Article by: ETO Markets

Gold surged above $… for the first time since December, driven by solid US consumer spending data and rising unemployment claims, which weighed on US Treasury yields and bolstered demand for the precious metal. December Retail Sales rose by 0.4% MoM, with an upward revision for November to 0.8%, signalling a resilient economy. However, Initial Jobless Claims increased to 217K, missing expectations and raising concerns about the labour market. Wednesday's inflation figures strengthened expectations of further Fed rate cuts in 2025, with markets pricing near-even odds of two reductions by year-end, starting in June. Bullion buyers-maintained momentum despite steady Treasury yields, while the market remains watchful of upcoming US housing and industrial production data.

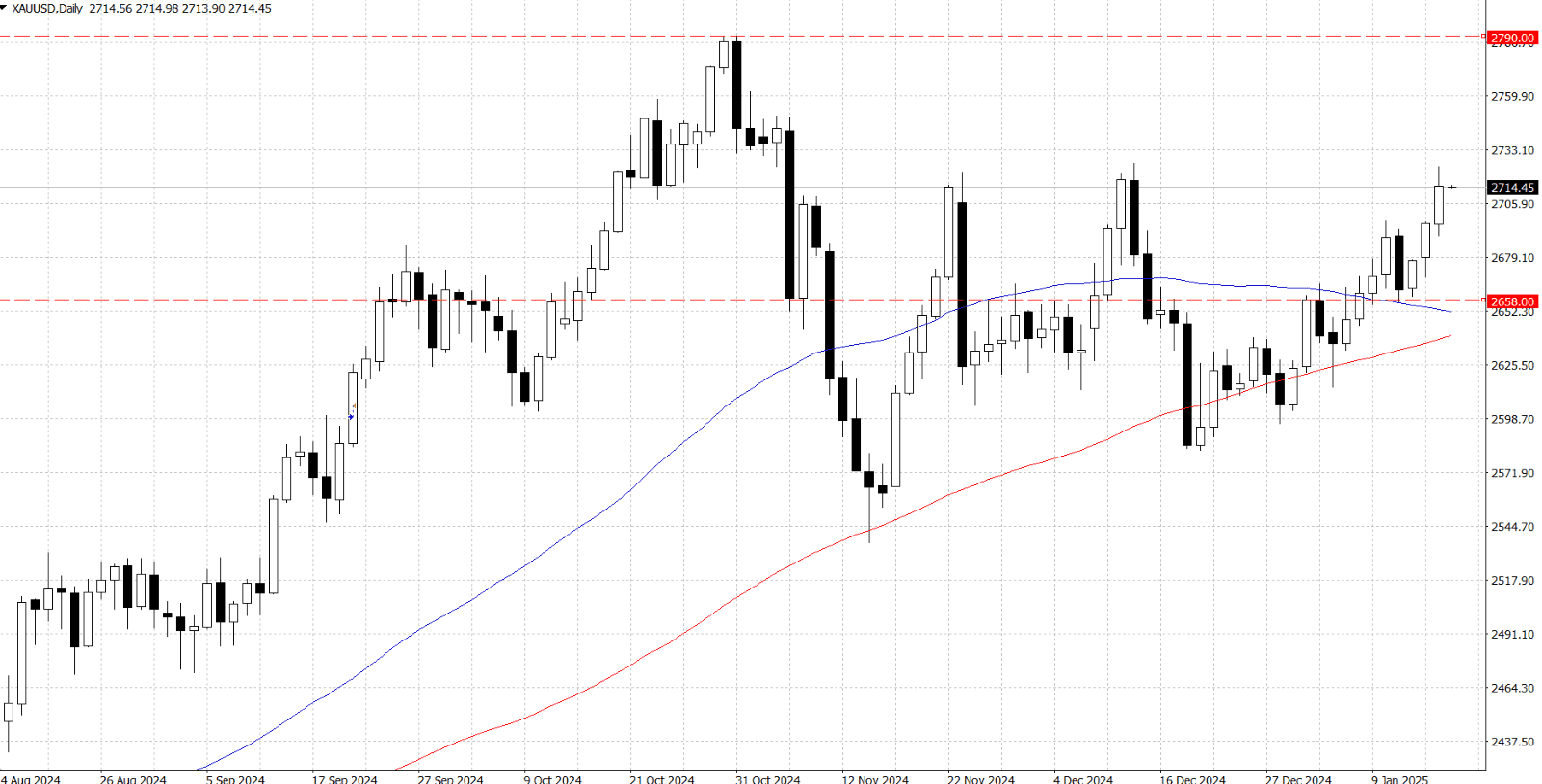

From a technical perspective, gold faces significant resistance at $… on Thursday, with further hurdles at $… and the all-time high of $…. A steepening RSI on the daily chart suggests a risk of overheating, which could trigger a correction back to $… if momentum falters. On the downside, initial support lies at the descending trendline near $…, followed by the 55-day SMA at $… and the 100-day SMA at $…. Clearing $… could pave the way for a test of $…, a double-top from late 2024, while a breakout above that level would set the stage for a challenge of the record high at $….