Article by: ETO Markets

After the release of the US jobs data, gold prices were near record highs before retreating. August's non-farm payrolls (NFP) data was weaker than expected, reducing the chances of the Federal Reserve cutting interest rates by 50 basis points in September. This has fuelled a rally in the US dollar, which has put pressure on gold. However, geopolitical risks such as concerns about a slowdown in the US economy and the lack of progress in ceasefire talks between Israel and Hamas continue to provide support for gold. Market expectations of a Fed rate cut remain, with about 70% of investors expecting the Fed to cut rates by 25 basis points in September, limiting the downside of gold. In addition, China's August inflation data and gold reserve report did not have a major impact on the market. Overall, while the strong US dollar has put short-term pressure on gold, the economic and political risk backdrop still supports safe-haven demand for gold.

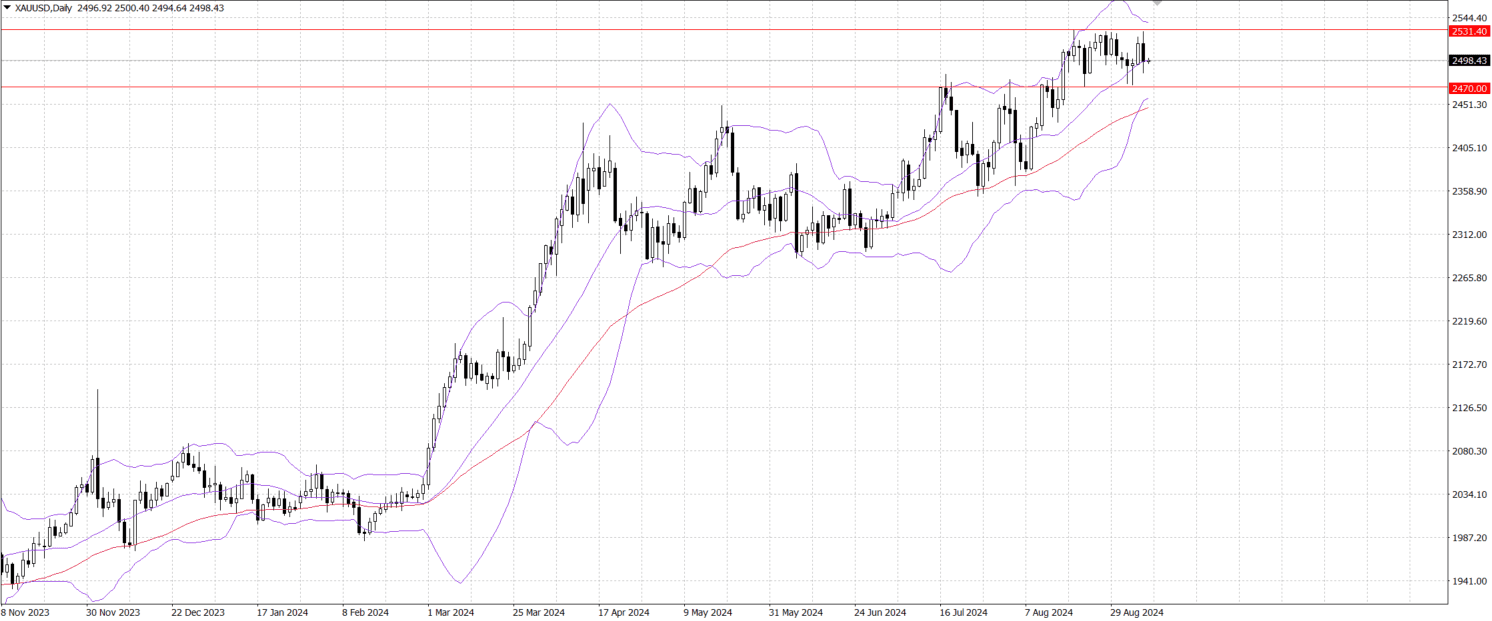

From a technical point of view, the price of gold has remained within a familiar range over the past three weeks, forming a rectangular arrangement on the short-term chart, which indicates that traders are still hesitant to choose the next direction. However, combined with the previous strong rally, this range-bound can still be seen as a bullish consolidation phase. The key support level below is located in the $…-$… area, a break below this level could trigger further declines, targeting the lower Bollinger band around the $… area, and further below the 50-day Simple Moving Average (SMA) support around $…. If the decline continues, gold could test the round $… mark and the $… area near the 100-day SMA. Conversely, a break above the $… and all-time highs in the $… area could further excite bulls and push gold prices higher to challenge the Bolling band's target of $….