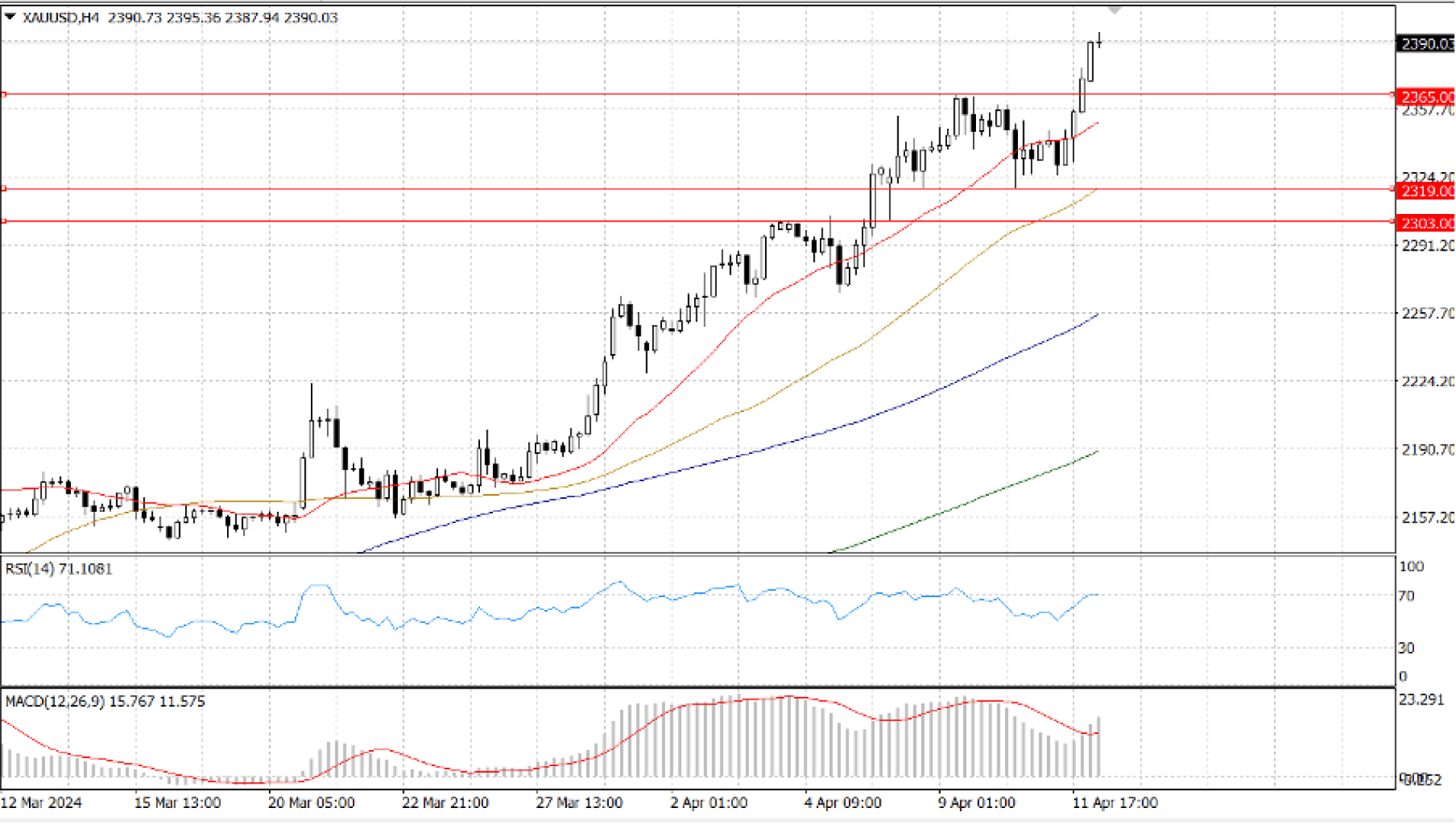

The last few weeks have seen a tremendous bull run for the precious metal. A recent uptick in Middle East tensions has driven up safe-haven bids and global central banks' pent-up demand for precious metals, making gold the talk of the town for the past several weeks. As a precaution against a possible slowdown in the economy, central banks amassed large reserves of gold.

According to US data, the Producer Price Index increased 2.1% YoY and 0.2% MoM in March, which was less than anticipated. The core annual PP increased by 2.4%, surpassing both the 2.1% reported in February and the 2.3% predicted. Additionally, initial jobless claims increased by 211K for the week ending April 5, which was less than the 215K forecast and a decrease from the previous 222K. With the slower-than-expected PPI, the US Dollar lost some territory, but it gained it again after Wall Street opened because the stock market was unable to maintain its early gains.

