Article by: ETO Markets

Gold prices continued to fall this week, mainly affected by the strengthening of the US dollar and rising US Treasury yields. After Trump was elected as the US president, market expectations of his expansionary economic policies pushed up the US dollar, and the US dollar index (DXY) hit an annual high. Investors believe that Trump's policies may promote economic growth and increase inflation, which will make the Federal Reserve cautious in future policy adjustments, weakening the appeal of gold. In addition, the latest US CPI data showed a slowdown in the pace of inflation, which further supported the market's expectations that the Federal Reserve will reduce future interest rate cuts, especially against the backdrop of a weakening US labor market.

Although some Fed officials have eased their cautious attitude towards future interest rate cuts, the market expects that the probability of another 25 basis point rate cut in December has risen to more than 80%. Comments from Fed officials (such as comments from Dallas Fed President Lorie Logan and Kansas City Fed President Jeffrey Schmid) show concerns about the risk of persistent inflation, which further limits the Fed's room for easing policy. As a non-yielding asset, gold has become less attractive as US Treasury yields remain high. At the same time, the strong performance of the US stock market has also diverted the market's demand for safe-haven assets.

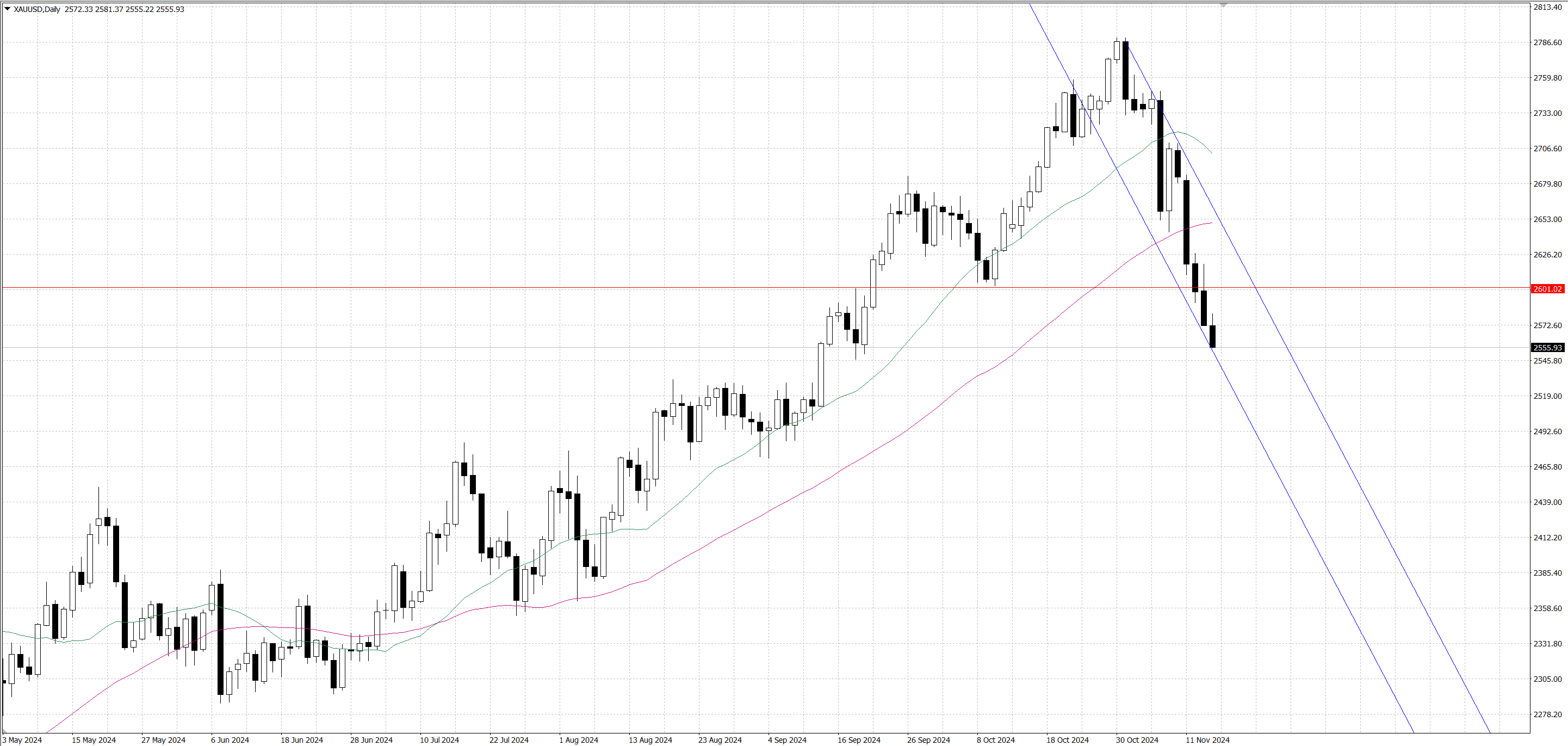

From a technical perspective, gold prices broke below the $… mark overnight, which is the 38.2% Fibonacci retracement level of the June-October rally, forming a new bearish signal. Negative oscillators on the daily chart suggest that the downtrend in gold prices is dominant and supports further declines towards the support level of the $…-$… area. This area contains the 100-day simple moving average (SMA) and the 50% Fibonacci retracement level. If this support level is broken, the decline may accelerate and further test the psychological support level of $….

On the rebound, if gold prices stabilize around $…, the initial resistance level is the round number mark of $…. A sustained break above this level may trigger a short-covering rally with an upward target of the $…-$… resistance range. If this range is cleared, further resistance is in the $… area.