Article by: ETO Markets

Better than anticipated, the US Nonfarm Payrolls increased from 333K in December, revised up from 216K, to 353K in January. The unemployment rate remained constant at 3.7%. The Average Hourly Earnings grew 4.5% YoY in January from 4.4% in December, indicating that pay growth is finally stabilizing. Some buyers were drawn to the greenback. The likelihood of a rate cut in March has decreased to 19% from 38% only one day earlier, as traders withdrew their bets on a May interest rate cut. It's important to note that since gold offers no yield, the higher-for-longer rate narrative lessens the appeal of the metal.

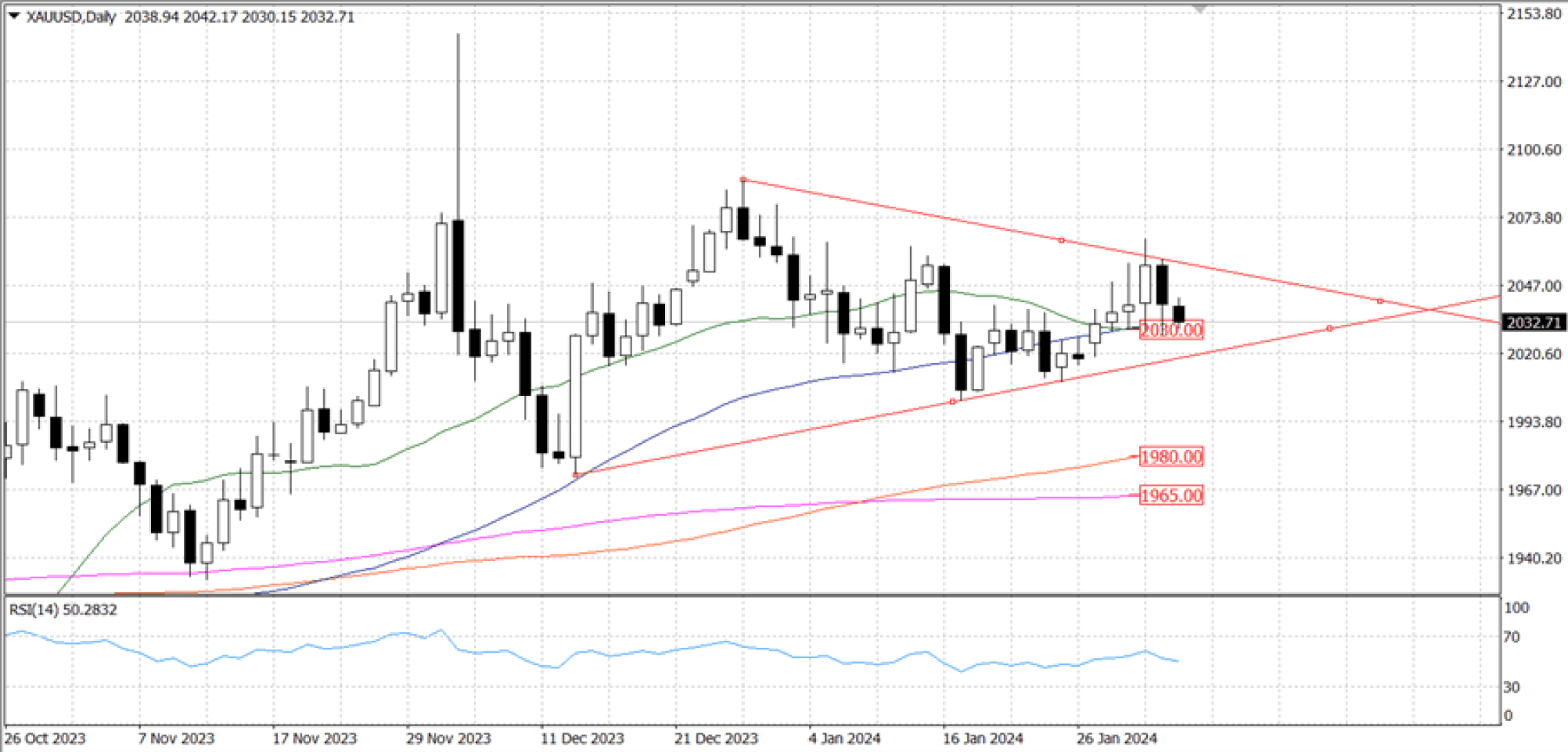

Following the release of the positive US NFP data, the price of gold falls vertically from $... The precious metal's four-day winning streak comes to an end. Despite producing a breakout of the daily-time-frame symmetrical triangle chart pattern, the yellow metal's short-term appeal has become wary.

At about $…, the lower band of the triangle on the daily chart is where the price of gold fights to stay above. There is pressure on the Relative Strength Index close to the 50 barriers.