Article by: ETO Markets

The foreign exchange market this week was mainly affected by U.S. economic data, Federal Reserve policy expectations and global geopolitical factors. The dollar found significant support as U.S. real yields rose, reaching a high of 2.156%, their highest levels since July 2024. Rising real yields are typically negatively correlated with gold and other non-yielding assets, which explains the sharp pullback in gold prices. This dynamic also points to a growing investor preference for the U.S. dollar, especially in the current economic context.

U.S. economic data showed a widening trade deficit and a slight slowdown in business activity. Although S&P Global reported a decline in U.S. services sector activity in October, the Institute for Supply Management's (ISM) Services Purchasing Managers' Index improved, showing the sector's resilience. These mixed data further support market expectations for the Fed's policy path, which is to ease monetary policy by about 49 basis points by the end of the year, which constitutes an additional positive for the dollar.

Overall, the dollar's strength this week stems from rising real yields and expectations of modest easing from the Federal Reserve. Other currency pairs have weakened relatively under pressure from the US dollar, but geopolitical risks and changes in global economic data will continue to guide exchange rate movements in the coming days.

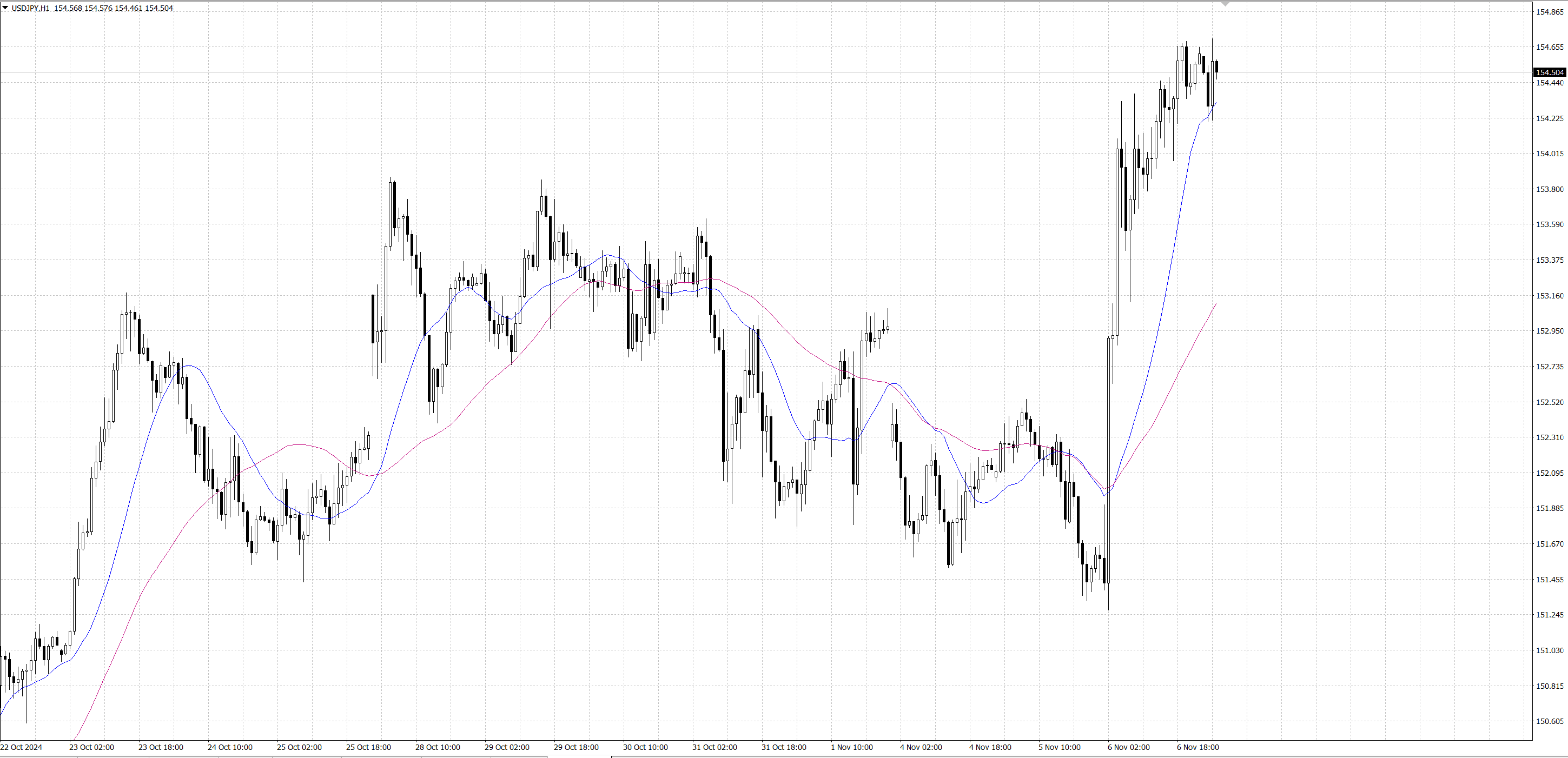

This week, the trend of the US dollar/Japanese yen (USD/JPY) was mainly driven by the US presidential election, the domestic political situation of the yen, and the expectations of the policies of the US and Japanese central banks. USD/JPY rose in the short term as the latest polls showed that Trump had an advantage in the election. However, OCBC pointed out that the overall outlook may still face volatility due to market concerns about the noise and potential uncertainty of the US election results.

