Article by: ETO Markets

Australian annual inflation rate for goods was 3.1% in this quarter. Since the September 2022 quarter, when annual inflation for goods peaked at 9.6%, there has been a six-quarter run of decreasing annual inflation. The March 2024 quarter saw a decrease in annual inflation for the majority of items. However, some goods, including furniture, appliances, footwear, and meat and seafood products, experienced deflation, or lower prices than they did a year previously. For the third quarter in a row, annual services inflation decreased to 4.3%, from a high of 6.3% in the quarter ending in June 2023.

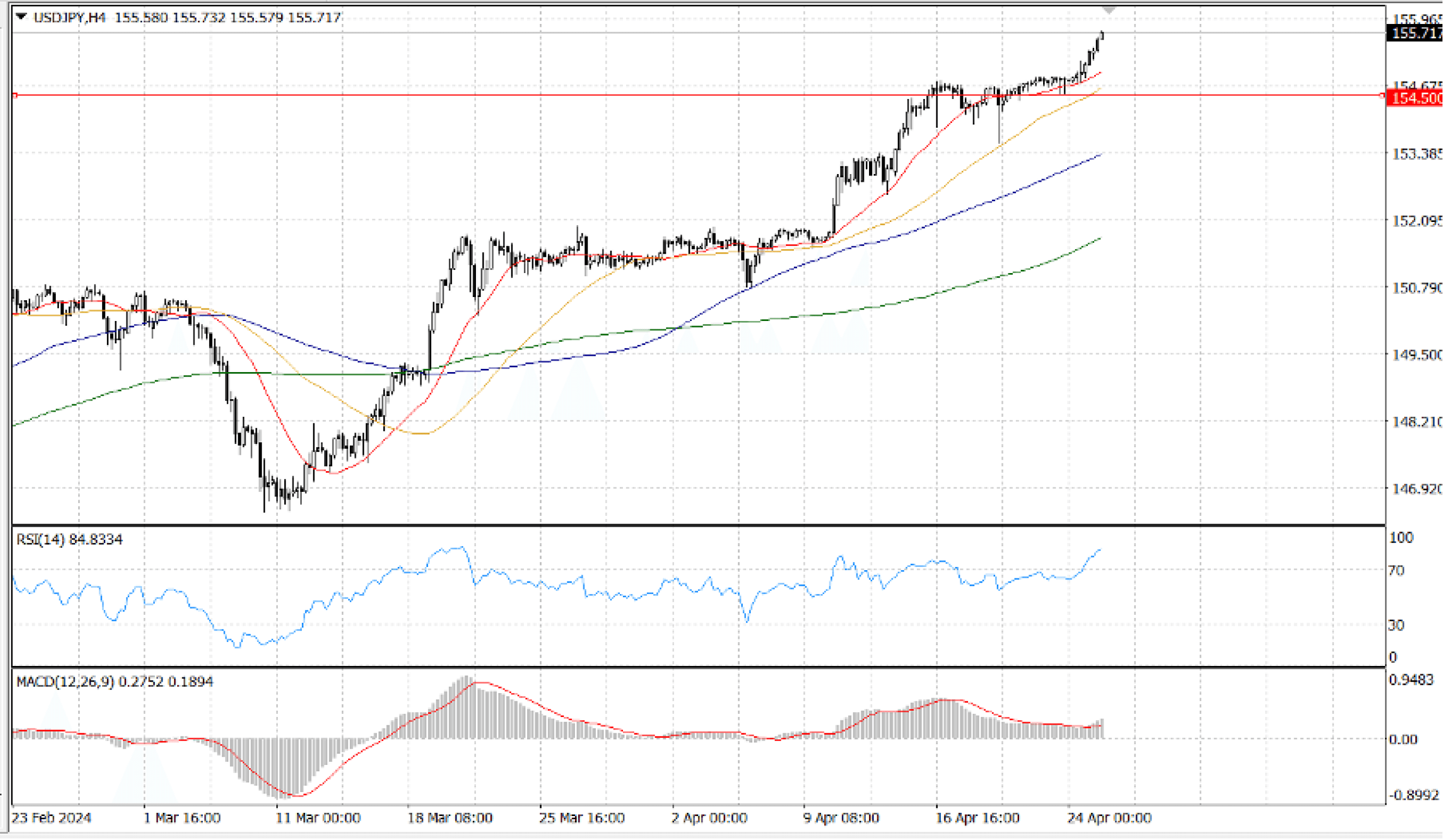

Japanese yen is still weaker than the US dollar and is trading close to a multi-decade low. There is a significant difference between the Bank of Japan's cautious attitude to continued policy normalization and predictions that the Federal Reserve will hold off on interest rate cuts due to persistent inflation. This turns out to be a major element undermining the safe-haven JPY together with an overall bullish risk tone supported by lessening geopolitical tensions in the Middle East.

Treasury yields in the US are still steady. To prevent a decline in the future, they must maintain above their current support and receive a significant follow-through climb. German yields have gradually increased. The range breakout continues to hold. As long as this is true, there could be more rise. The five- and ten-year yields have dropped. Even if there is still potential for decline, the overall trend is upward. Supports are in place to prevent further declines and raise rates once more.

A large supply shortfall of silver combined with growing demand for the metal due to its industrial applications in semiconductors, photovoltaics, and electric vehicle charging could temporarily support the price of the metal. According to the Silver Institute, continuous structural gains from applications in the green economy allowed the industrial demand for silver to reach a record of 654.4 million ounces in 2023.

