Market Review

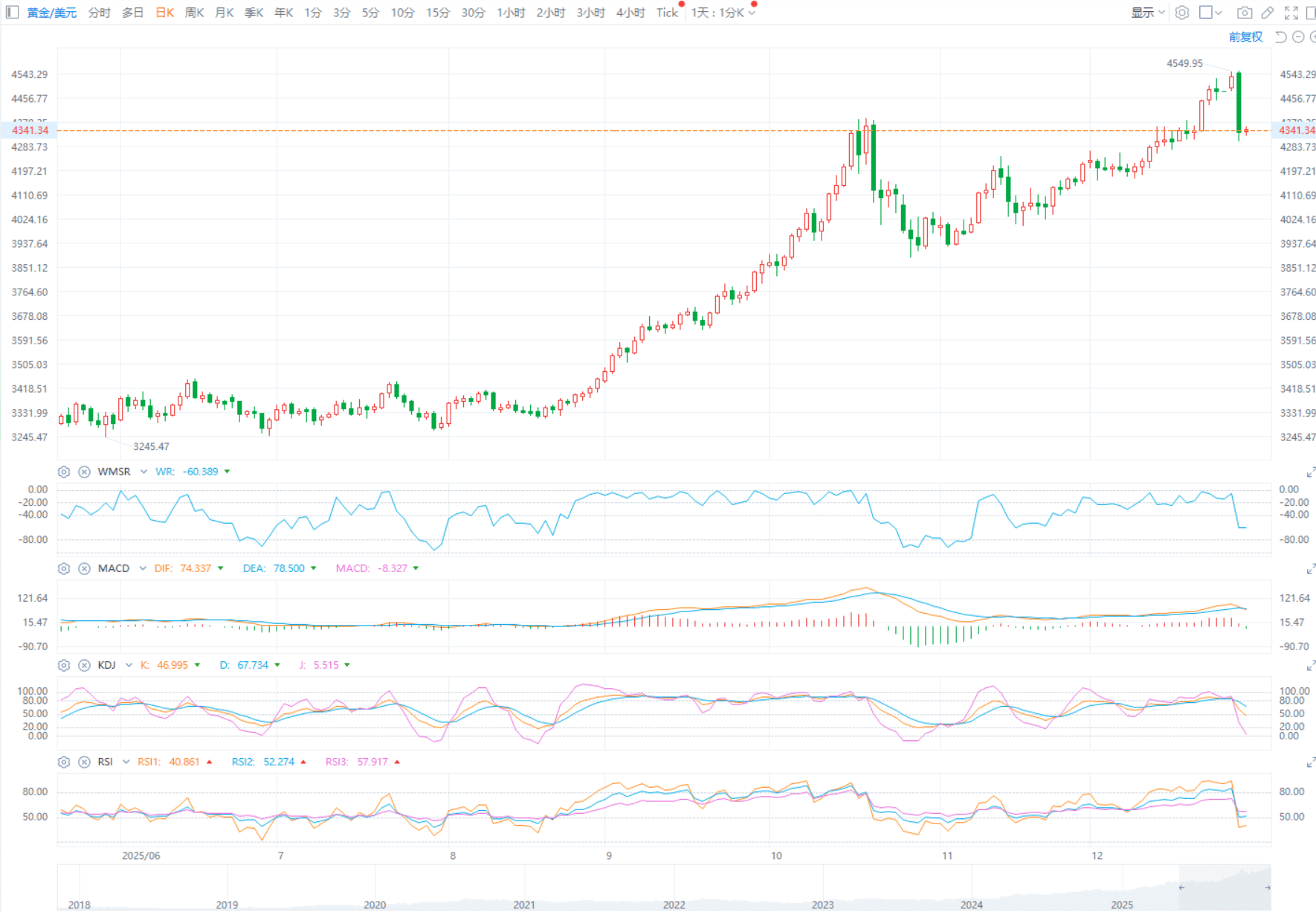

According to ETO Markets monitoring, on Monday, December 29, spot gold plunged sharply from the previous session’s record high of USD 4,549.69 per ounce. Heavy selling pressure was released in a concentrated manner, triggering a single-day drop of around 4.4%. Gold closed at USD 4,331.78 per ounce, marking the steepest daily decline in recent periods.

During early Asian trading on Tuesday, December 30, gold stabilized near last week’s lows. As of writing, prices are consolidating around USD 4,340 per ounce, with market sentiment clearly turning cautious.

Global Headlines

Precious Metals See Broad Selloff

Precious metals retreated sharply on Monday. Spot silver fell 8.9% in a single session despite briefly hitting a record high earlier. Platinum plunged 14.5%, while palladium dropped more than 15%. The pullback highlights intensified volatility after an extended rally.

Trump Pressures FED Leadership Independence

Trump said he is considering legal action against FED Chair Powell for “serious misconduct” and hinted that a new FED Chair nominee could be announced in January. The comments reignited market concerns over FED independence and future policy stability.

Middle East Tensions Reignite Quickly

Trump warned that the U.S. would support swift action against Iran if it continues missile or nuclear development. Israel said it would provide updated intelligence assessments, pushing geopolitical risk higher once again.

Netanyahu US Visit Raises Uncertainty

Israeli Prime Minister Netanyahu arrived in the U.S. for talks covering Gaza ceasefire negotiations and Iran-related risks. While strategic alignment remains strong, differences persist over timing and scale of potential actions.

US Venezuela Pressure Intensifies

Trump said U.S. forces recently destroyed a “major facility” in Venezuela, without providing details. U.S. officials linked the operation to anti-narcotics efforts. Caracas has yet to respond, adding to geopolitical uncertainty.

ETO Markets Analyst View (Spot Gold)

From a technical perspective, spot gold has entered a corrective phase after repeatedly setting record highs. Prices have broken below key short-term moving averages, while RSI has fallen below 30, signaling emerging oversold conditions. However, downside momentum has not fully reversed.

If gold continues to trade below USD 4,375 per ounce, the correction could extend toward the USD 4,300 or even USD 4,270 zones. A recovery back above USD 4,375 would suggest a shift toward consolidation and technical repair. Overall, volatility at elevated levels has increased sharply, and the market needs time to digest prior extreme gains. In the absence of new macro catalysts, gold is more likely to rebuild structure through choppy consolidation rather than a quick rebound.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.