Article by: ETO Markets

Gold is trading sideways around the $3,230 mark, slightly below its new all-time high, as bulls take a breather after a three-day rally, even as escalating US–China trade tensions provide ongoing support for the safe-haven metal. The market is influenced by improving global risk sentiment, which has somewhat curtailed immediate demand for gold, while expectations that the Federal Reserve will resume its rate-cut cycle—potentially lowering borrowing costs through at least three cuts this year—have kept the US Dollar near its lowest level since April 2022. These factors, coupled with increased tariffs between the US and China and a notable spike in US Treasury yields as investors shift away from bonds amid weaker economic confidence, reinforce gold’s appeal as an inflation hedge. Moreover, recent US consumer price data showing a modest decline in headline inflation and a near four-year low in core inflation expectations, along with anticipation of further policy easing and potential inflationary pressures from tariffs, suggest that the fundamental outlook remains supportive for gold, warranting caution against any significant near-term price declines. Market participants are now focused on upcoming statements from key Federal Reserve officials and crucial US retail sales data, which are expected to provide additional direction for both the US Dollar and the precious metal.

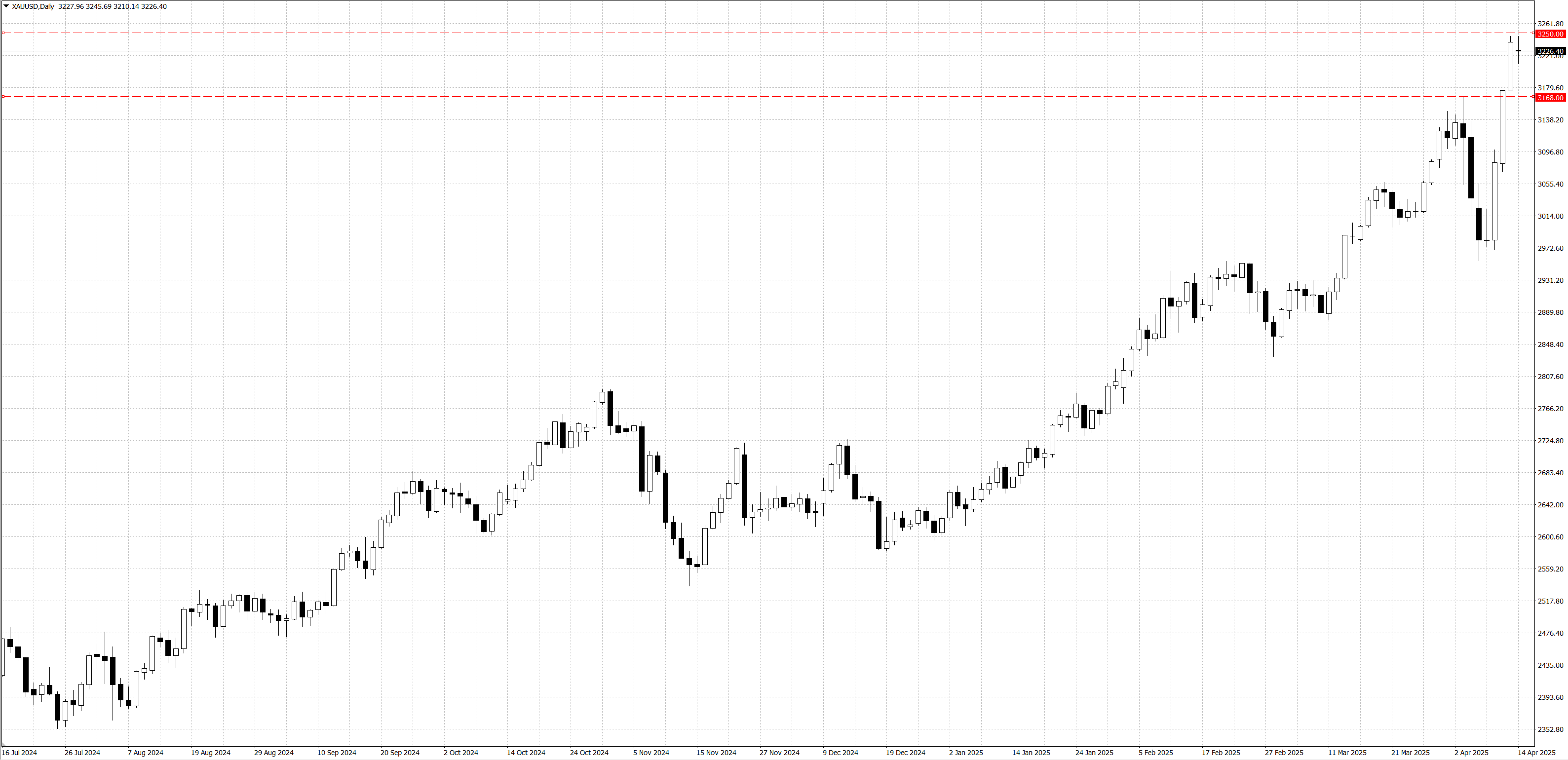

From a technical perspective, the daily Relative Strength Index (RSI) is slightly overbought, lingering just above the 70 level, which indicates that gold may be nearing stretched conditions. This suggests that traders should be cautious and wait for a period of consolidation or a modest pullback before initiating any new long positions. In the meantime, a corrective move down to around the $… level could present an attractive buying opportunity, as this area is expected to act as a strong support base. Moreover, the region between $… and $… is identified as a pivotal support zone, potentially limiting further downside and providing short-term traders with a key technical foundation for future upward moves. On the other hand, the psychological level $… could act as a potential resistance level, followed by $….