In this week, the U.S. dollar (USD) has still shown strength against major currencies, driven by positive economic indicators and the Federal Reserve's recent interest rate cut of 50 basis points. This cut was intended to support economic stability as a “soft landing” and maintain employment levels, leading to expectations of further gradual cuts in the future.

At the same time, the European economy is facing sluggish growth due to various challenges, including an energy crisis and post-pandemic recovery struggles. The European Central Bank (ECB) may consider cutting rates, potentially leading to a weaker euro.

In a move to support economic growth, China's central bank announced a 0.5 percentage point reduction in banks' reserve requirement ratios (RRR), effective September 27. This marks the second cut for the year, with indications of a possible further reduction of 0.25 to 0.50 percentage points later this year. The Finance Ministry emphasized its commitment to providing stronger support for the economy, mentioning that there remains significant capacity for the central government to increase debt and the fiscal deficit. However, no specific details regarding additional stimulus measures were provided

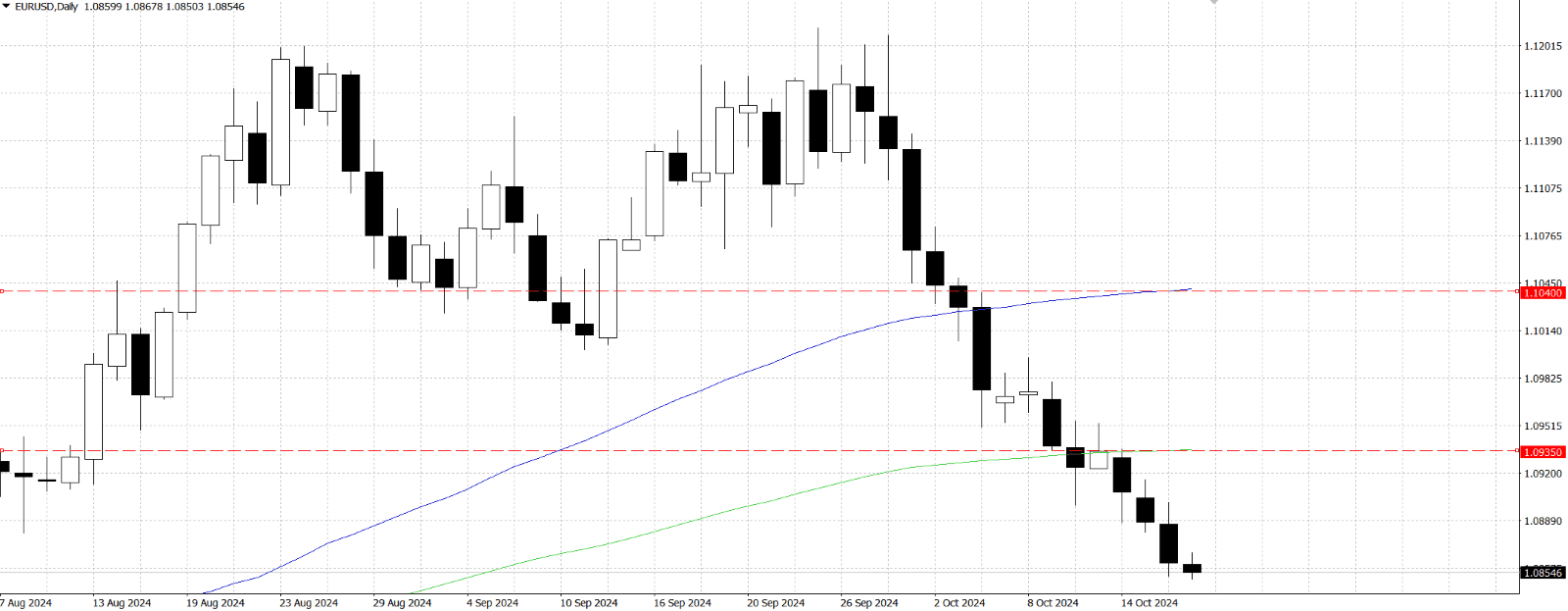

This week, the EUR/USD pair has exhibited weakness amid several key developments. The Euro remains under pressure due to the European Central Bank’s (ECB) dovish stance, with markets anticipating further rate cuts. In fact, the ECB is widely expected to reduce interest rate by 25 basis points at its meeting on October 17. This expectation has weighed on the currency, extending EUR/USD’s decline for a third consecutive week.

Meanwhile, on the U.S. front, expectations around Federal Reserve policy remain hawkish, bolstered by solid economic data and the Fed’s commitment to keeping interest rates high to combat inflation. The U.S. Dollar has continued to strengthen, pushing the Dollar Index (DXY) back above 103.50—a level last seen in early August—even as Treasury yields eased across various maturities.

This divergence in monetary policy between the ECB and the Fed has further contributed to the Euro’s underperformance against the Dollar. Adding to the Euro’s challenges, geopolitical uncertainties and fluctuating commodity prices have created a mixed trading environment, driving investors toward the safe-haven appeal of the U.S. Dollar.

