Article by: ETO Markets

On Tuesday, U.S. economic data revealed that JOLTS job openings were 8.06 million, lower than the expected 8.37 million. The data indicates that the U.S. employment situation is deteriorating. The upcoming non-farm payroll figures will be a crucial factor influencing gold prices this week. If the non-farm payroll numbers also fall significantly short of expectations, it will provide strong support for gold prices.

Despite the continuous decline in U.S. Treasury yields, the dollar index has slightly risen. Gold has also dropped to around $… amid a broad sell-off in commodities. This may be the result of investors' concerns about global economic growth. As global inflation slows, speculation about interest rate cuts is increasing, leading to a rebound in global bond markets, which may also detract from investment in gold.

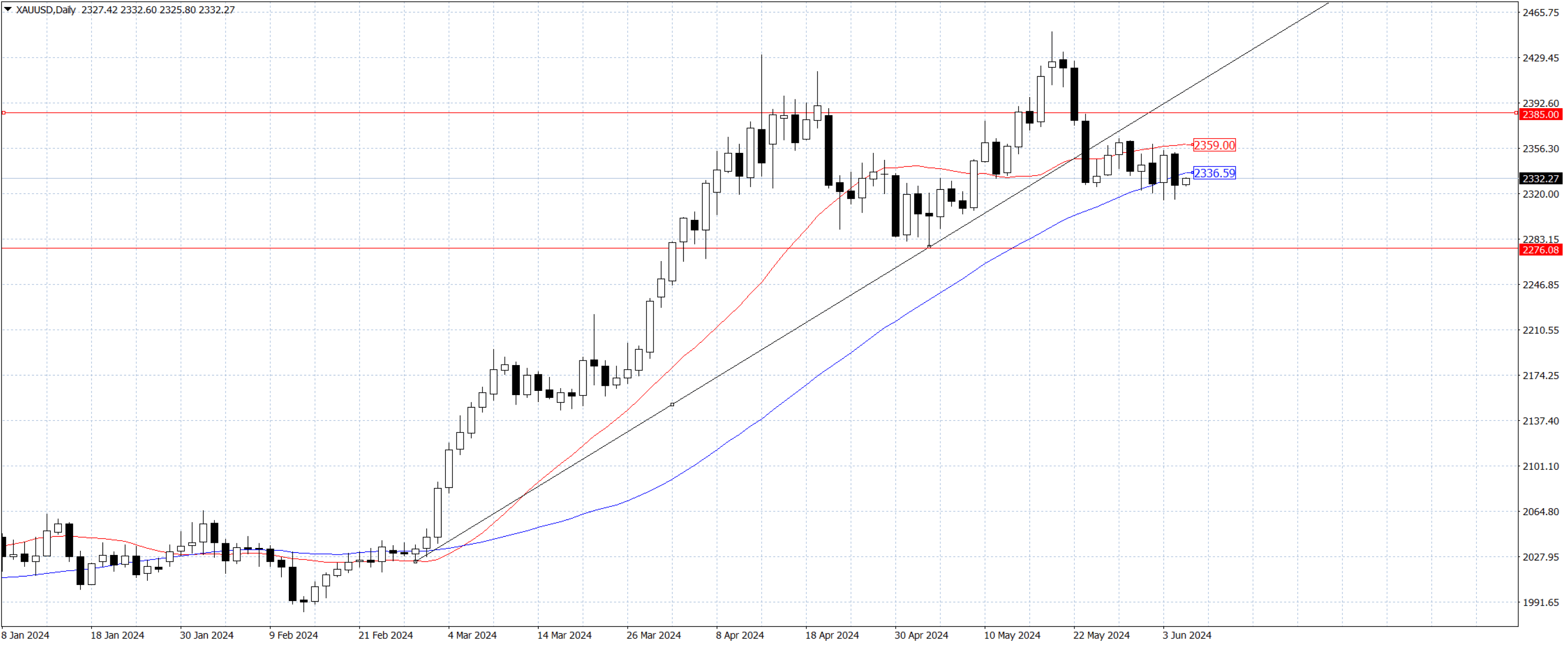

The upward trend of gold has been temporarily disrupted, with gold prices fluctuating between the 20-day Simple Moving Average (SMA) and the 50-day SMA. Any breakout to the upside or downside will provide new momentum for gold prices. If gold buyers reclaim the $… level, there is hope of returning above $… and challenging the historical high. However, if gold prices fall to the May 8 low of $…, the next target will be $...