Article by: ETO Markets

Gold prices (XAU/USD) continue to rise for the second consecutive day, reaching the $… level amid escalating trade tensions and renewed US Dollar (USD) weakness. Concerns over US President Donald Trump's newly imposed tariffs on steel and aluminium, along with fears of a global trade war, have bolstered demand for the safe-haven metal. Meanwhile, hotter-than-expected US inflation data has reinforced expectations that the Federal Reserve will maintain its hawkish stance, leading to a surge in US Treasury bond yields, which could limit gold’s upside. Despite this, the USD remains weak, further supporting bullion. Investors now await US Producer Price Index data and jobless claims figures for further market direction.

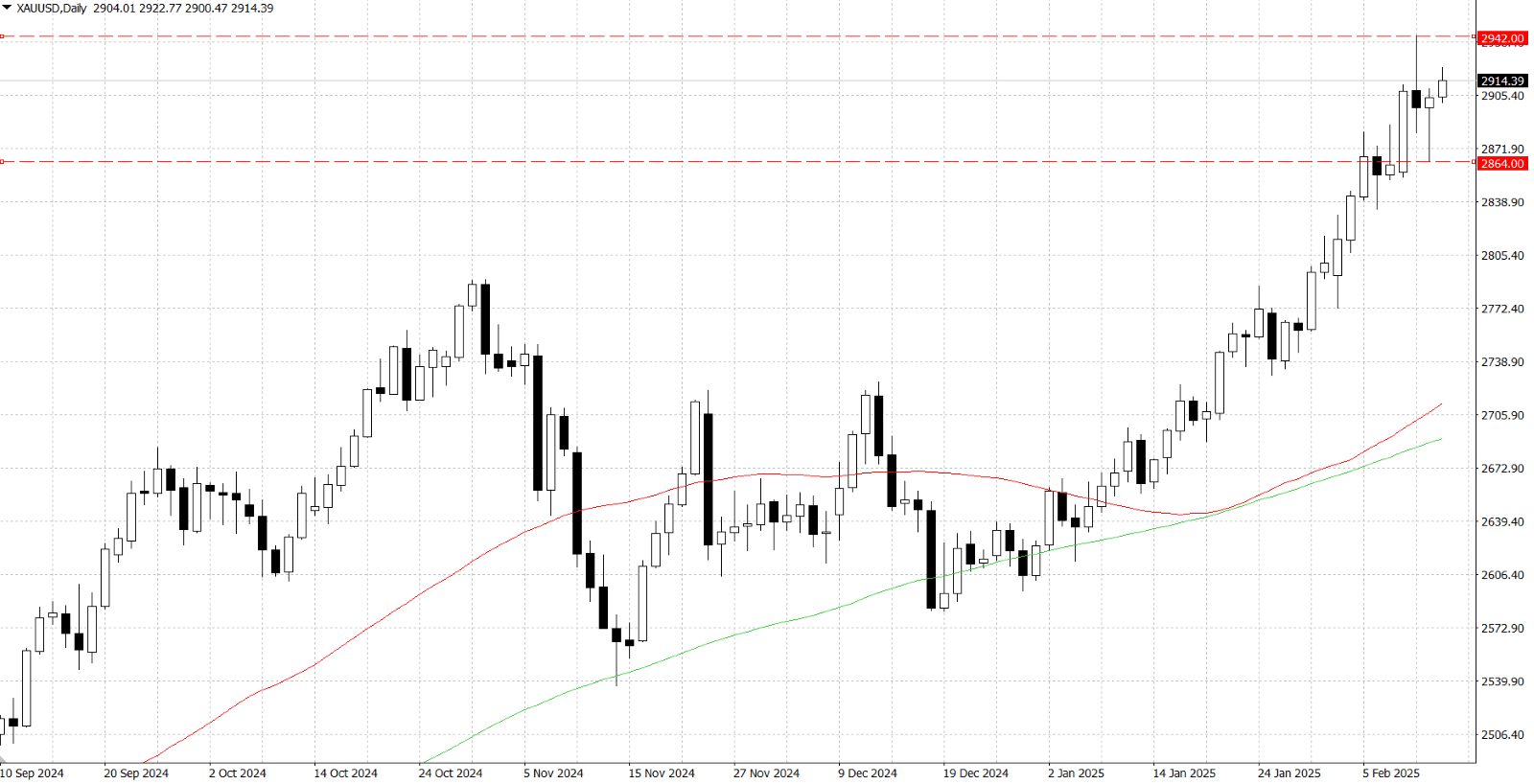

From a technical perspective, the daily Relative Strength Index (RSI) remains in overbought territory, indicating that gold prices (XAU/USD) may face resistance and could be due for a corrective pullback. The immediate upside hurdle is at the $…-… zone, which represents the recent all-time high reached on Tuesday and is expected to act as a strong resistance level. A sustained break above this region could open the door for further gains. However, given the overbought conditions, bulls may take a breather before attempting to push higher. On the downside, if gold price falls below the psychological $… level, it could trigger further selling pressure, exposing the overnight swing low near $…. A decisive move below this level could accelerate a corrective pullback toward the next intermediate support around the $…-… region. A break below this support zone would shift the short-term bias in favor of the bears, increasing the likelihood of a deeper retracement towards the key $… mark, which could act as a strong support level.