In Japan, the special parliamentary session and prime ministerial election on November 11 will be key events. Although Shigeru Ishiba is expected to maintain his victory, the minority government may need to cooperate with the opposition parties, which may affect the policy path of the Bank of Japan. In addition, the minutes of the Bank of Japan meeting showed that the policy rate may be raised to 1% in the second half of 2025. If the future economy and prices are in line with forecasts, Bank of Japan Governor Ueda expects to continue to raise interest rates, which is in sharp contrast to the expectation of future rate cuts by the Federal Reserve. Signs of increasing wage pressures and expanding inflation in the service sector also support the potential strength of the yen. However, against the backdrop of the US presidential election, market noise may add uncertainty to the exchange rate outlook and may trigger rumors of intervention to curb sharp unilateral movements.

From a technical perspective, USD/JPY is trading around …, with the momentum indicator flat and the RSI showing an upward trend, with short-term risks skewed to the upside. Upside resistance is seen at … and … (corresponding to the 76.4% Fibonacci retracement level). If the price breaks above 156.50, further tests of higher levels are likely. However, if the pair fails to break through these resistance levels, downside support is seen at 151.60 (200-day moving average) and 150.60/70 area (50% Fibonacci retracement level of the July high to September low and 100-day moving average).

Overall, while USD/JPY has upside momentum in the short term due to political and economic factors, the election and potential changes in domestic yen policies, as well as market concerns about excessive gains, may lead to increased volatility and downside risks. Investors should pay close attention to key support and resistance levels and be wary of rumors of possible market intervention.