From a technical perspective, further drops might send the EUR/USD below the round level of …, followed by the August low of … (reached on August 1). On the upside, the pair encounters interim resistance at the 55-day and 100-day SMAs, positioned at … and …, respectively.

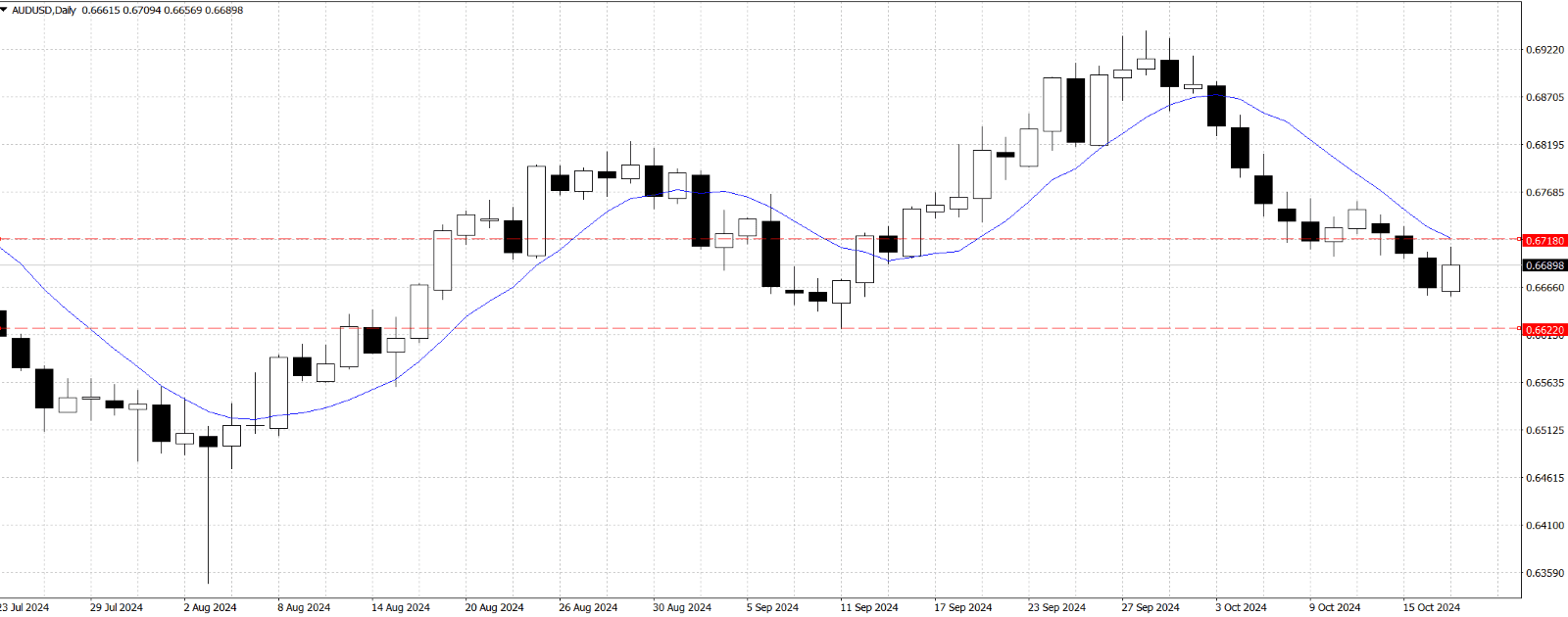

The AUD/USD pair has shown weakness during this week, trending towards bearish territory. The Australian dollar faced downward pressure, slipping below key resistance levels. For US perspective, the U.S. dollar has continued to gain strength, bolstered by robust economic data, particularly in retail sales, which has fueled expectations for sustained higher interest rates by the Federal Reserve . This shift in sentiment has made the AUD less attractive to investors.

In the point of view of Australia, the Reserve Bank of Australia (RBA) held its cash rate steady at 4.35% in September, signaling a dovish outlook compared to earlier guidance. The RBA's caution stems from its assessment of inflation risks, and there is speculation of a potential rate cut by the end of the year. This contrasts sharply with the Federal Reserve's tightening stance, creating a challenging environment for the AUD.

Additonally, ongoing concerns regarding the effectiveness of China’s stimulus efforts have weighed heavily on the Aussie dollar. Despite slight increases in commodity prices like copper and iron ore, traders remain cautious due to doubts about the impact of these measures on China's struggling economy. Recent deflationary pressures in China has further compounded these concerns.

Regarding resistance, if the pair breaks out above the descending channel, attention may turn to the nine-day Exponential Moving Average (EMA) around …, followed by the key psychological barrier at …. On the downside, the pair may aim for its eight-week low of …, which was last reached on September 11. A break below this level could trigger further declines, with the next target being the lower boundary of the descending channel, situated near the psychological support level of ….