Market Review

According to ETO Markets monitoring, on Thursday, December 25, trading activity remained muted due to the Christmas holiday, with gold prices showing limited intraday movement.

During early Asian trading on Friday, December 26, spot gold edged higher amid persistent geopolitical uncertainty. Prices rose around 0.3% intraday and briefly touched USD 4,493.63 per ounce, continuing to consolidate near historic highs.

Global Headlines

Gold Posts Strongest Annual Gain

Gold futures in New York are up nearly 71% year-to-date, marking the strongest annual performance since 1979. Ongoing trade frictions, geopolitical conflicts, and sanctions of risks continue to underpin safe-haven demand.

Moody’s Sees Further FED Cuts

Moody’s Chief Economist Mark Zandi said the emergency tightening cycle has ended as inflation cools and growth remains resilient. After three rate cuts in 2025, the FED funds rate now stands at 3.50%–3.75%. Further cuts in 2026 remain possible if inflation stays under control, though patience will be required.

Ukraine Extends Russia Import Ban

Ukraine announced a one-year extension of its ban on Russian imports, with related tariff measures now running through December 31, 2026. The move signals limited near-term improvement in bilateral trade relations.

Israel Maintains Gaza Security Zones

Israel’s defense minister said the country will retain security zones inside Gaza even if the next phase of a ceasefire proceeds. The decision highlights ongoing risks of renewed regional tensions.

Russia Criticizes Europe’s Peace Stance

Russia accused the EU and the UK of prioritizing military support over peace efforts in Ukraine, arguing such actions further escalate regional confrontation.

US Signals Sanctions Over Force

U.S. officials indicated a preference for using sanctions rather than military action in dealing with Venezuela. Markets interpreted the stance as easing near-term geopolitical escalation risks.

Silver Fund Warns Premium Risk

SDIC Silver LOF warned that its market price remains well above net asset value. The fund temporarily halted trading and announced a lower investment cap from December 29, highlighting unsustainable premium risks.

ETO Markets Analyst View (Spot Gold)

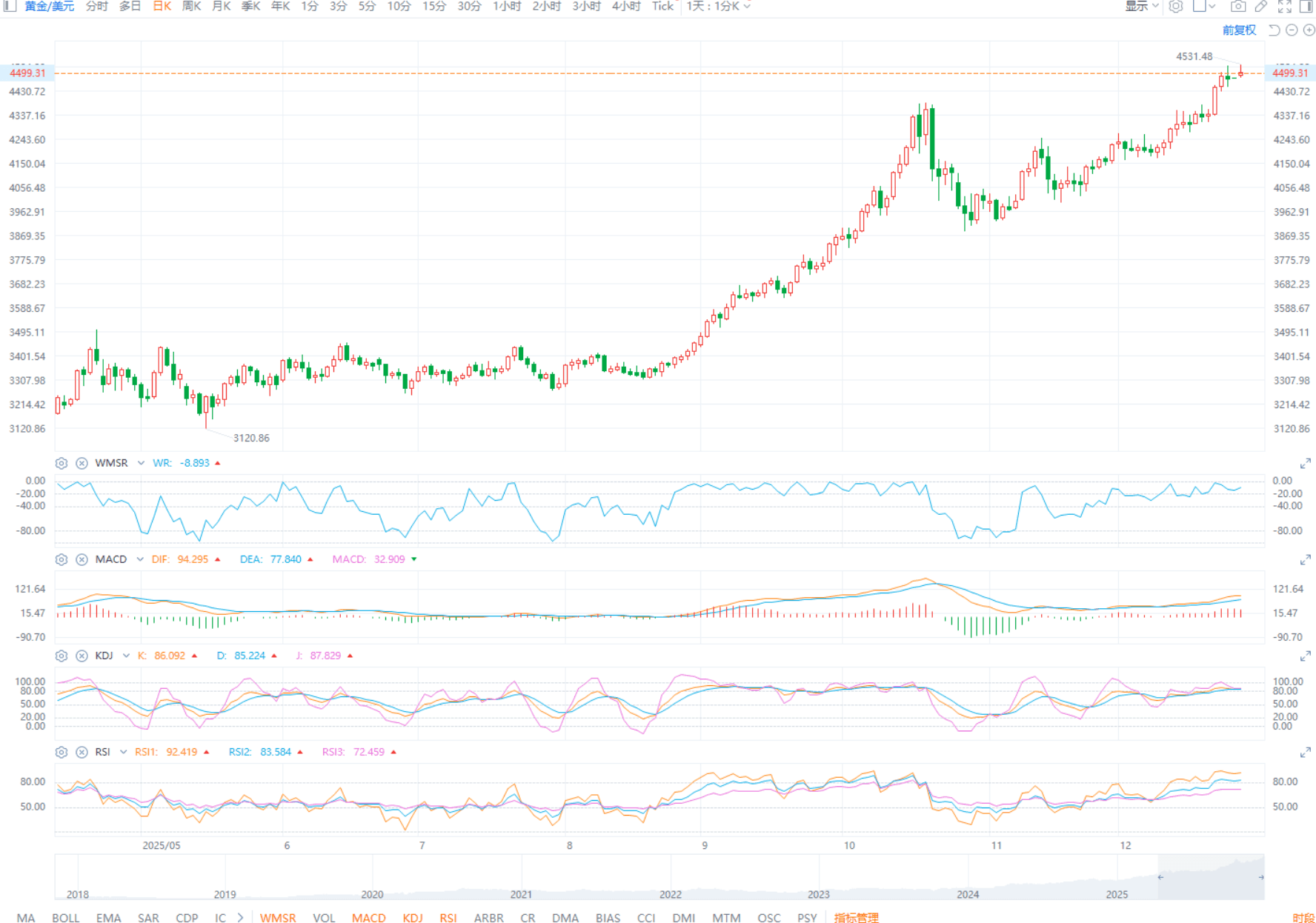

From a technical perspective, gold remains in a high-level consolidation phase, with directional momentum easing. The USD 4,470 per ounce area serves as a key pivot.

If prices stabilize above this level, upside potential remains toward USD 4,505–4,550. A break below would shift focus to support in the USD 4,448–4,428 zone. RSI signals show slowing momentum, but no clear reversal. With holiday liquidity thin, price swings may be amplified, warranting cautious positioning.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.