Article by: ETO Markets

The US ISM survey, which revealed that manufacturing sector output shrank more than expected in February, was a negative news that further damaged the US dollar. Further supporting speculation that the US central bank will begin lowering interest rates at the June policy meeting were the less aggressive comments made by a number of Federal Reserve officials. This is therefore thought to be a major element providing a tailwind for the unwavering yellow metal.

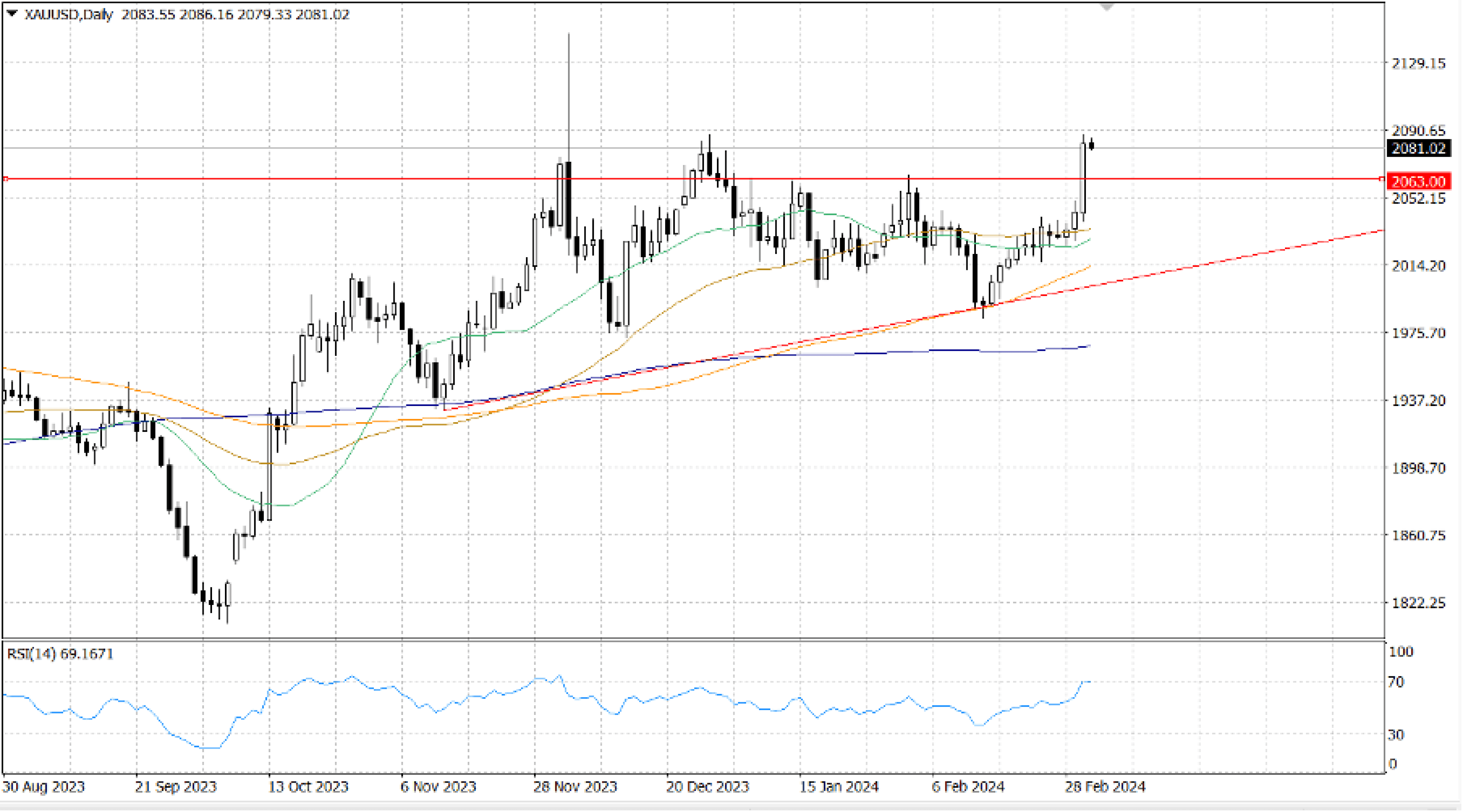

It appears that the previous resistance breakpoint, which is located near $… range, is now guarding against further declines. However, persistent weakness below could lead to intense technical selling and reveal the 50-DMA support, which is now located close to $… in the market. The latter should be viewed as a crucial turning point that, if it is decisively violated, will undermine the optimistic perspective and tip the scales in favor of bearish traders.

Conversely, the $ … zone, which represents a two-month high that was touched on Friday, appears to be an immediate barrier in front of the $ … round number.