Article by: ETO Markets

The price of gold (XAU/USD) has continued to fall this week amid the strengthening of the US dollar. Gold prices were lower for a third straight day through Friday, reflecting the dollar's extended rally from a more than four-month low the previous day. The fall was mainly due to the sharp depreciation of the euro as a result of ECB policy, which in turn pushed up the dollar. In addition, profit-taking has also contributed to the correction in gold prices to some extent, especially in the context of gold prices having risen more than 6.5% since the beginning of the month. Despite the pullback, expectations that the Federal Reserve may cut interest rates in September provided some support for gold. On Thursday, jobless claims data from the Bureau of Labor Statistics showed a loosening in the U.S. labor market and signs of easing inflation pressures, factors that support the Fed's upcoming rate-cutting cycle. The consensus is for a 100 percent chance that the Fed will cut rates in September and possibly two more before the end of the year. These factors make non-yielding gold more attractive in the market and are expected to limit further losses.

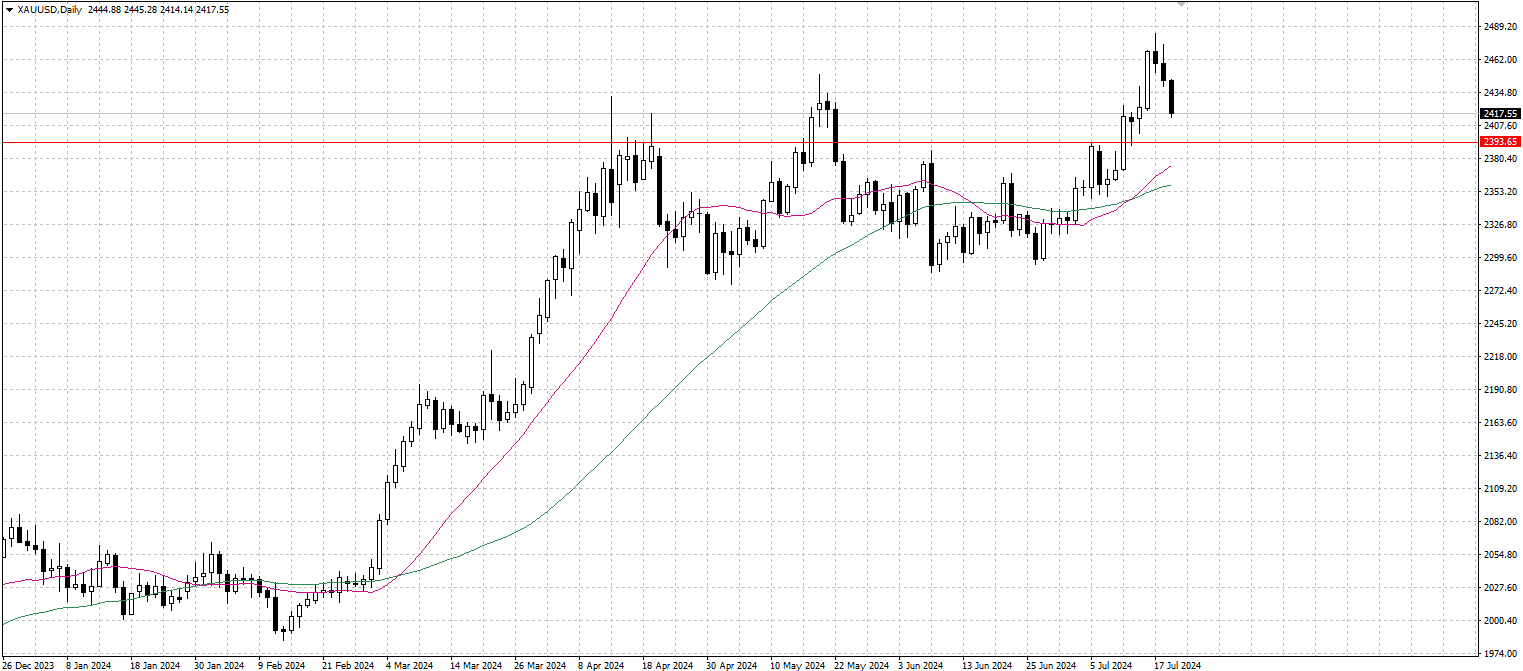

From a technical point of view, there is strong support around the $…-…area. A break below this level could trigger further technical selling, targeting the 50-day Simple Moving Average (SMA) support, which is currently around the $…-…area. A sustained break below this support could lead to a further dip to the $… area of the 100-day SMA and some intermediate support near the $…- $… area. On the other hand, gold saw immediate resistance near the Asian session high of $…. A break above this level could see gold climb further to the $…-… region. Given that the volatility indicator on the daily chart remains in positive territory, bulls could retest the all-time high, the $…-… area, and look to break through the psychological $… level.