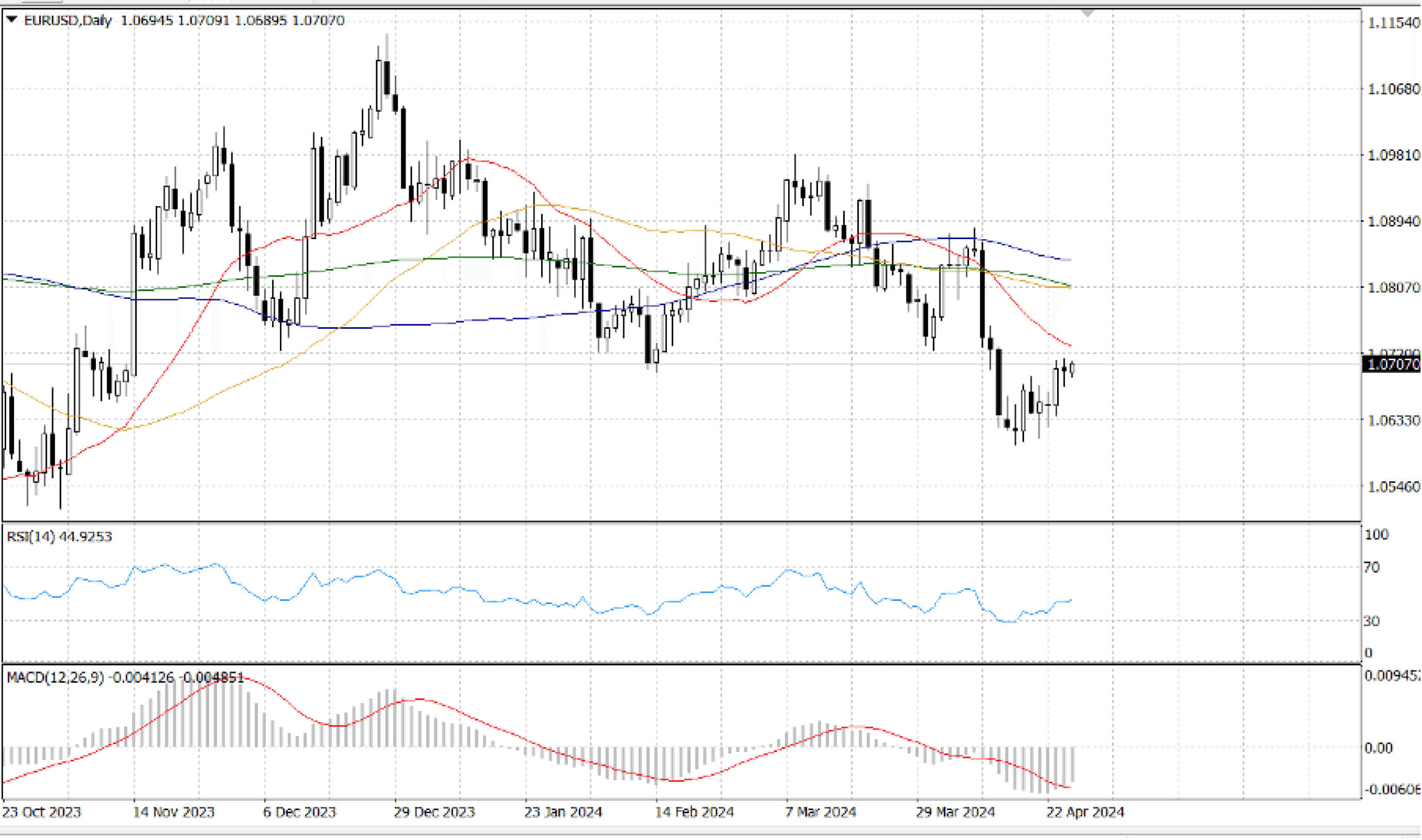

According to recent remarks made by Board members, the European Central Bank is expected to begin its easing cycle in June. Three interest rate reduction, or 75 basis points, are predicted for the rest of the year. On the other hand, it is expected that the Fed will lower interest rates for the first time in September, while it is not completely ruled out that they could do the same in July.

Although it appears that the EUR/USD has bottomed below … , buyers' inability to close above … on a daily basis may allow for a retest of the year-to-date low at ... If the latter is broken, a critical support level around … , the swing low from October 3, 2023, will be revealed. If buyers manage to retain the spot price above … , they should aim for the 50- and 200-DMA confluence first, then look for a challenge of the psychological ...

After hiking interest rates in March for the first time since 2007, it is generally anticipated that the Japanese central bank will maintain its current policy settings and the number of bonds it purchases. On the other hand, given sticky inflation, investors appear to be convinced that the Federal Reserve will not start its cycle of rate-cutting before September. Consequently, this implies that the USD/JPY pair's path of least resistance is upward.

A new catalyst for bullish traders might be the overnight breakout over a short-term trading range and the subsequent strength above the … mark. The USD/JPY pair is ready to continue its recent, solid upward trend from the swing bottom in March and pursue a breakthrough over the round number of ...

On the flip side, any meaningful corrective slide is likely to attract fresh buyers and remain limited near ... This is followed by … support zone, which, if broken, might prompt some technical selling and drag the USD/JPY pair to the … round-figure mark.