Article by: ETO Markets

Gold prices (XAU/USD) remain near a one-week low amid cautious trading during the Asian session on Tuesday as investors await the Federal Reserve's crucial policy decision on Wednesday. Elevated US Treasury yields and a strong US Dollar, supported by expectations of a less dovish Fed and robust US economic data—particularly the surge in Services PMI and Composite PMI—act as headwinds for the precious metal. Traders remain on the sidelines, seeking clarity from the FOMC's policy statement, dot plot, and Chair Powell's speech on the future rate-cut path. Meanwhile, US Retail Sales data, set for release later on Tuesday, could provide short-term direction, but geopolitical tensions involving North Korea, Russia, and Yemen add further complexity to market sentiment.

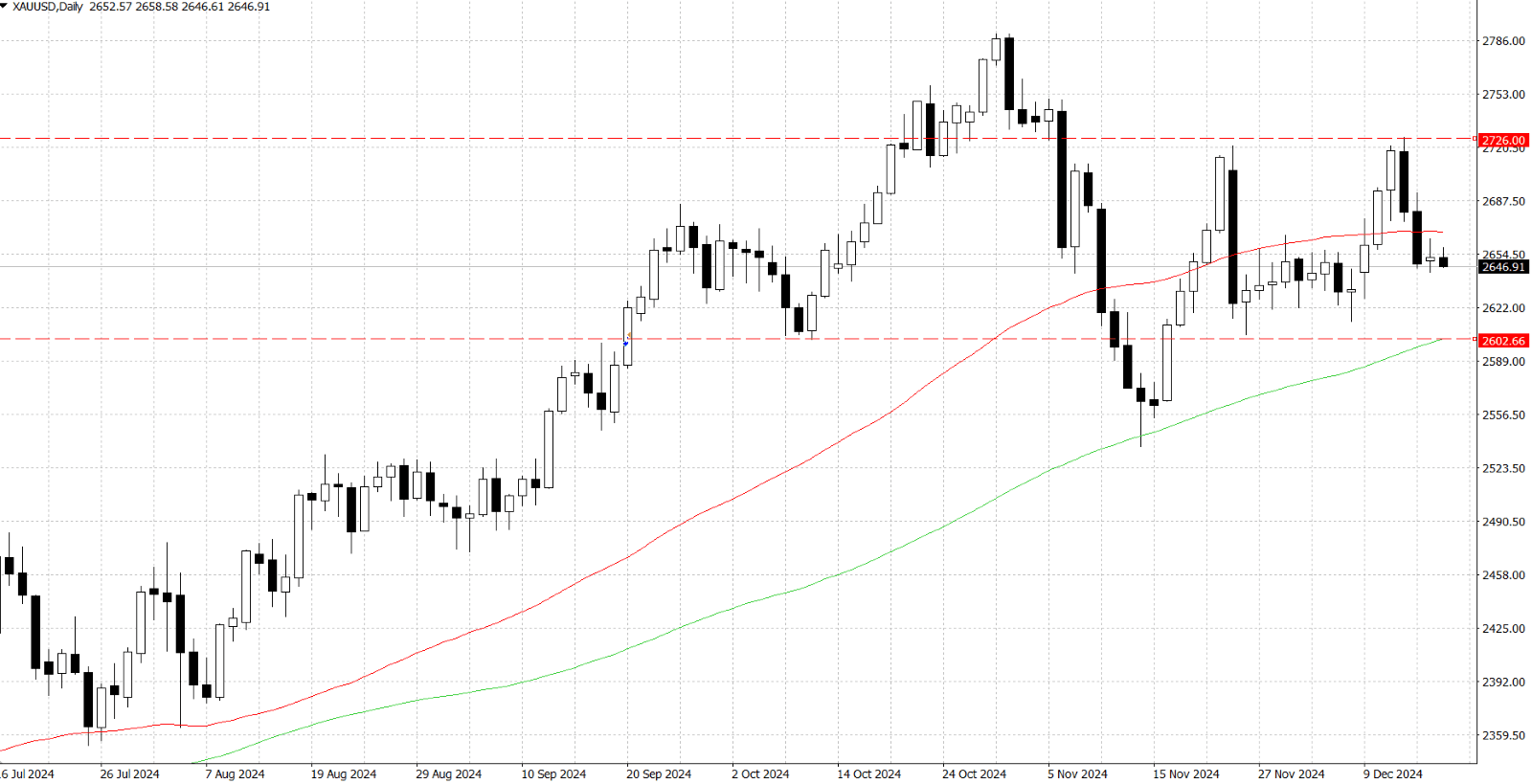

From a technical perspective, the $… (the daily low) area serves as immediate support for Gold, followed by key levels at $… (monthly low), and the critical $… mark supported by 100-days Simple Moving Average (SMA), a decisive break of which could trigger further bearish momentum. On the upside, the $… region (55-days SMA) acts as a near-term resistance, with a break above $… potentially paving the way for a retest of the $… psychological mark. Sustained strength beyond this level could see gains extend toward the monthly high of $…, signalling a continuation of Gold's upward trajectory.