Article by: ETO Markets

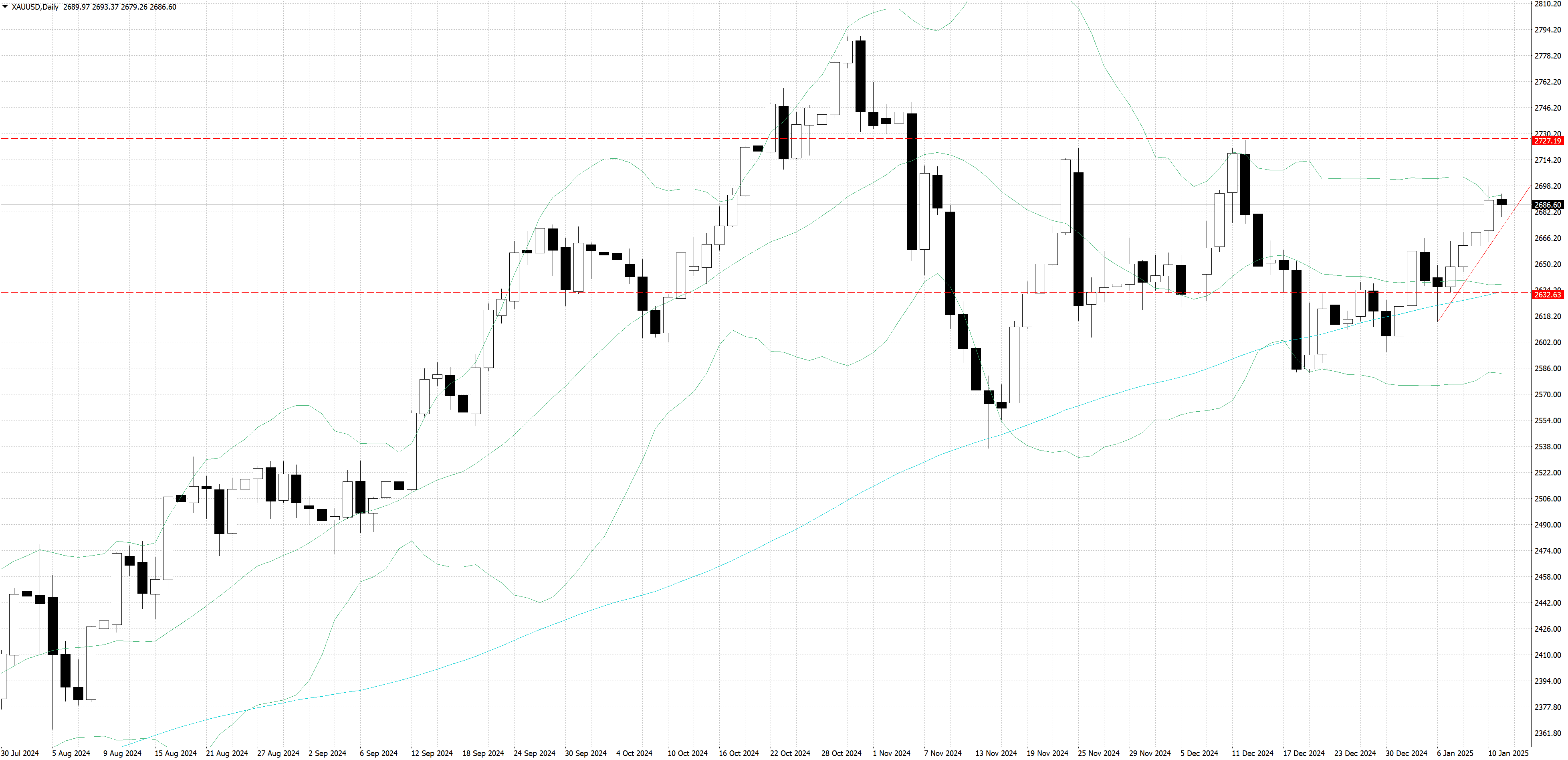

The gold market is currently navigating a complex fundamental landscape dominated by competing macroeconomic and geopolitical forces. Friday's robust NFP print (256K vs 160K expected) and moderation in wage growth to 3.9% have reinforced expectations for a more hawkish Fed stance, as evidenced by the recent pullback from $… resistance. This fundamental shift is corroborated by the bearish engulfing pattern formed at current levels, suggesting near-term consolidation. However, escalating geopolitical tensions provide underlying support, with recent developments including expanded Russia-Ukraine conflict (139 reported strike locations), new Western sanctions targeting Russia's shadow fleet, and ongoing Middle East instability. The interplay between these factors has established a defined trading range, with price action showing reduced volatility near key technical levels.

From a technical perspective, the market has formed a series of higher lows within an ascending channel since December. Primary support resides at $…, where the 20-day Simple Moving Average provides dynamic support, followed by $…, where the ascending trendline converges with the 100-day Simple Moving Average, forming a robust floor for any deeper corrections. Resistance is clearly defined at $… (recent rejection high + psychological level), followed by $… (prior swing high). The current momentum structure remains constructive but suggests consolidation before the next directional move, likely catalysed by this week's US inflation data.