First, the Federal Reserve cut interest rates by 50 basis points this week, taking its benchmark rate to a range of 4.75% to 5%, and expects rates to fall another half percentage point by the end of the year. The decision intensifies the market's focus on the Fed's future policy, especially in the new economic forecast, which sees rates falling to 3.4 percent by 2025, down from 4.1 percent previously forecast, and further to 2.9 percent by 2026. In addition, the point at which inflation returns to the 2% target has been pushed back to 2026, creating uncertainty in market expectations about the extent of future rate cuts.

In his post-meeting press conference, Fed Chairman Jerome Powell downplayed the risk of a recession, stressing that inflation pressures had eased and that the labor market was solid. Nonetheless, the significant rise in US Treasury yields led the dollar to rebound from its lowest point since July 2023, supporting the dollar's performance in the foreign exchange market. Judging from the reaction of the foreign exchange market, the US dollar has shown a strong recovery this week, especially in the market correction after the Fed meeting, the US dollar index (DXY) is back above 101. However, the price of gold (XAU/USD), while capped by the recovery of the US dollar, increased geopolitical risks and concerns about a global economic slowdown still supported its safe-haven demand. Overall, markets have shown a cautious appetite for risk this week, with both safe haven assets and the dollar supported.

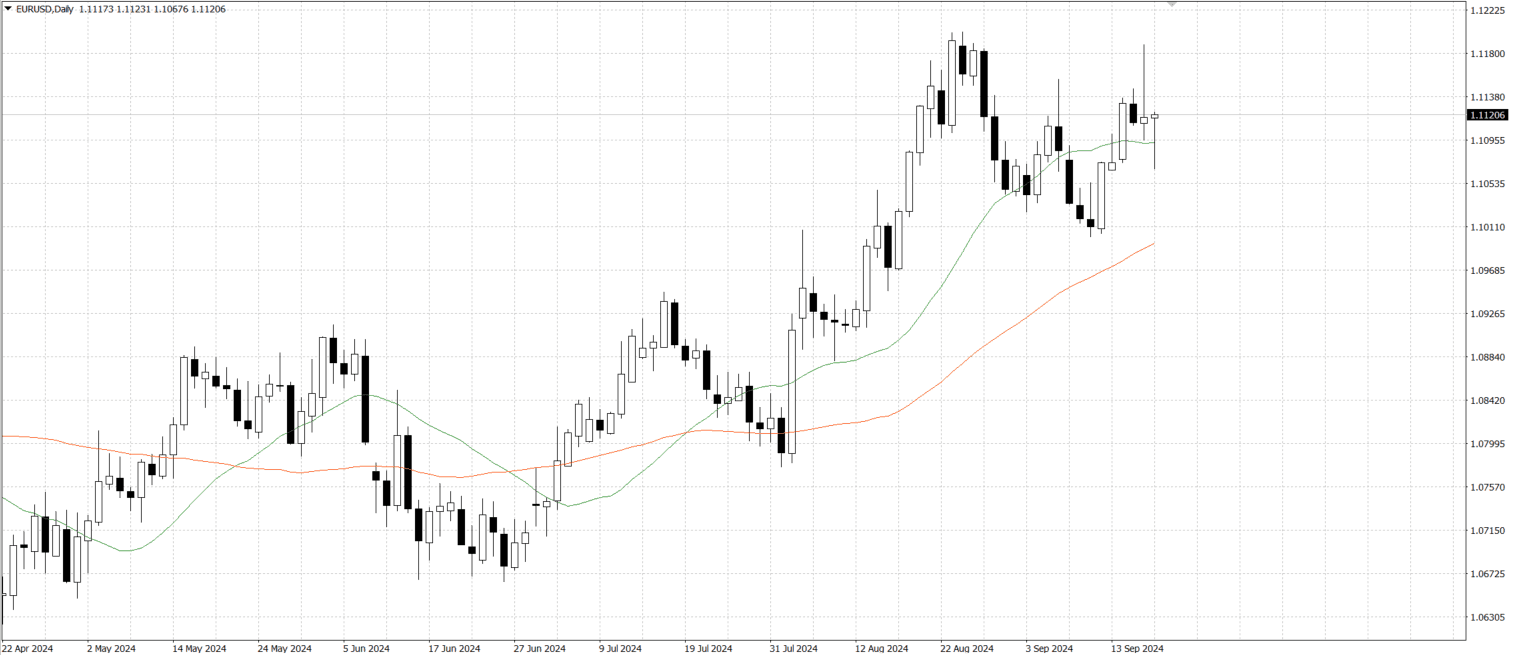

The Fed's policy decision had a significant impact on EUR/USD. The Fed's aggressive rate cuts are designed to counter slowing U.S. economic growth and lower underlying inflationary pressures. According to the newly released dot plot, the Fed's interest rate expectations have been significantly lowered, showing the federal funds rate falling to 4.4% by the end of 2024 and further to 3.4% by 2025. This dovish stance lessens the attractiveness of the dollar and supports the euro's upside in the short term.

In addition, the Fed's forecast for the future U.S. economy is not very optimistic. The US GDP growth forecast was revised down from 2.1% to 2.0%, and the unemployment rate is expected to stabilize at 4.4% by the end of 2024. Such concerns about economic growth and the job market could continue to push the Fed to ease monetary policy further, putting pressure on the dollar, while the euro could benefit.

