Article by: ETO Markets

in the US dollar combined to limit the upside for gold. Weak US macroeconomic data released last week added to concerns about a possible downturn in the US economy, which in turn raised expectations that the Federal Reserve would cut interest rates by 50 basis points in September. These expectations should limit further gains in U.S. bond yields and the dollar, providing support for non-yielding gold. In addition, ongoing geopolitical tensions in the Middle East have further strengthened safe-haven demand for gold. Overall, while market risk sentiment and a stronger US dollar have put pressure on gold prices, expectations of Fed rate cuts and geopolitical risks have provided important support for gold, limiting its downside.

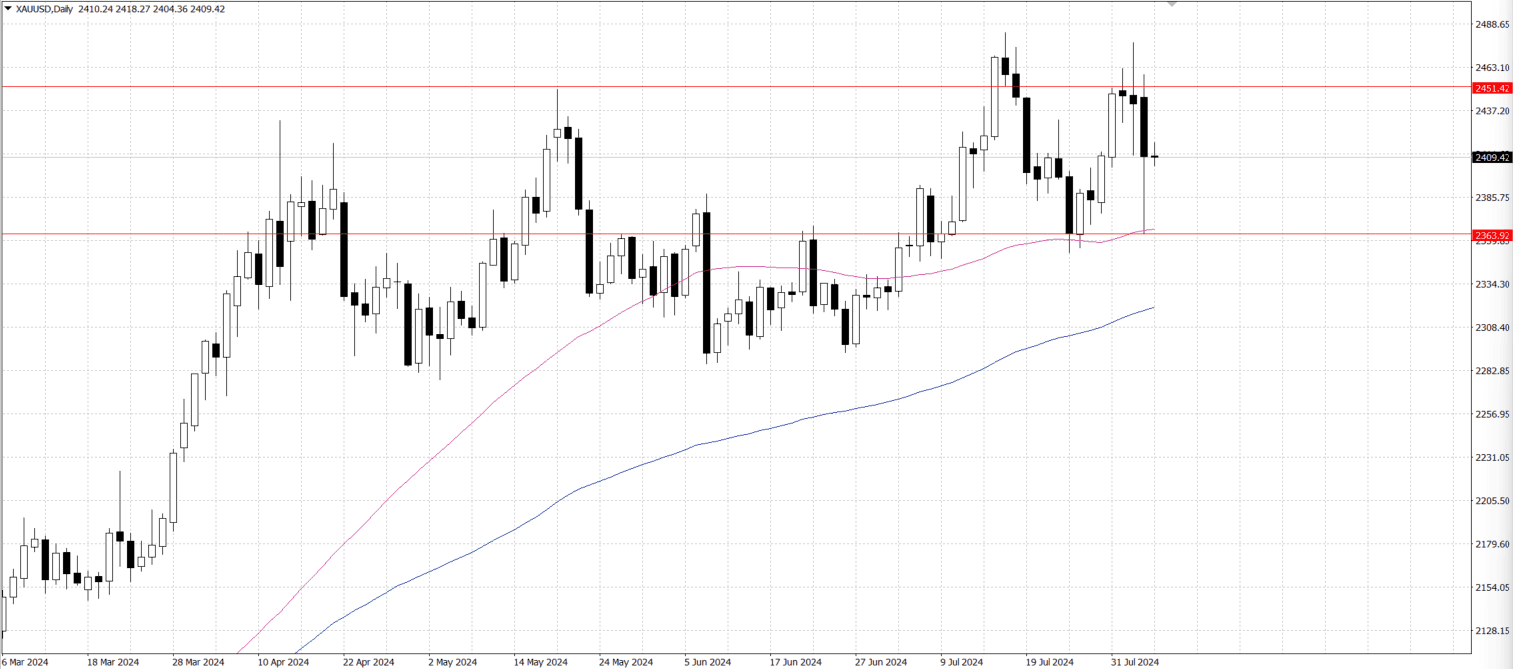

From a technical point of view, gold found strong support near the $…-… region (50-day simple moving average) and a rally was formed there. In the short term, this support level should be a key turning point. A decisive break below this area would pave the way for a further pullback, with the next support near the $…-… area, a break below which could lead to a further dip to $… or the 100-day moving average. A sustained break below the 100-day moving average could trigger more technical selling pressure, making the short-term bias bearish. On the upside, $… could provide some immediate resistance, followed by the $…-… area. If gold breaks above this level, the next significant resistance is in the $…-… area, with further breaks challenging the all-time highs of $…-… reached in July. A break above the psychological level of $… would set the stage for further appreciation in the near term.