Article by: ETO Markets

Gold's momentum is being fuelled by a confluence of significant macro factors. President Trump's imminent announcement of ...% tariffs on steel and aluminium imports has intensified market uncertainty, driving strong safe-haven flows into precious metals. This development comes against a backdrop of continued institutional buying, notably evidenced by the People's Bank of China's ... consecutive month of gold reserve additions. The market is showing remarkable resilience despite mixed U.S. economic signals, including January's NFP report of ... jobs (below ... forecast) and unemployment at ...%. Fed officials' recent commentary, particularly from Kashkari and Goolsbee, suggests policy uncertainty regarding the inflationary impact of new trade measures, further supporting gold's appeal as an inflation hedge. The price action indicates sustained institutional demand, with pullbacks consistently finding strong buying interest.

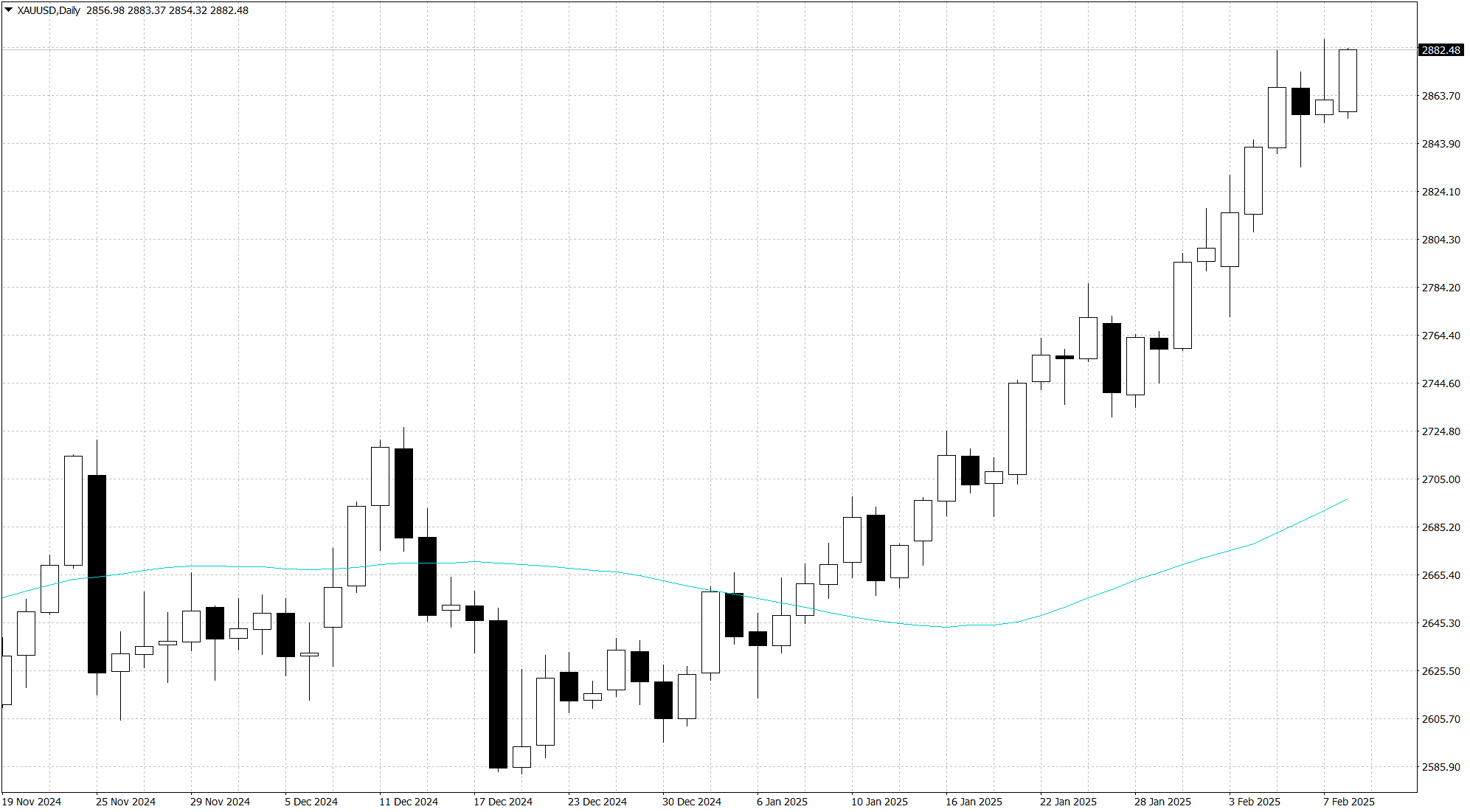

The current market structure displays exceptional strength, with significant technical evidence supporting continued upward momentum. Price action forms a decisive uptrend characterized by shallow pullbacks and strong recoveries, with each consolidation zone becoming support for the next advance. The critical $...-$... support level, established through recent multiple successful tests, represents significant buyer interest and serves as a launching pad for further gains. Secondary support at $..., validated by previous consolidation and increased volume, provides a safety net for any deeper retracements. The immediate upside target of $... appears achievable given current momentum, while extended projections suggest potential for $...-$... upon a decisive break higher. Recent price behavior indicates a momentum-driven market where traditional resistance concepts hold less relevance, as evidenced by the market's ability to quickly absorb selling pressure and establish new highs. The sustained uptrend, coupled with strong volume confirmation and institutional buying interest, suggests that while brief consolidations may occur, the path of least resistance remains higher.