Article by: ETO Markets

Gold prices hover around $… in Friday's Asian trading session, consolidating after two volatile days influenced by Donald Trump's re-election and the Federal Reserve's monetary policy announcements. Trump's victory initially weighed on gold as his inflation-boosting policies strengthened the US Dollar (USD) and Treasury yields, which pressured the non-yielding metal. However, gold rebounded after the Fed’s rate cut by 25 basis points to a range of 4.50%-4.75% and Fed Chair Jerome Powell’s commitment to a gradual easing cycle, which triggered USD selling. Despite the recovery, the market's renewed optimism about Trump’s policies supports the USD, posing a headwind for gold. Investors now look to US consumer sentiment, inflation expectations, and upcoming CPI data for further direction.

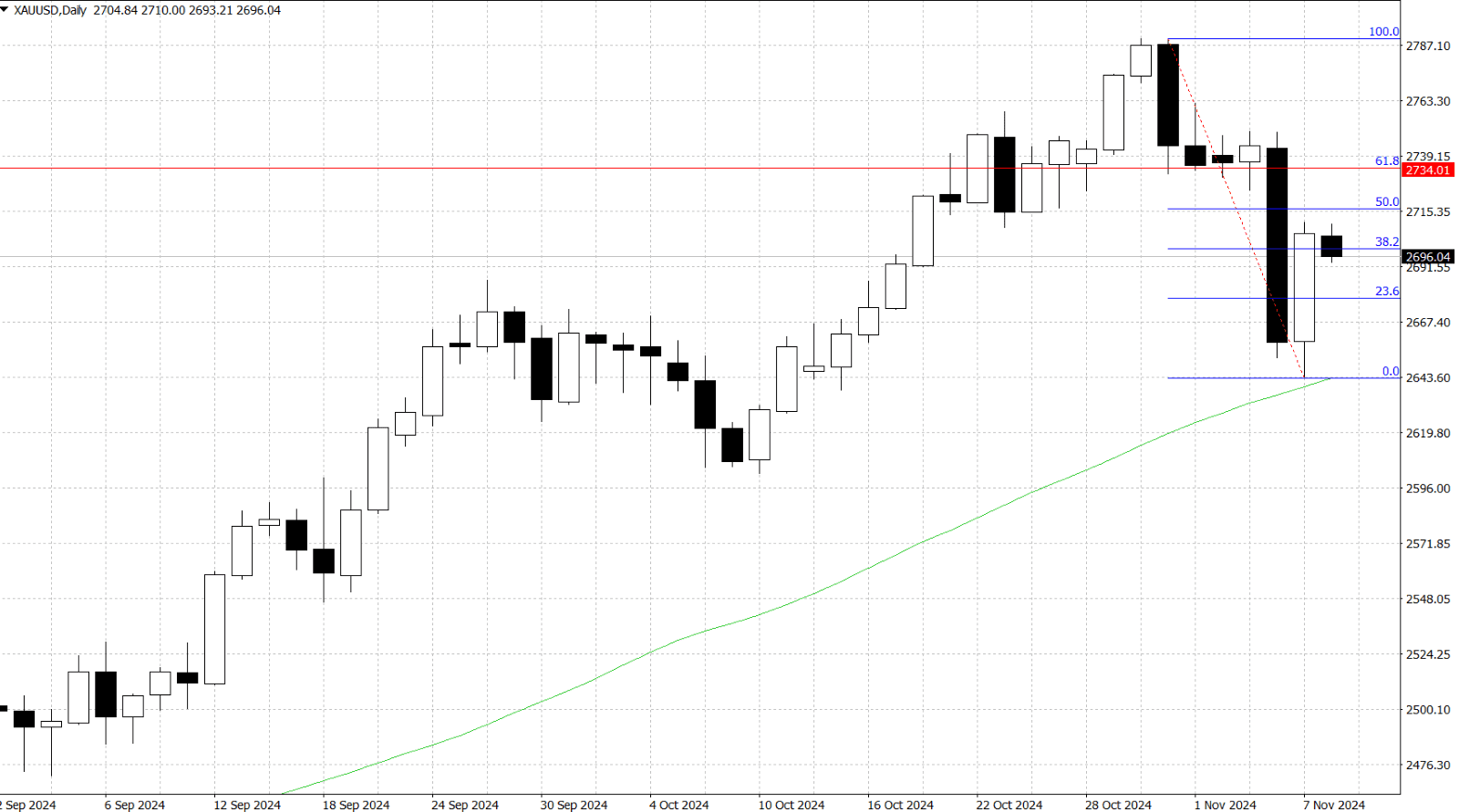

From a technical perspective, gold’s recovery faces resistance near the $… level, the 50% Fibonacci retracement of its recent decline from an all-time high. A break above this point could lead to further gains toward $… (61.8% Fibo level) and possibly beyond $…, targeting the $…-… zone, which includes the record high from October 31. On the downside, immediate support is at $…, with further support at $… and the 50-day SMA around $…. A break below this SMA could intensify bearish momentum, potentially driving gold towards the October swing low near $…-…, as daily chart oscillators show weakening bullish traction.