Article by: ETO Markets

Weak U.S. economic data attracted more buying interest during today's Asian trading session, pushing prices to near a two-week high of $2375 per ounce. The market continues to focus on the Federal Reserve's expected rate cut in September, with lower borrowing costs expected to stimulate economic activity. Additionally, rate cuts by several central banks signal concerns about slowing economic growth, while sluggish U.S. bond yields are also supporting the rise in gold prices.

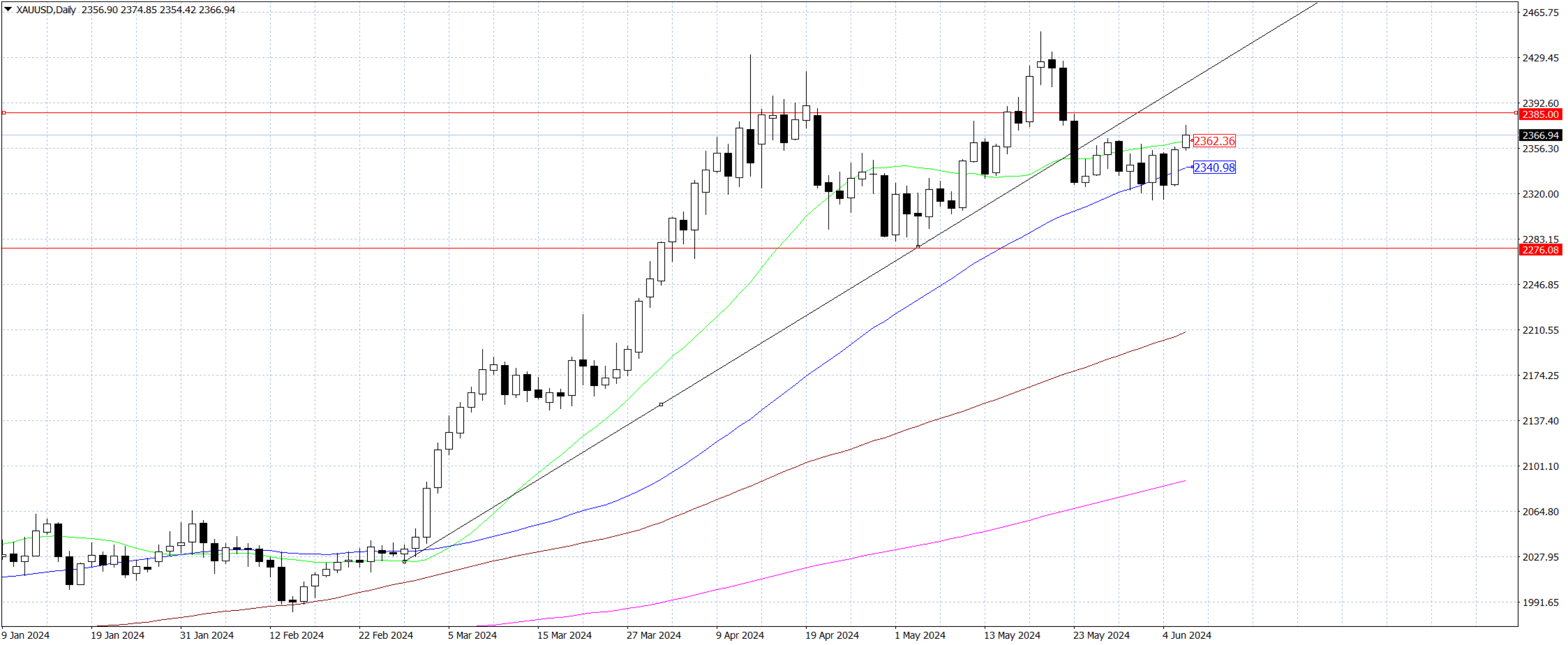

Gold buyers have regained control and are heading towards $... Friday's U.S. non-farm employment change and unemployment rate are key factors affecting gold's trend. If the data remains lower than expected, gold may initiate a new round of gains and break through $... Only if the gold price falls below $… could the situation be reversed.