If XAU/USD decisively surpasses the $… area, it would pave the way to challenging the psychological $… mark. Further upside is seen at $… and $... On the other hand, if the precious metal’s price drops below $…, look for a challenge of the April 10 low of $…, followed by the April 8 daily low of $...

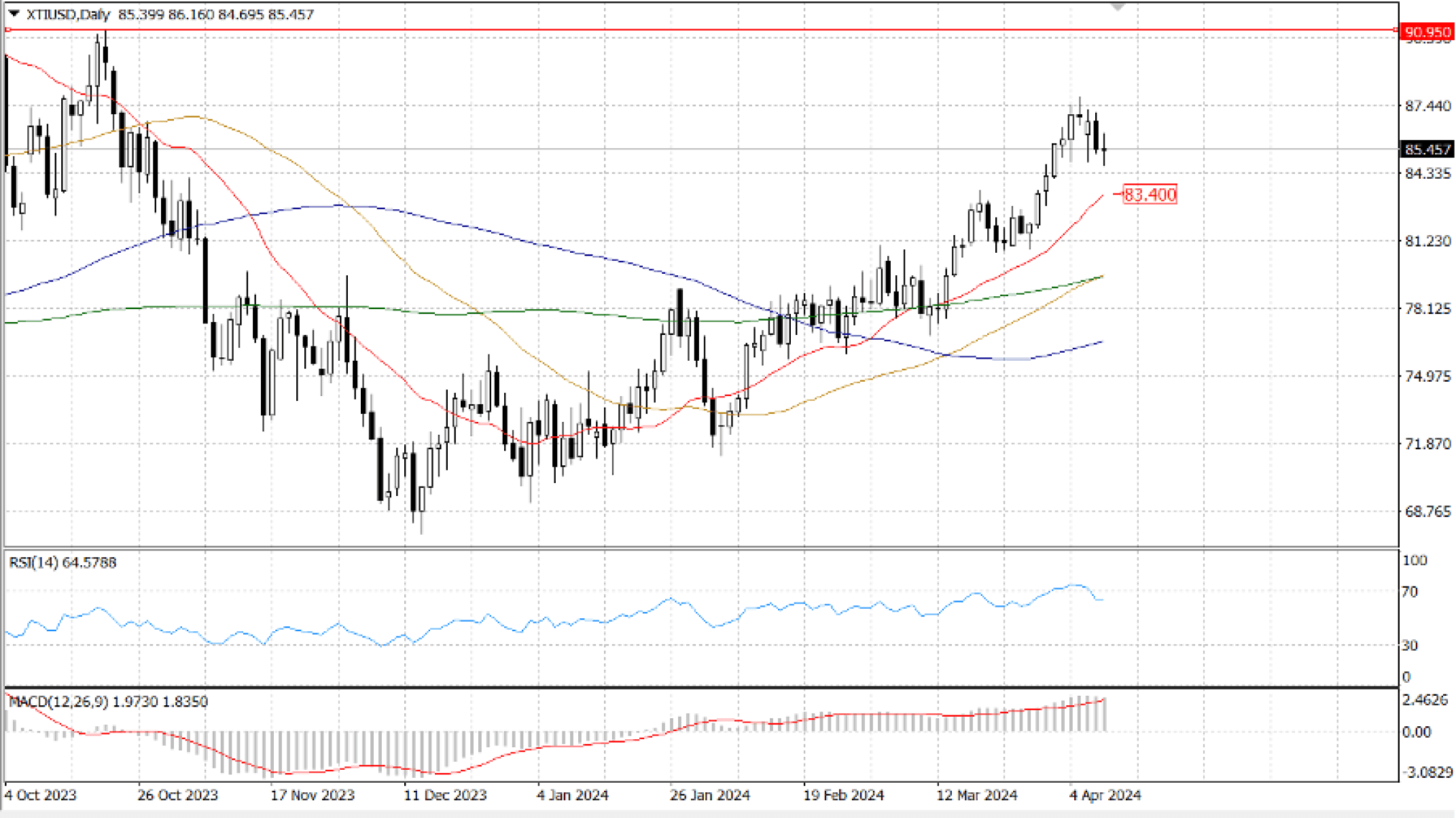

Significant disruptions to the oil supply chain will result from Iran's involvement into the Gaza combat zone. Iran is OPEC's third-largest oil producer, and its active engagement in the conflict will considerably tighten the oil market, raising the price of oil. Drone assaults by Ukraine on Russia's oil facilities have also stoked concerns about disruptions to the oil supply in the eastern part of Europe.

Before making a new push higher, the price may hold in a protracted consolidation inside the present range, although positive bias is anticipated as long as it remains above the rising 20-DMA at $... Targets at $… and the last October high $… are exposed by breaching the $… high.