Article by: ETO Markets

Investors were obliged to reduce their expectations for a more aggressive policy easing due to hawkish remarks made by Fed members and rather hot consumer inflation statistics reported by the US on Thursday. The US Dollar and US Treasury bond yields benefit from this, which may limit advances for the non-yielding gold price. Markets are still factoring in a higher likelihood of a Fed rate cut in March in the meantime. As traders now turn to the US Producer Price Index for short-term stimulus, this should maintain a floor on the non-yielding yellow metal.

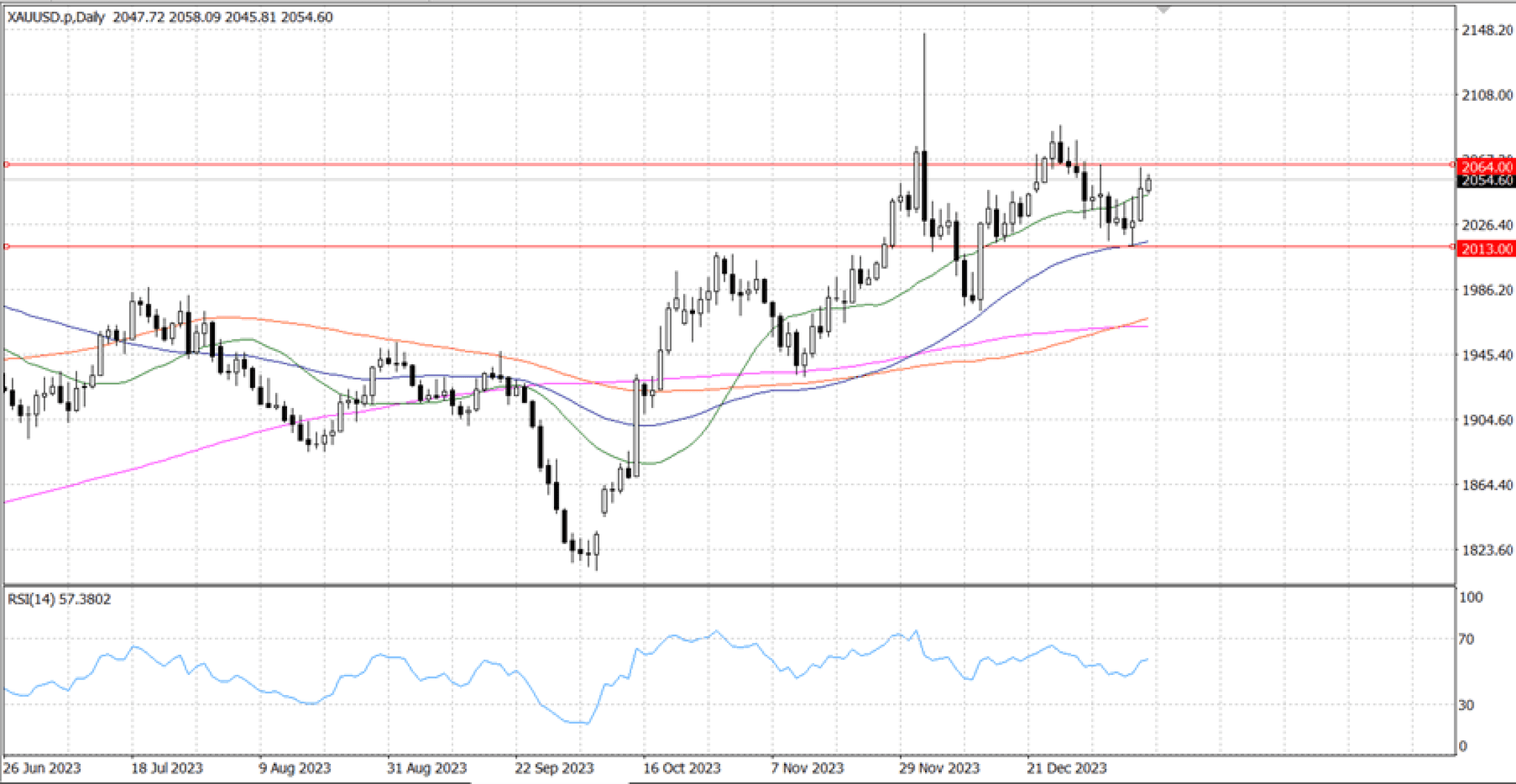

Optimistic traders are favored by the overnight bounce from the 20-DMA, the ensuing uptrend, and favorable oscillators on the daily chart. Nevertheless, it will still be wise to hold off on positioning for further gains until there is a sustained surge above $2,064. Conversely, the $2,016 zone appears to be safeguarding the short-term decline ahead of the multi-week low, which is located around the $2,013 region, or the 50-DMA that was tested on Thursday. A strong fall below the latter will be interpreted by negative traders as a new trigger, pushing the price of gold down to the psychological $2,000 level.