Article by: ETO Markets

Gold price (XAU/USD) is influenced by a combination of key factors. First, tensions in the Middle East have increased further, particularly the increased risk of conflict between Israel and Lebanon, as well as Iran. This geopolitical uncertainty typically drives demand for safe-haven assets such as gold, providing a strong incentive to support gold prices. At the same time, market expectations for the Federal Reserve to cut interest rates in September remain strong, further enhancing gold's appeal. Investors widely expect the Fed to cut interest rates by 25 basis points at its September meeting, with some possibility of a 50 basis point cut, which has provided support for non-yielding gold. The positive tone in global equity markets has limited gold's gains somewhat. Optimism in equity markets typically weakens demand for safe-haven assets, especially against a backdrop of increased risk appetite. In addition, traders are generally taking a wait-and-see approach ahead of key U.S. inflation data due this week, avoiding making too many directional bets ahead of the release. The upcoming U.S. producer price Index (PPI) and Consumer price Index (CPI) will be important factors influencing market expectations, which may have a significant impact on the future path of Federal Reserve policy, and thus affect the direction of gold prices.

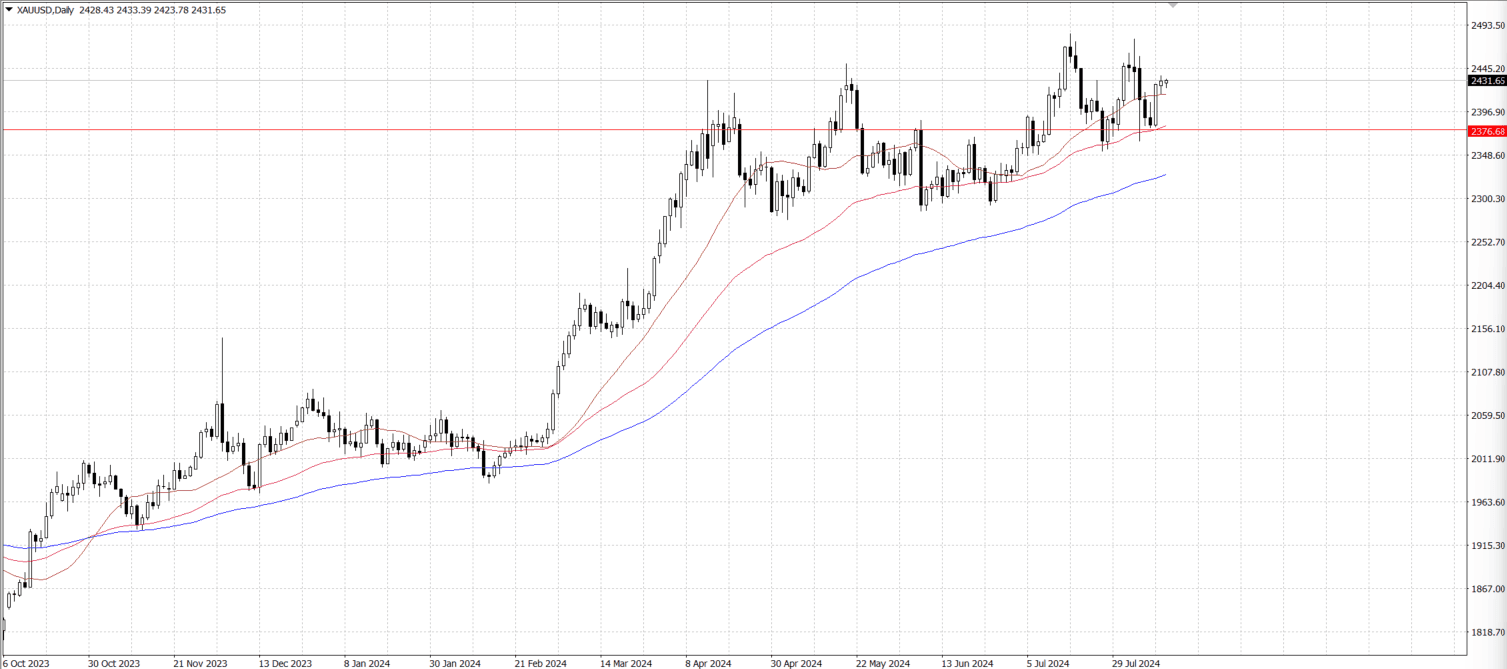

From a technical point of view, the gold price is currently enjoying strong support near the 50-day simple moving average (SMA) and shows some potential for a rebound. The volatility indicator on the daily chart remains in positive territory, indicating that gold prices are expected to rise further in the short term. However, given the lack of strong follow-on upward momentum in the near term, traders should remain cautious when making new directional bets. On the upside, gold needs to break the resistance area of $…-… to further challenge the all-time high of $…-… set in July and potentially break the psychological level of $…, which would set the stage for further gains. On the other hand, if gold fails to hold the round $… mark, it may face pullback pressure in the short term. The 50-day SMA support in the $…-… area will be a key line of defense, and a break below this could take gold back to the late July lows in the $…-… area, or even to the 100-day SMA support. If this support area is broken, gold's action could turn bearish and trigger a new wave of technical selling.