Article by: ETO Markets

The gold market continues to benefit from multiple supportive factors, with geopolitical tensions taking centre stage. Recent reports of US President Biden considering contingency plans for strikes on Iran's nuclear facilities have intensified safe-haven demand. The precious metal's appeal is further enhanced by expectations of monetary policy easing, with the Federal Reserve signalling a cautious approach to rate cuts in 2025. Central bank buying remains robust, with the World Gold Council indicating continued strong purchase intentions for 2025. However, the metal faces headwinds from a resilient US Dollar Index trading near multi-year highs at ... . The incoming Trump administration's policy uncertainties, particularly regarding trade and inflation, add another layer of complexity to the market outlook. Chinese economic indicators suggest mixed recovery prospects, with services and construction sectors showing improvement while manufacturing remains subdued.

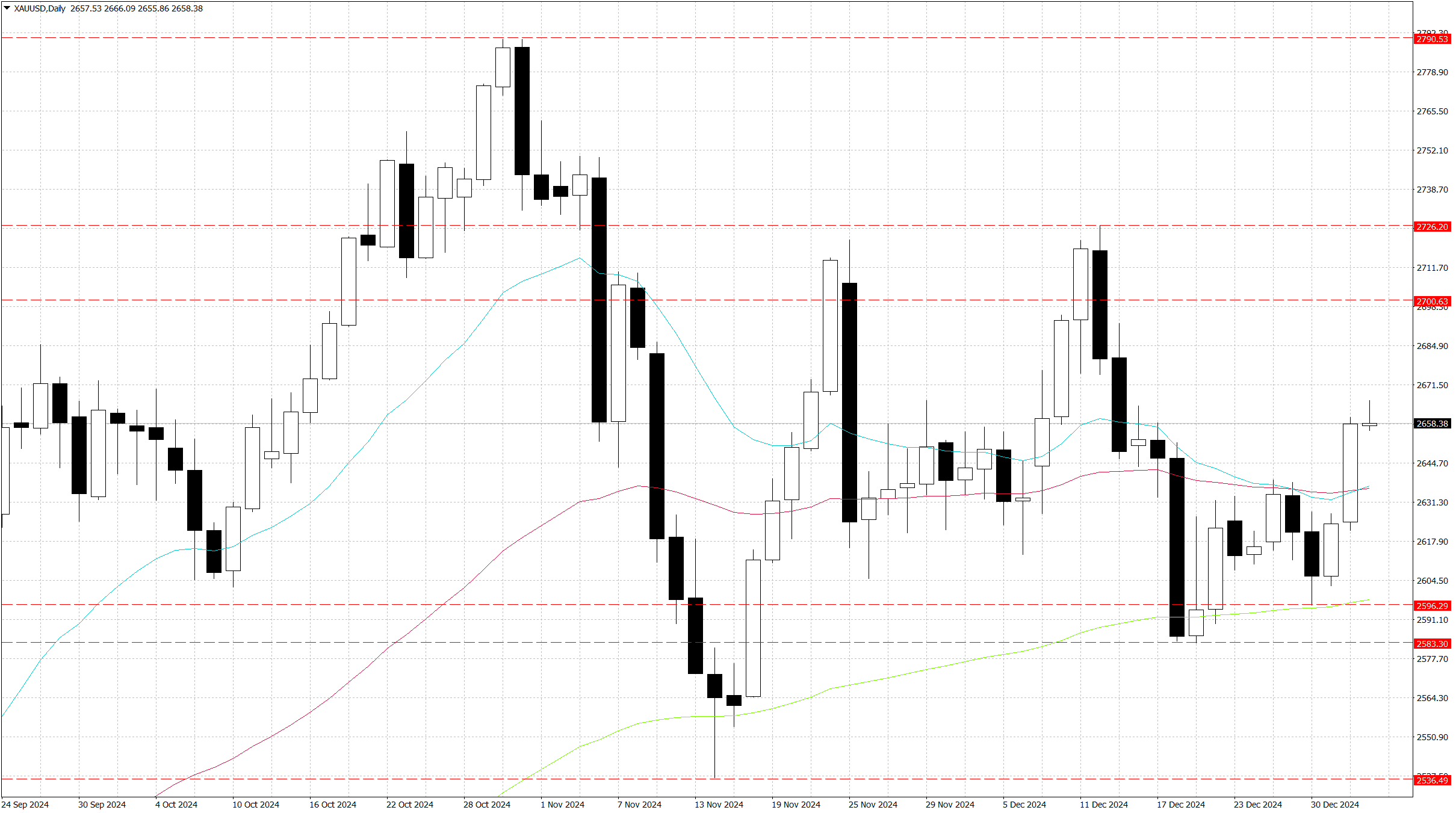

The technical landscape for gold reveals a constructive setup with emerging bullish momentum. The primary resistance level sits at ... , marking the December 12 high, followed by the psychological barrier at ... , where significant selling interest has historically emerged. The immediate support structure begins at ... , aligning with the 9-day Exponential Moving Average, while secondary support rests at ... , corresponding to the December 30 weekly low and 100 day moving average. The Relative Strength Index has crossed above the ... thresholds, indicating growing bullish momentum, though the overall price action suggests cautious positioning near current levels. The break above the 50-day Simple Moving Average at ... reinforces the positive bias, with the price structure forming higher lows on the daily timeframe. The current configuration suggests a primary bullish bias, though careful attention should be paid to the reaction at the mentioned resistance levels for confirmation of continued upward momentum.