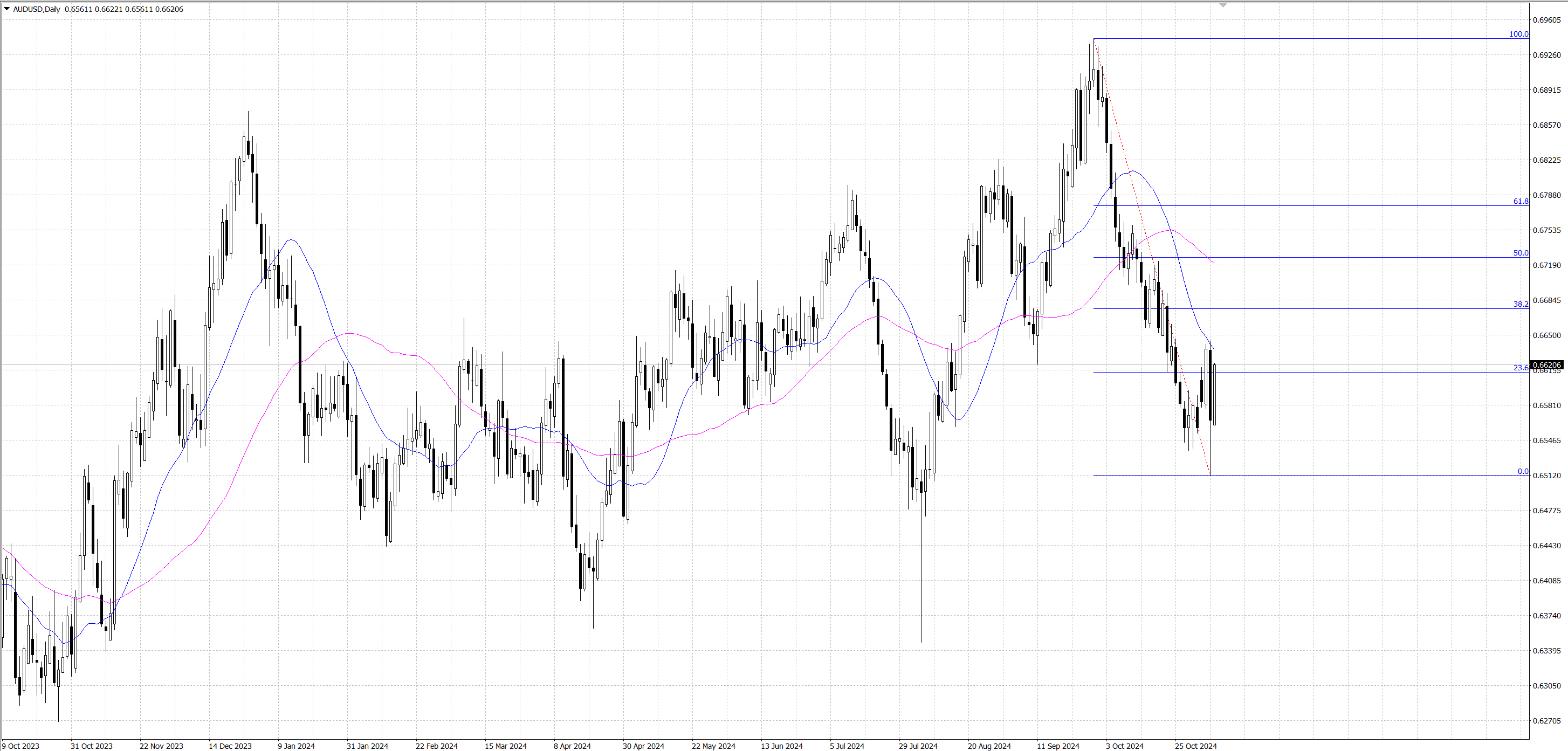

The Australian dollar (AUD/USD) was weak this week on the back of trade balance data and US political developments. Australia's trade surplus fell to A$4,609 million in September, below expectations of A$5,300 million and A$5,284 million in August, and the lowest level since March. This data indicates that exports fell more than imports, weakening support for the Australian dollar. In addition, the US dollar was supported by Trump's victory in the US presidential election, further exerting downward pressure on the Australian dollar.

The Federal Reserve is expected to cut interest rates by 25 basis points at its November meeting, which is highly anticipated by the market, providing potential support for the US dollar. Although the market expected a smaller rate cut, combined with the recent strong performance of the US ISM Services PMI (from 54.9 to 56.0 in October, exceeding expectations of 53.8), the strength of the US dollar continued. In addition, the Reserve Bank of Australia (RBA) kept the official cash rate unchanged at 4.35% this week, continuing its decision to pause interest rate hikes for the eighth time. RBA Governor Michele Bullock stressed that due to inflationary pressures and a strong job market, current monetary policy still needs to maintain a tight stance.

From a technical perspective, AUD/USD is currently trading around …, showing a continued bearish trend. Technical indicators on the daily chart show that the pair remains below the 9-day and 14-day exponential moving averages (EMAs), indicating that downward pressure is dominant. The 14-day relative strength index (RSI) is also below 50, further confirming the bearish outlook.

In terms of support, AUD/USD has initial support at the three-month low of …, and if it falls below this level, it may further test the psychological support of …. On the upside, if the price breaks through the 9-day EMA (…) and 14-day EMA (…) resistance levels, it may indicate that the upward momentum has increased and further challenge the psychological level of ….