Article by: ETO Markets

Gold prices (XAU/USD) rose for a third straight day in early Asian trading on Thursday, although market sentiment is unclear. Growing expectations that the Federal Reserve may cut interest rates in September and December have weighed on the dollar, supporting non-yielding gold. Comments from Federal Reserve Chairman Jerome Powell also reinforced market expectations of a rate cut. At the same time, global economic and geopolitical uncertainties have also increased the safe-haven demand for gold. However, news that the People's Bank of China (PBoC) suspended gold purchases for the second month in a row put some pressure on gold prices. Investors will be closely watching the upcoming release of U.S. consumer price index (CPI) data, which will give more clues on the Federal Reserve's interest rate policy.

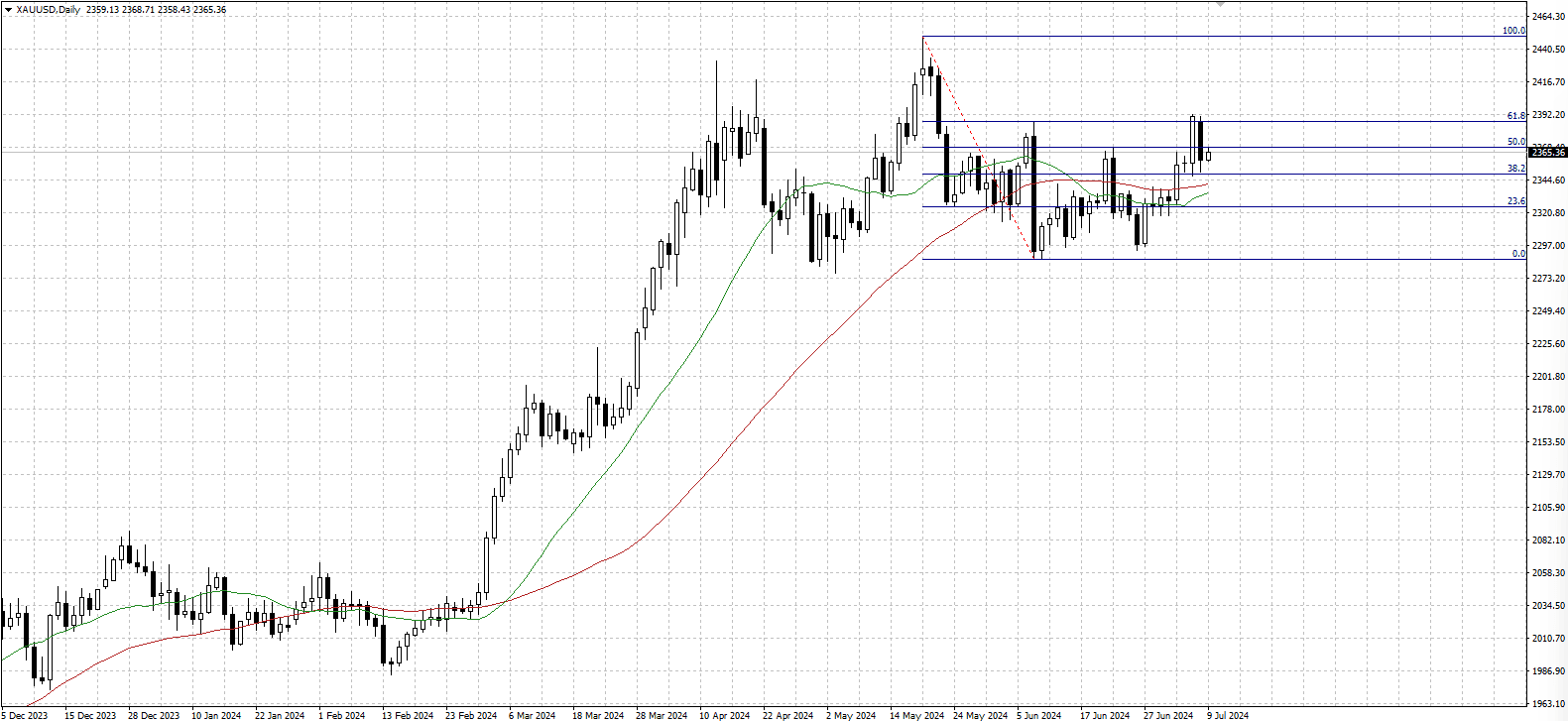

From a technical point of view, the main resistance levels for gold prices are the 61.8% Fibonacci retracement at the $… to $… area and $…. If gold can break through these levels, it could rally further to a one-month high. Conversely, if gold pulls back, it could find support at the 50% Fibonacci retracement of $… to the U.S. dollar area, and a break below this support could retest the 50-day moving average support at $….