Article by: ETO Markets

Gold prices (XAU/USD) remain in a bullish consolidation phase near $…, supported by expectations of further Federal Reserve rate cuts this year following signs of abating inflation, which have pressured US Treasury yields and the US Dollar. Fed Governor Christopher Waller’s remarks on potential rate cuts and weaker US labour market data added to the metal's appeal. However, easing concerns about US President-elect Trump’s trade tariffs, the Israel-Hamas ceasefire deal, a modest USD recovery, and speculation of a Bank of Japan rate hike next week cap Gold’s upside. Despite these headwinds, XAU/USD is poised for a third consecutive weekly gain as traders await US housing and industrial production data for further direction.

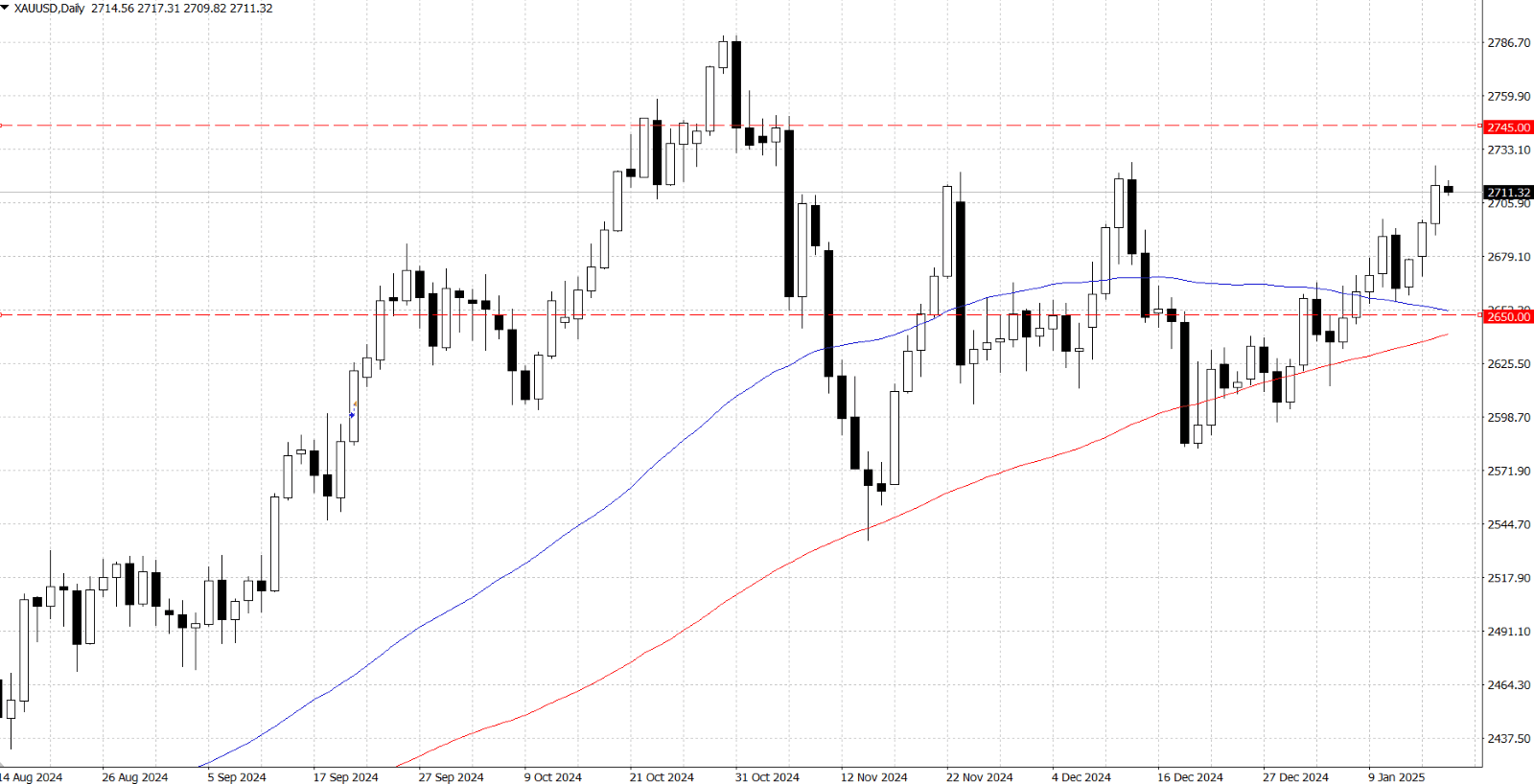

From a technical standpoint, Gold's daily chart displays positive oscillators, favouring bullish traders and suggesting potential for further gains. However, sustained strength above the $…-$… supply zone is needed to confirm a bullish breakout. If cleared, Gold could target $…, followed by $…-$…, and potentially challenge the all-time high of $… from October 2024. On the downside, initial support lies at $…-$…, with further pullbacks likely to attract buyers near $…-$…. A breach below this pivotal zone could expose Gold to the $… level, with $…—bolstered by the 100-day EMA and a short-term ascending trendline from November lows—serving as a critical confluence area to limit deeper corrections.