Article by: ETO Markets

Gold prices have struggled to maintain momentum after a modest intraday bounce from near four‐week lows, as investor caution prevails amid a broader global market sell-off. The cautious sentiment is compounded by the People’s Bank of China, which for the fifth consecutive month has bolstered its gold reserves, reflecting concerns over rising geopolitical risks and a deepening global trade war. Meanwhile, the US Dollar has weakened at the start of the week, driven by expectations that a tariffs-induced economic slowdown may force the Federal Reserve to resume rate cuts soon. Declining US Treasury yields further support gold’s appeal despite upbeat US job data and hawkish Fed remarks, although the lack of follow-through in gold’s recovery suggests that recent corrections from last week’s peaks may not have fully run their course, leaving market participants wary as they unwind bullish positions to cover broader losses.

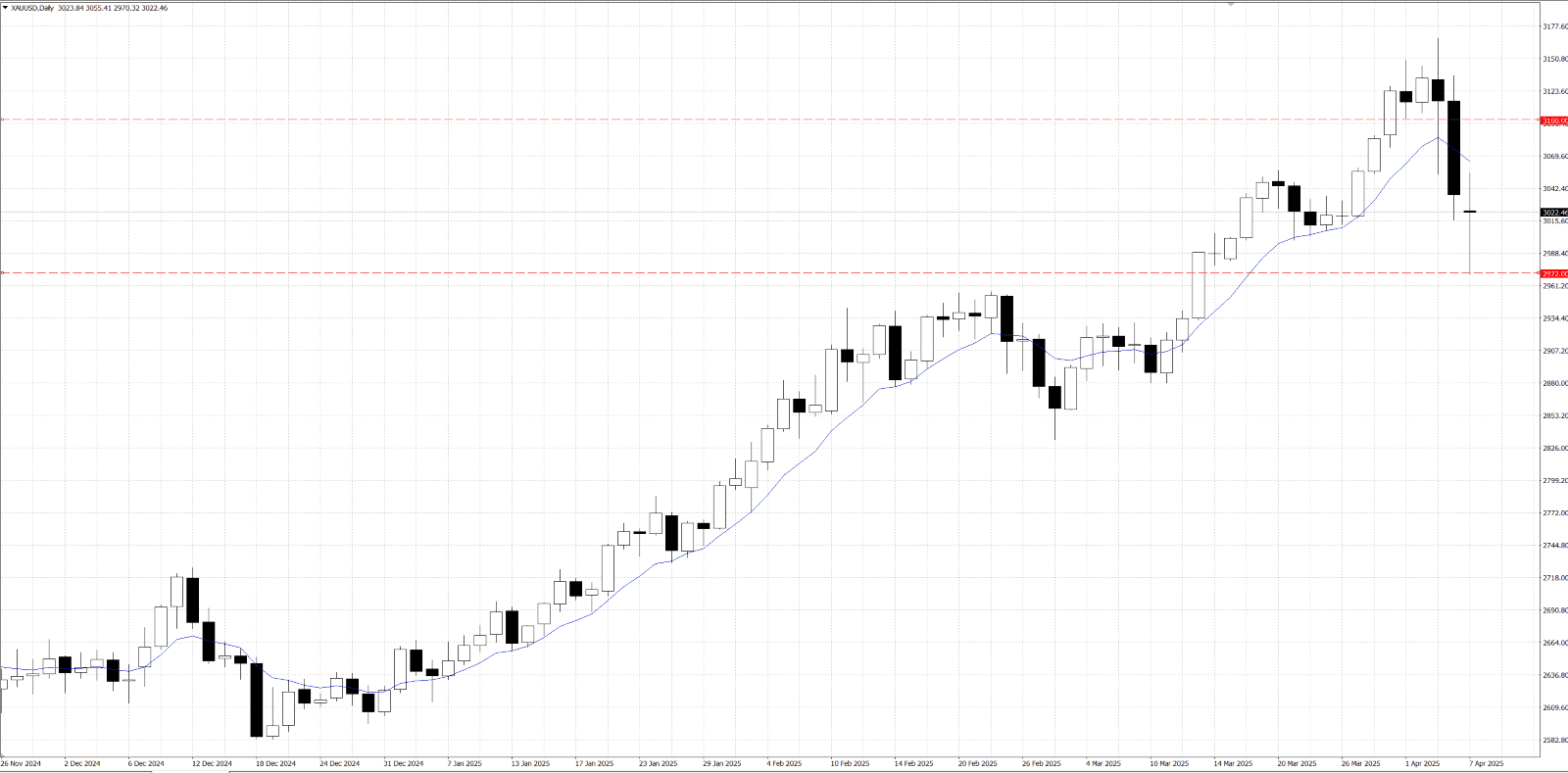

From a technical perspective, last week’s sharp retracement from the all-time peak has stalled ahead of the 61.8% Fibonacci retracement level derived from the February-April surge, while the subsequent upward move has faltered near the $…horizontal support, now acting as resistance. This level is pivotal for intraday traders, as a break above it could see Gold climb toward the $… region and potentially reach the $… round figure. On the downside, the $… psychological mark, which coincides with the 50% retracement level, appears to protect the immediate support near the $…-… area—the multi-week low reached earlier this Monday. Additionally, the 50-day Simple Moving Average around $… reinforces this support, suggesting that a decisive break below this level might shift the near-term bias toward bearishness and pave the way for further depreciation.