Article by: ETO Markets

This Thursday, gold prices initially rose to an intraday high of $2326 under the influence of weak Producer Price Index (PPI) data, but later retreated. Considerations by the Federal Reserve (Fed) for interest rate cuts provided strong support for the U.S. dollar, prompting gold bulls to adopt a more cautious stance. Despite U.S. CPI reports indicating ongoing deflationary trends and other weak economic data reinforcing this view, Fed Chairman Jerome Powell expressed continued "confidence concerns" regarding progress on inflation.

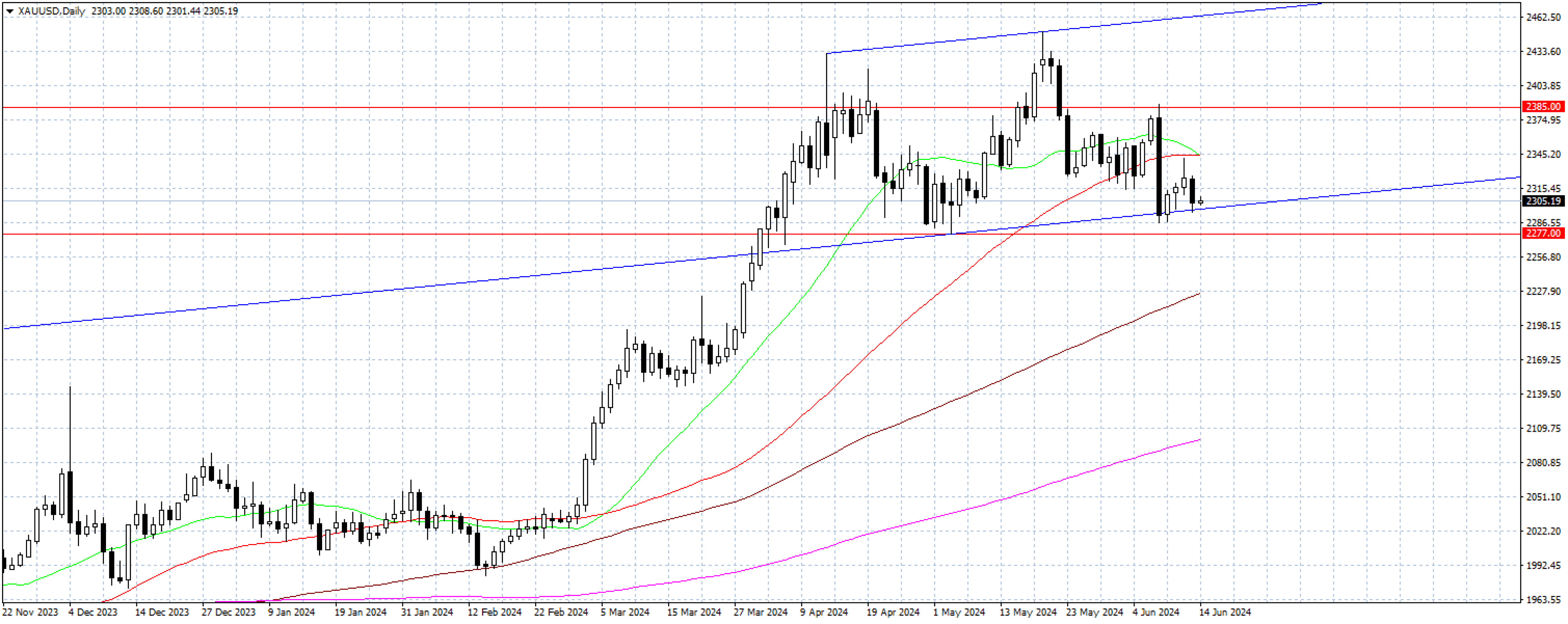

On the daily chart, the head and shoulders pattern remain unchanged, indicating a neutral to bearish bias for gold prices. However, the failure to break below the $… level has provided an opportunity for gold buyers to regain momentum. Pushing the price above $… could attract more bullish sentiment, potentially testing the June 7th cycle high of $... Conversely, if gold sellers manage to break below the support at $…, as suggested by the head and shoulders pattern, their ultimate target would be around $...