Article by: ETO Markets

Gold price (XAU/USD) has been affected by a number of factors recently. While the dovish stance of the Fed and geopolitical tensions in the Middle East supported gold prices for a time, the rise in U.S. Treasury yields and the strengthening dollar kept gold's gains in check. The intensification of the conflict between Israel and Hamas, and US intelligence indicating that Hamas may retaliate in recent days, has led to an increase in risk aversion. In addition, U.S. economic data is scarce, and investors will focus on Thursday's initial jobless claims data. That said, Asian central banks suspended gold purchases, which also put pressure on prices. The market now expects the Fed to cut rates by 50 basis points in September, an expectation that has provided some support for gold prices.

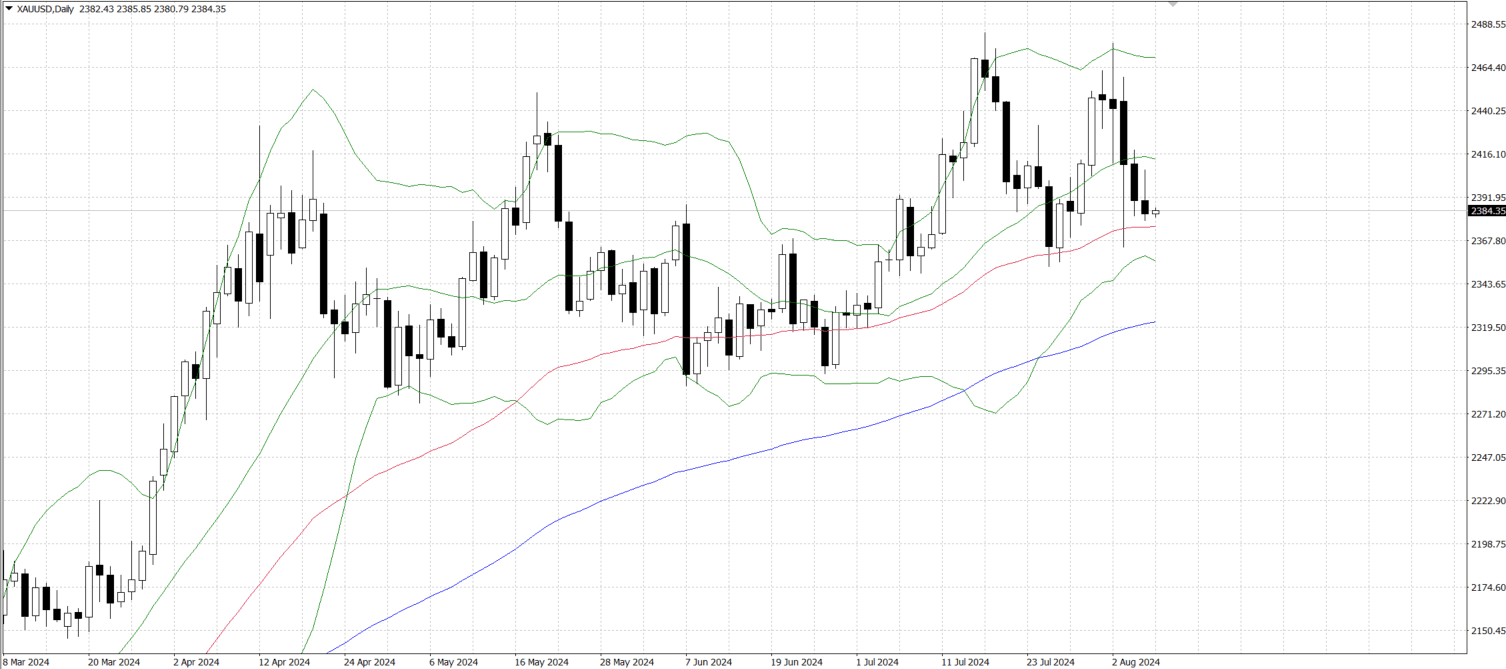

From a technical point of view, gold prices are consolidating near $…, momentum is flat, and RSI is hovering at neutral levels. This suggests that neither buyer nor seller has a clear dominant position. If the XAU/USD continues to weaken, the next support level will be the 50-day Simple Moving Average (SMA) at $…, followed by the 100-day SMAAT at $…. Further support is located at the support trend line of $… and the low of $…. If gold keeps falling, it could test the round $… mark. Conversely, if buyers retake $…, the next resistance level will be the psychological level of $…, a break of which would expose the August 2 peak of $.., followed by the all-time high of $… and the psychological level of $….