Article by: ETO Markets

Gold prices have managed to hold above the $… mark during the Asian session on Friday despite a lack of strong buying interest, as traders remain cautious and await the crucial US Nonfarm Payrolls (NFP) report. This key employment data is expected to influence near-term US Dollar dynamics and potentially provide fresh momentum to gold. Meanwhile, growing concerns over a slowing US economy have spurred expectations that the Federal Reserve might implement multiple rate cuts in 2025, which has helped depress the dollar to near multi-month lows. Investor sentiment is further weighed down by uncertainties surrounding US President Donald Trump's trade policies—highlighted by his recent move to temporarily exempt Canadian and Mexican goods compliant with the US–Mexico–Canada Agreement from steep 25% tariffs—thereby reinforcing gold’s appeal as a safe-haven asset. Comments from Fed officials, including warnings of economic threats and inflation risks, along with a better-than-expected drop in US Initial Jobless Claims to 221K, have added to the overall cautious market outlook as traders brace for the upcoming employment data.

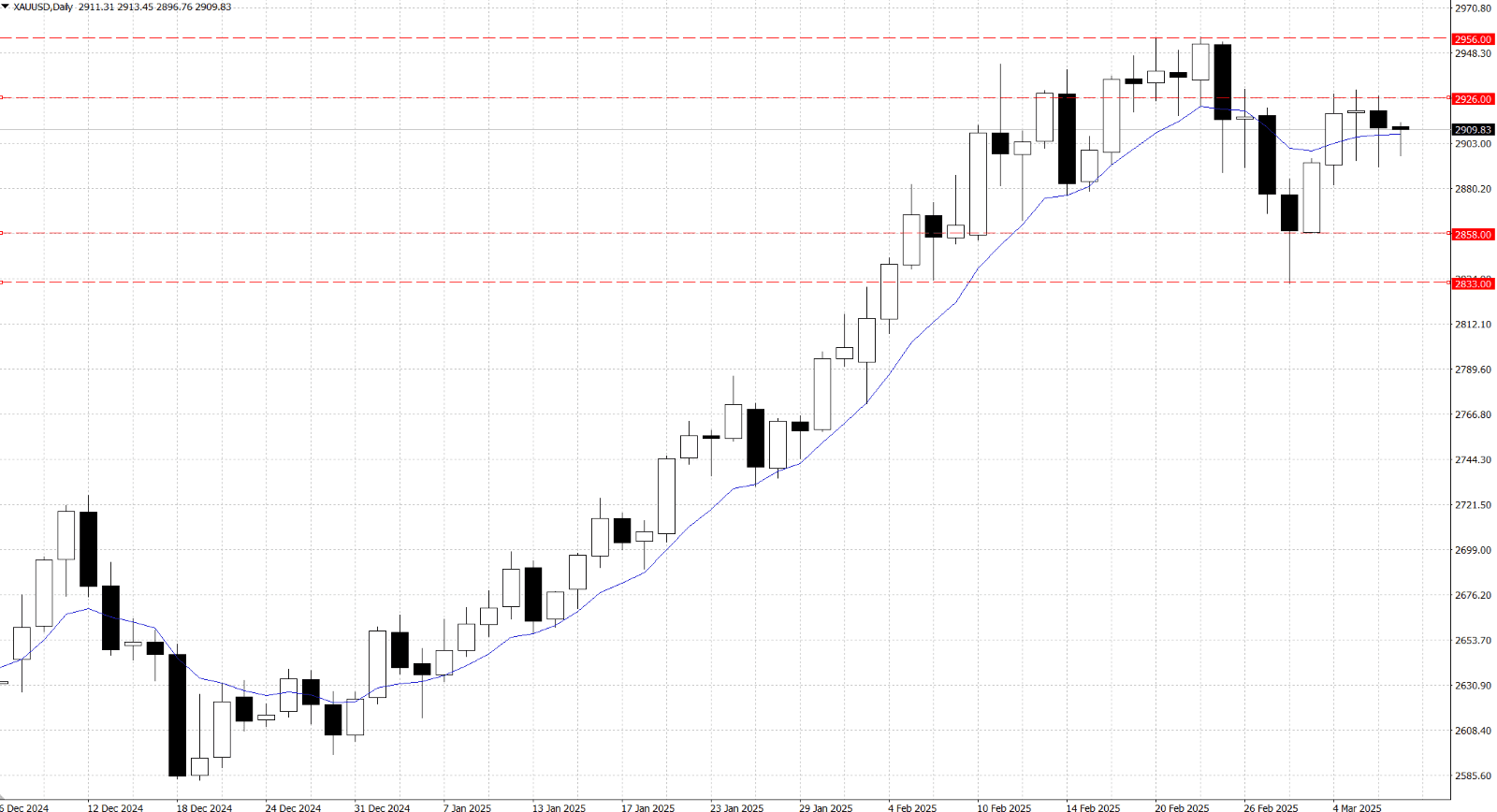

From a technical standpoint, Gold has been resiliently hovering below the $… level, signalling a cautious stance for bearish traders as positive daily oscillators continue to support the commodity. The price may fail to hold this key level, it could slide towards the $… range, with intermediate support around $…, and potentially test last week’s swing low near $… before ultimately falling toward the $… mark. Conversely, an upward breakout past the immediate hurdle of the $…–…zone could pave the way for a retest of the all-time peak around $…, which was last seen in February. Such a move, accompanied by follow-through buying, would likely trigger renewed bullish momentum and resume the three-month uptrend observed in recent trading sessions.