Article by: ETO Markets

Gold prices (XAU/USD) consolidated near a two-week high, with the market focused on the upcoming release of US non-farm employment change. Recent weak macroeconomic data in the United States has increased market expectations that the Federal Reserve will cut interest rates in September and December, which has weakened the dollar and provided support for gold. Specific data showed that the ADP report added 150,000 private sector jobs in June, which was lower than expected; initial jobless claims rose to 238,000; and ISM services PMI fell to 48.8. Investors are generally taking a wait-and-see attitude, waiting for the non-farm payrolls report to decide their next move. June payrolls are expected to show the creation of 190,000 jobs; the unemployment rate remains at 4 percent; and the annual growth rate of average hourly earnings is likely to decline slightly to 3.9 percent. These data will have important implications for the Fed's policy path and further determine the direction of gold.

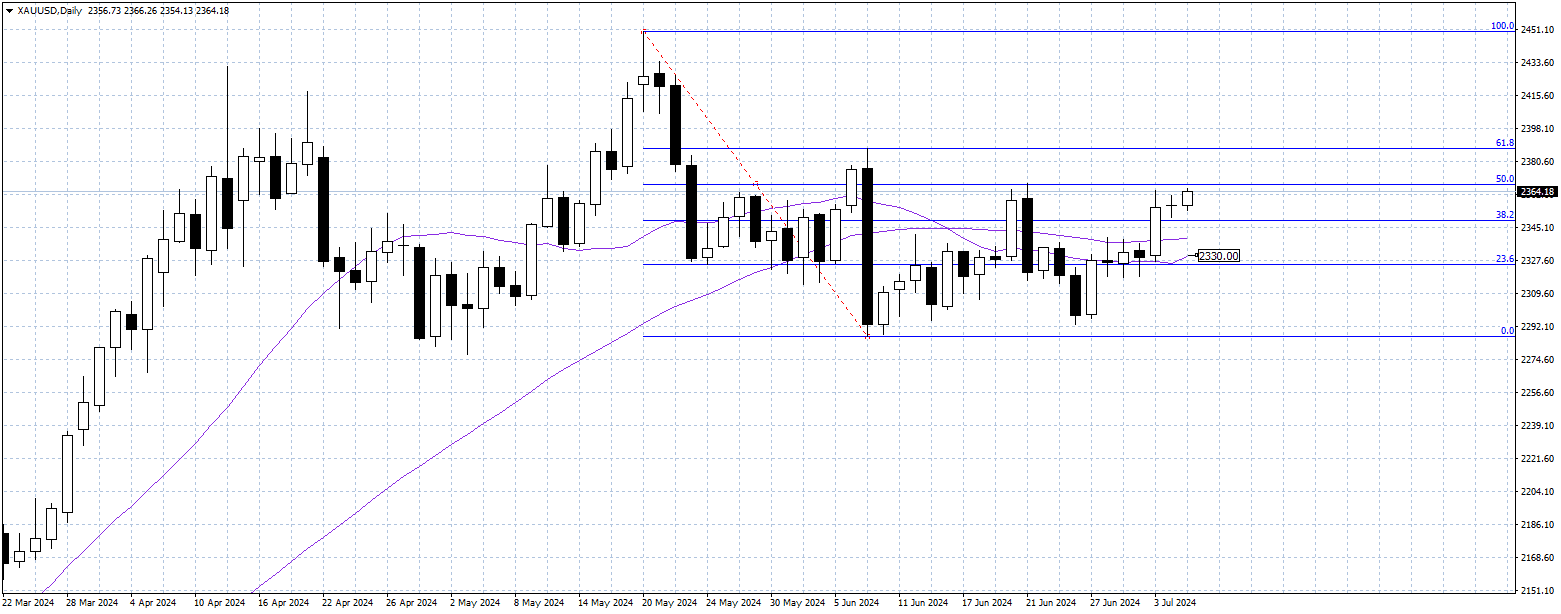

From technical perspective, the price of gold (XAU/USD) rose to the 50% Fibonacci retracement level of $… during the Asian trading session on Friday. The next resistance level is the June 7 high of $…, which also corresponds to the 61.8% Fibonacci retracement level. The Relative Strength Index (RSI) at 56 indicates that there is potential for further upside movement. For gold sellers to push the price back into a bearish trend, they need to break below the 20-day Simple Moving Average (SMA) at $… to attract new sellers.