Article by: ETO Markets

Gold prices (XAU/USD) faced some selling pressure during the Asian session on Wednesday, partially erasing the previous day's strong gains near record highs. The decline was driven by profit-taking amid a generally positive risk sentiment, which reduced demand for safe-haven assets. However, concerns over former US President Donald Trump’s tariff policies continue to support gold prices. Additionally, expectations of further interest rate cuts by the Federal Reserve, fuelled by disappointing US Retail Sales data and mixed inflation signals, limit the US Dollar's recovery and provide a floor for gold. Fed Funds Futures indicate a 40-basis point rate cut by year-end, keeping traders cautious ahead of the Federal Open Market Committee (FOMC) meeting minutes. Investors are closely watching these minutes for insights into the Fed’s monetary policy outlook, particularly regarding interest rate cuts, which could influence gold’s price movement.

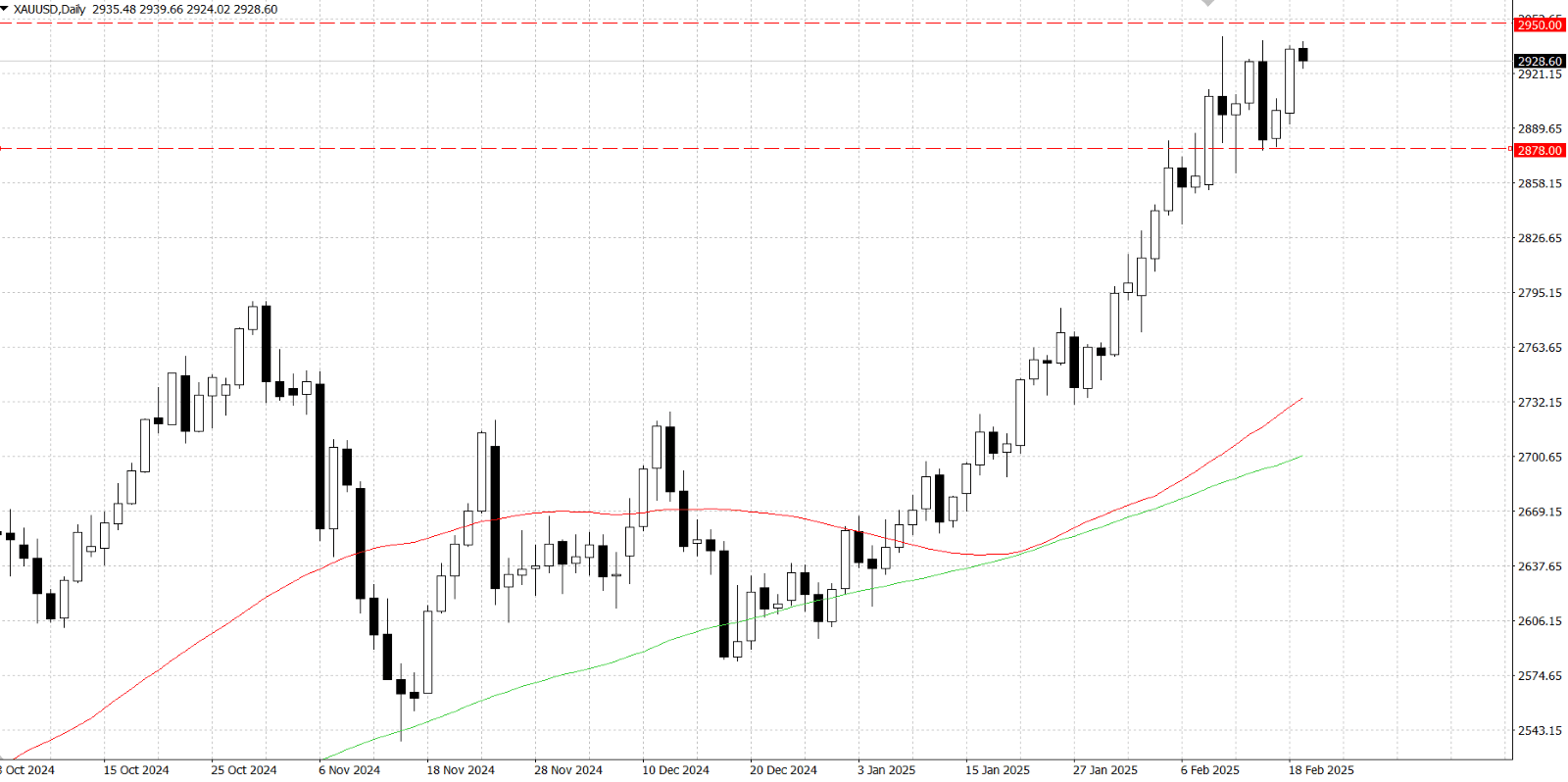

From a technical perspective, gold's current range-bound movement suggests a bullish consolidation following its recent rally to an all-time high. The daily RSI remains near overbought levels, indicating the possibility of continued consolidation, but the overall bias still favours the upside. Key support levels are seen at $…, with additional support around $… and the $…-$… zone. A decisive break below these levels could trigger technical selling, potentially dragging XAU/USD towards $…, $…, and further down to $…. On the upside, the $… region remains a strong resistance level. A breakout above this could fuel further bullish momentum, reinforcing the ongoing uptrend observed over the past two months.