At the same time, the economic data on the European side is relatively flat, and the euro's movement is more driven by the US economy and Federal Reserve policy. Eurozone growth remains challenging, but the Fed's rate cut provides short-term support for the euro.

From a technical point of view, EUR/USD retreated after hitting a high of …, indicating that the market's initial reaction to the Fed's rate cut has faded and the market sentiment is becoming cautious. The current key support level is around …, which has been used as important support on several occasions. If EUR/USD continues to break below this support, it may further explore the … area.

On the upside, … is an important resistance level in the short term, and if this level is broken, EUR/USD is expected to rise further towards .... However, the euro's gains could be capped by market uncertainty over future Fed policy.

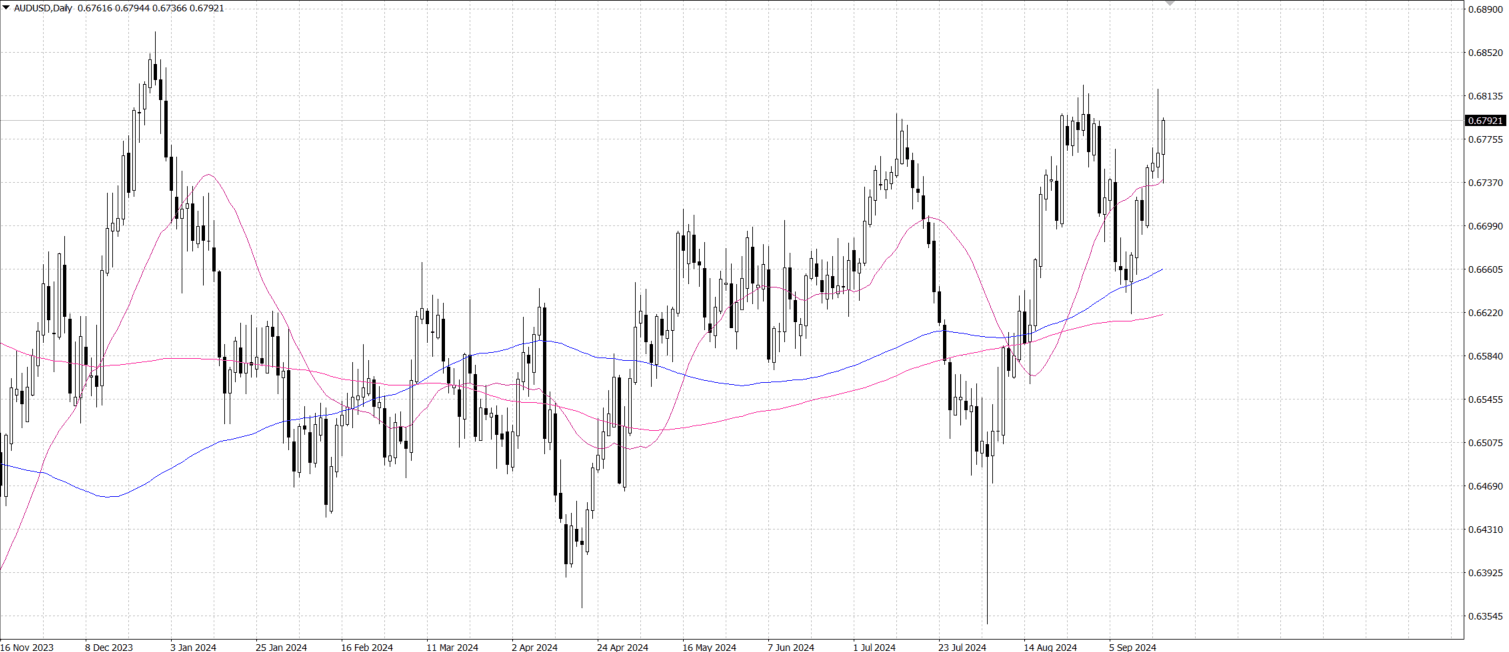

The strength of the Australian Labour market is directly supporting the Australian dollar. While employment growth was slightly slower than last month, the performance, which far exceeded market expectations, bolstered confidence in the Australian dollar. In addition, the US dollar weakened after the Fed cut interest rates aggressively, further boosting the Australian dollar's performance against the greenback.

U.S. economic data showing a surprise rise in retail sales and the Federal Reserve's more dovish outlook for future interest rates combined to curb the dollar's upside. Global economic concerns, including continued weakness in China, are likely to weigh on global risk sentiment over the medium term and therefore on the direction of the Australian dollar.

From a technical point of view, AUDUSD is currently trading around …. The pair shows a downtrend on the daily chart and is below an upward wedge pattern, suggesting the possibility of a bearish reversal. However, the 14-day Relative Strength Index (RSI) is just above 50, indicating that a break above the 9-day exponential moving average (EMA) is still needed to confirm a downtrend.

On the upside, AUDUSD could test the seven-month high of …, and a break above this level could further test the resistance levels of … and …. On the downside, if we break below the 9-day EMA of …, the psychological support of … will be the key, and if we break below this level, the pair may further explore the support zone around ….