Market Review

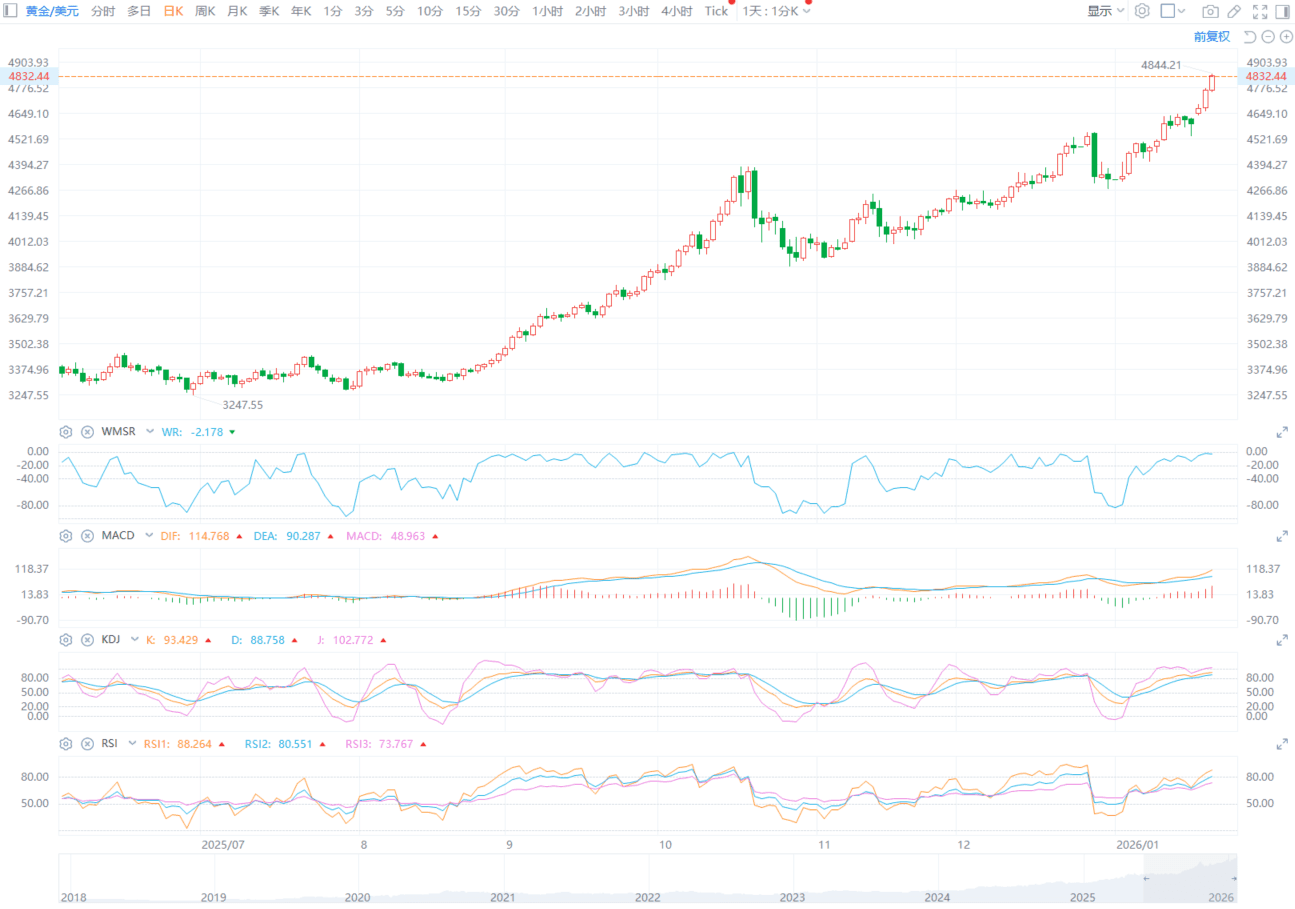

According to ETO Markets monitoring, on January 20 (Tuesday), spot gold surged decisively above the USD 4,700 per ounce threshold. Prices accelerated sharply and set fresh record highs during the session. Silver advanced in tandem, while the USD, U.S. equities, and U.S. Treasuries all came under pressure, reflecting a clear deterioration in risk appetite. Spot gold held firmly at elevated levels into the close.

In early Asian trading on January 21 (Wednesday), spot gold extended its rally and printed another record high, briefly reaching USD 4,844.21 per ounce. Prices remain volatile but continue to trade within the upper range.

Global Headlines

1) Trump Keeps Greenland Military Option Open

U.S. President Trump said his objective to gain control of Greenland “will not change” and refused to rule out the use of military force. He reiterated that Greenland is of strategic importance to the United States and said this position has been stated repeatedly.

2) Trump Signals Alternative Tariff Tools

Trump said that if the Supreme Court restricts the government’s use of tariffs, the administration could deploy alternative measures, including licensing mechanisms. He stressed that tariffs are not the only tool available and that policy flexibility remains.

3) Powell Attends Supreme Court Hearing

The U.S. Supreme Court will hear oral arguments in the case involving FED Governor Cook. FED Chair Jerome Powell is expected to attend. The case centers on whether the president can remove a FED governor without “cause,” with implications for FED governance.

4) FED Chair Race Narrows Further

U.S. Treasury Secretary Scott Bessent said the shortlist to succeed Powell as FED Chair has been narrowed to four candidates. A final decision could come as early as next week, with evaluations ongoing.

5) June Rate Cut Odds Rise

CME pricing shows the probability of a 25 bp rate cut in January at 5%, with a 95% chance of no change. By June, the probability of at least one 25 bp cut rises to 44.8%, with odds of deeper easing also increasing.

6) ADP Hiring Momentum Softens

Latest ADP data show average weekly private-sector job gains slowing to 8,000, down from 11,750 previously. Hiring momentum has cooled at the margin, though overall employment conditions remain broadly stable.

ETO Markets Analyst View (Spot Gold)

After clearing the USD 4,715 level, gold has maintained a strong upside structure. The short-term trading range has shifted higher, and as long as prices hold above USD 4,715, the bias remains for consolidation with an upward tilt. The market retains scope to probe the USD 4,795 and USD 4,815 areas.

If gold falls back below USD 4,715, attention should turn to support near USD 4,680. A break there could open the door to a deeper pullback toward the USD 4,655 region, marking a transition into high-level consolidation.

RSI continues to trend higher without clear divergence, indicating momentum still supports the prevailing trend. That said, after a rapid advance, short-term volatility may increase.

With macro events clustering and policy uncertainty elevated, gold is likely to alternate between high-level consolidation and trend continuation. Investors should closely monitor key policy signals and market structure, while managing exposure and pacing carefully.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.