Article by: ETO Markets

In early European trading on Tuesday, gold prices (XAU/USD) rebounded somewhat on the back of a weaker US dollar. Weak U.S. job data last week bolstered market expectations of a Federal Reserve rate cut in September, lending support to precious metals. In addition, political uncertainty in France and geopolitical tensions in the Middle East increased safe-haven demand in the market, further boosting gold prices. However, the People's Bank of China (PBoC) suspended gold purchases for the second month in a row, which could weigh on gold/USD in the short term. Market expectations for a September rate cut now stand at 76%, up 5% from 71% on Friday. The data added to market expectations of a rate cut by the Federal Reserve. Investors will be watching Federal Reserve Chairman Jerome Powell's testimony before Congress for more clues on future monetary policy. And Thursday's Consumer Price Index (CPI) inflation data will be a key focus for investors.

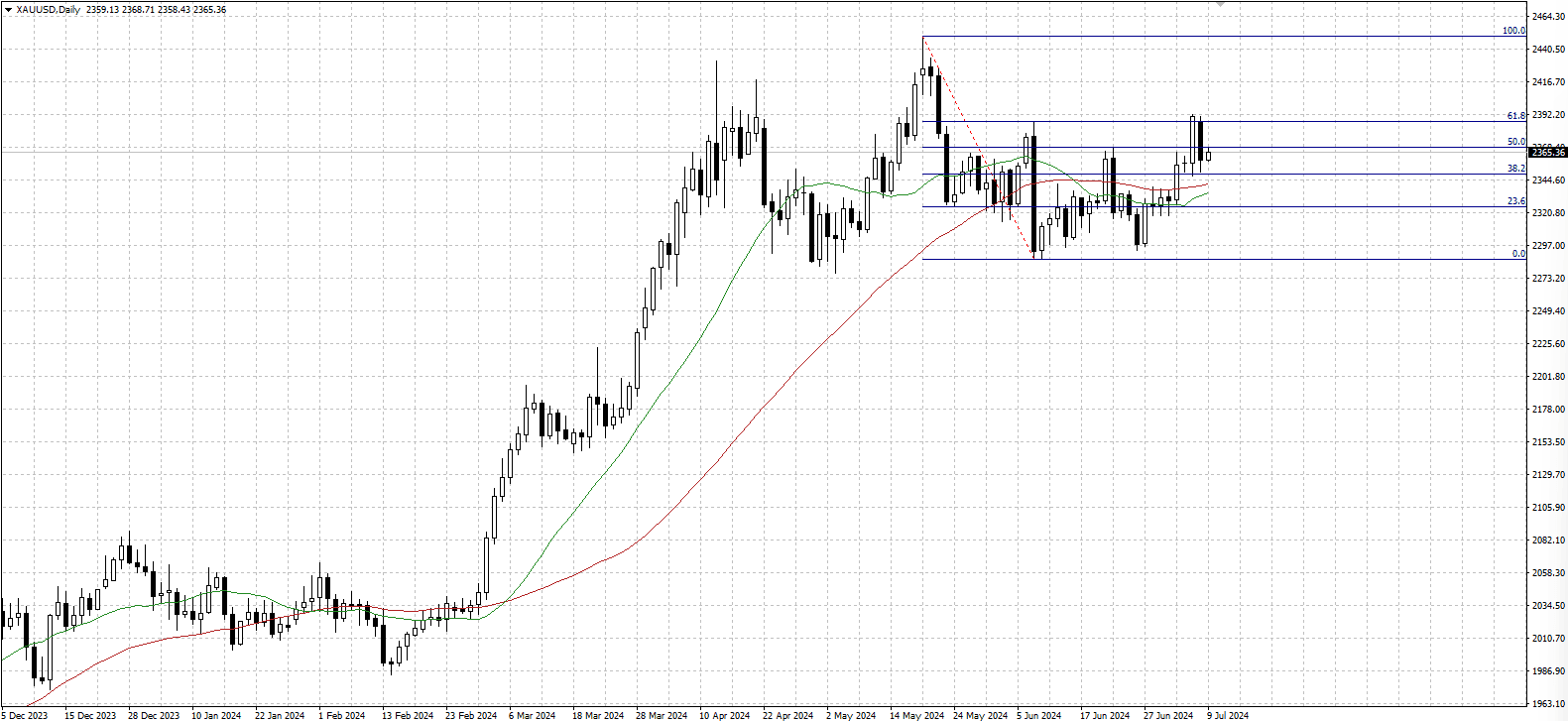

From a technical point of view, gold (AUD/USD) fell to the 50% Fibonacci retracement level of $2367. However, the overall gold price remains bullish on the daily chart, with the 14-day Relative Strength Index (RSI) continuing above 50, indicating that bullish momentum remains strong. The immediate resistance for gold is currently at the 61.8% Fibonacci retracement at $2390. In the event of a pullback, initial support is near the 38.2% Fibonacci retracement at $2,350, followed by the $2,340 area, which is near the 50-day Simple Moving Average (SMA).