Article by: ETO Markets

Due to predictions that the Federal Reserve may be done raising interest rates, the yields on US Treasury bonds and the US dollar are both continuing to decline. The non-yielding price of gold is therefore thought to be receiving some support from this. Aside from this, any significant decline in the safe-haven XAU/USD pair should be constrained by the possibility of an intensification of the Israel-Hamas conflict and the deteriorating economic situation in China.

October saw a decline in the Chinese manufacturing PMI below 50 as a result of decreased demand and slower production. Nevertheless, the negative data from China casts doubt on the recent optimism regarding a rebound in the second-largest economy in the world. Notably, China is the world's largest consumer of oil, thus pressure on oil prices could come from a poor economic forecast.

Oil traders will be watching the US weekly Initial Jobless Claims report. The US Nonfarm Payrolls, which are predicted to increase by 180K jobs in October from 336K in September, will be the focus of attention on Friday. These developments could have a big effect on the WTI price denominated in USD. The data will be used as a guide by oil traders to identify trading opportunities around WTI prices.

If the Fed deviates from the dot plot and declares that high bond yields will preclude the necessity for another rate hike, the USD may face selling pressure and lead the GBP/USD pair higher. The October ADP Employment Change and ISM Manufacturing PMI data will be highlighted on the economic calendar ahead of the Fed's policy announcements.

The 200-SMA which represents the Fibonacci 23.6% retracement of the most recent downturn, lines up as immediate resistance at … before ... A 4-hour close above the latter would draw technical buyers and allow for a longer recovery toward the static level of ... Before … and …, there is first support on the downside at ... The H4 chart's Relative Strength Index which shows the GBP/USD pair's indecision, is still moving sideways close to ...

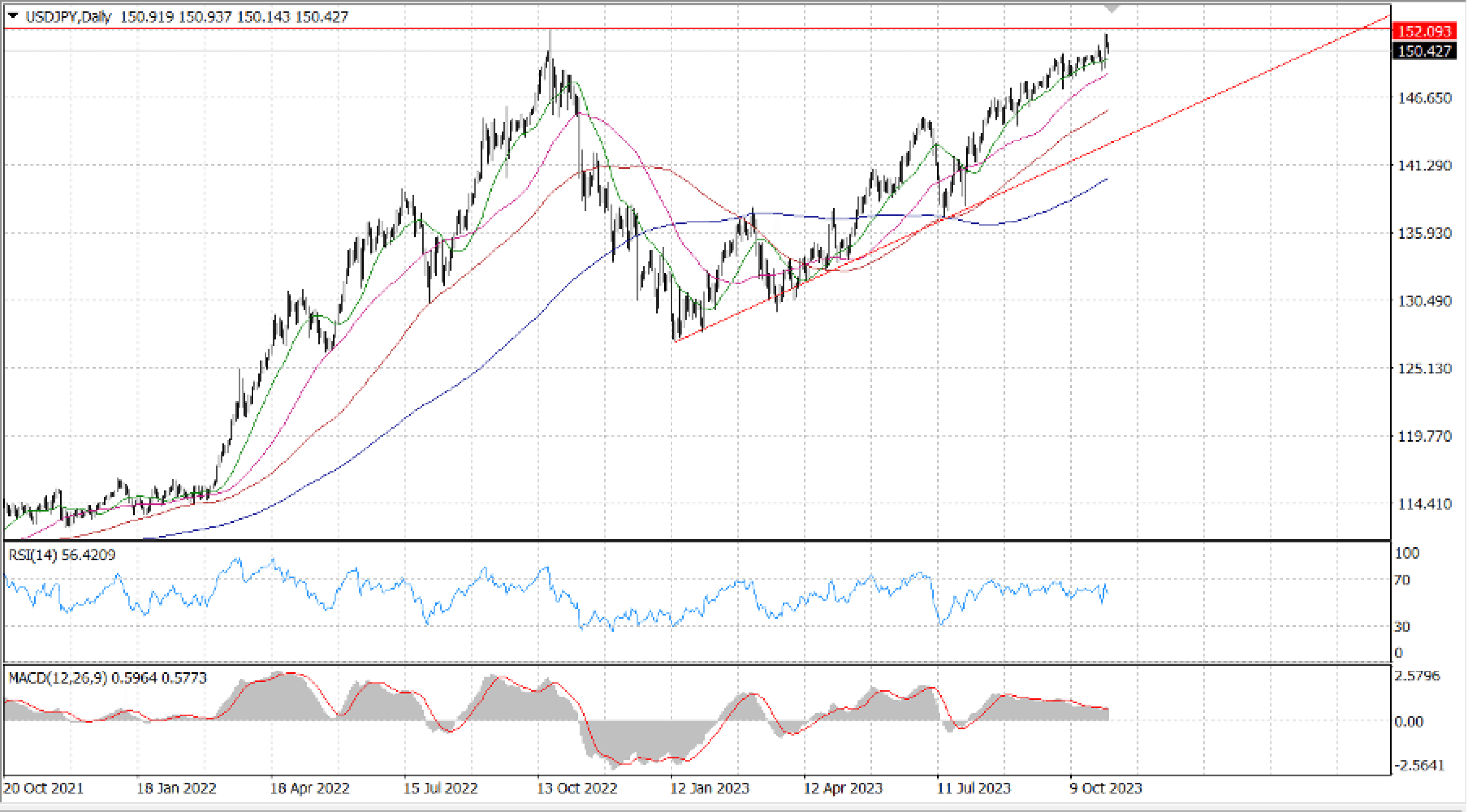

Though the Bank of Japan's dovish posture may help limit losses, suspicions that Japanese authorities could intervene in the FX market to counteract a persistent fall in the home currency further add to the offered tone around the USD/JPY pair. A little modification to the BoJ's yield curve control strategy suggested a gradual transition away from years of extreme stimulus. Additionally, the Japanese central bank hinted that a departure from the ultra-dovish position may take longer than anticipated.

A little resistance to the USD/JPY pair might be seen on Tuesday in the … range, which is a touch below the October 2022 multi-decade top of … Bullish traders will view a prolonged move and acceptance above the latter as a new trigger. The USD/JPY pair may then rise to the …, with the goal of regaining the … level for the first time since …