Article by: ETO Markets

The gold market is experiencing significant pressure following the Federal Reserve's hawkish signals regarding future rate cuts. While the Fed has implemented its third consecutive rate cut, officials now project fewer rate reductions for 2025 than previously anticipated - only two 25bp cuts versus the earlier forecast of four. This hawkish tilt, combined with rising US Treasury yields reaching multi-month highs, supports USD strength and weighs on the non-yielding metal. However, ongoing geopolitical tensions, including the Russia-Ukraine conflict and Middle East unrest, continue to provide underlying support through safe-haven demand.

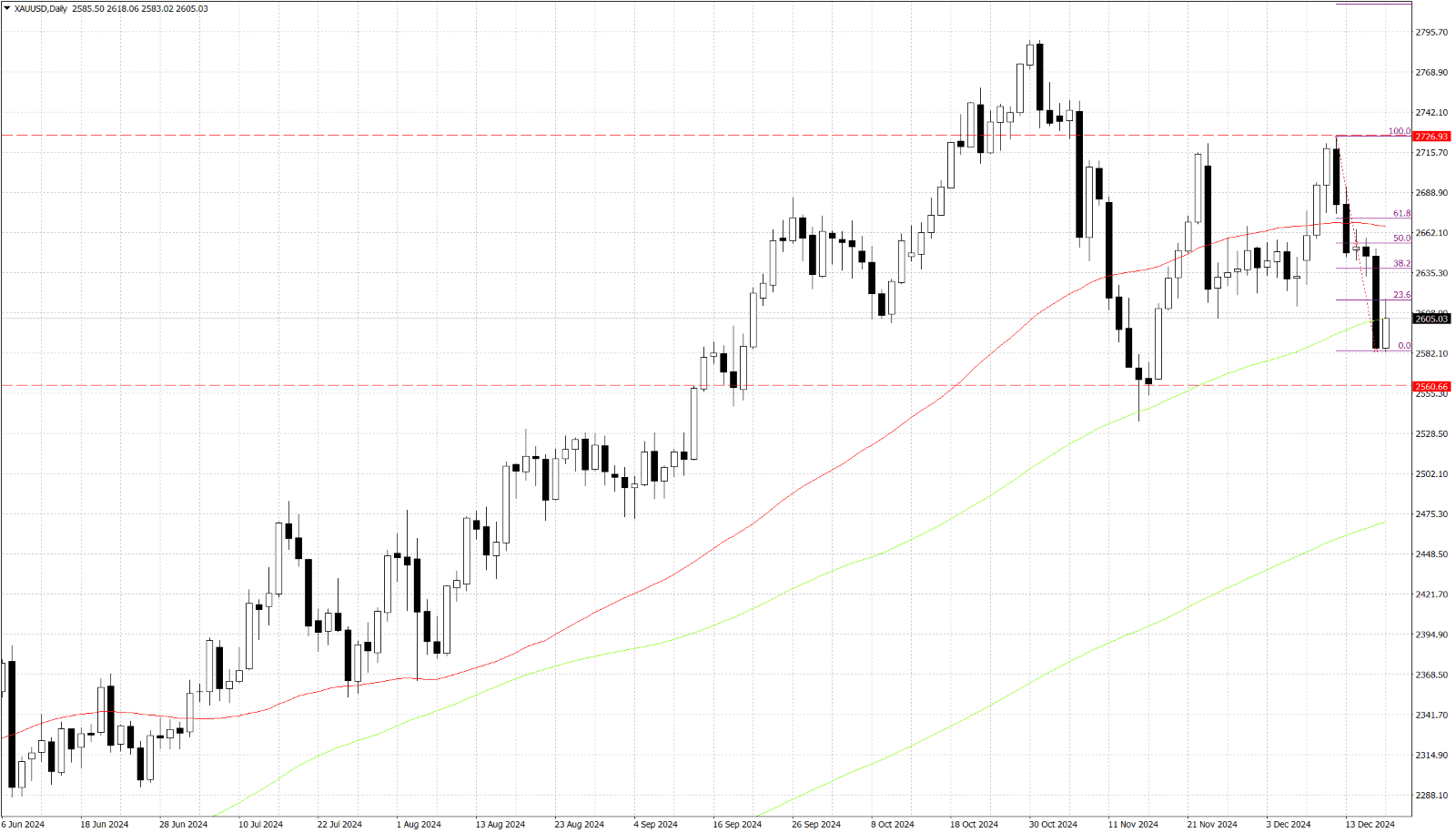

The gold price structure has turned notably bearish after breaking below the crucial 100-day Simple Moving Average for the first time since February 2024, confirming a significant technical deterioration. The recent price action shows a clear rejection from the $… resistance level, followed by a sharp decline below the critical $… support zone. Momentum oscillators are gaining negative traction, suggesting further downside potential. The immediate focus is on the $… support level, while any recovery attempts are likely to face strong resistance at $…, the 23.6% Fibonacci retracement level. The overall technical setup indicates that sellers maintain control below the 100-day Simple Moving Average.