Article by: ETO Markets

As the dollar edged back from a one-week high, gold attracted new buyers and regained positive momentum on the back of safe-haven demand. Concerns about a slowdown in the world's two largest economies - the United States and China - combined with rising geopolitical tensions in the Middle East have provided support for gold prices. In addition, the Fed's upcoming policy meeting is expected to point to a 50 basis point rate cut, which further weakened the dollar and limited the downside for non-yielding gold. However, the recovery in US Treasury yields has supported the dollar and could put pressure on higher gold prices.

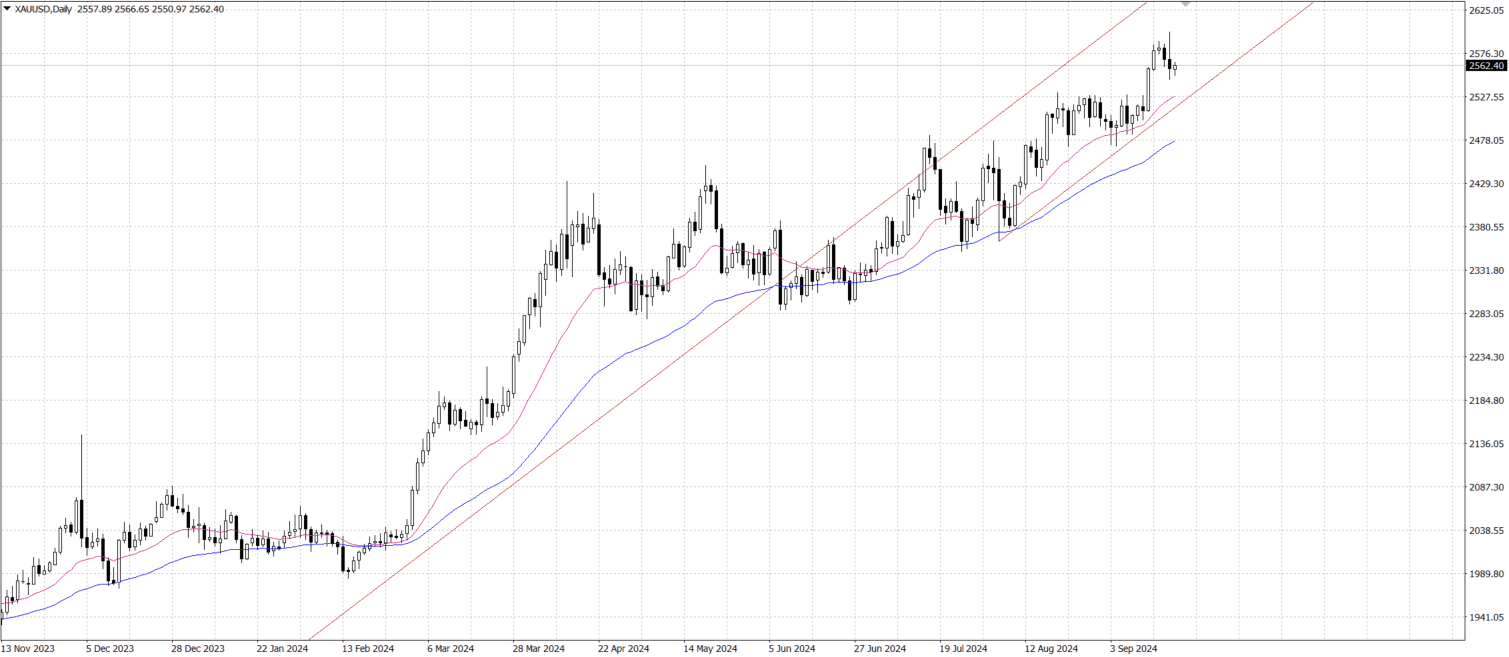

Technically, gold is well supported around the $…-… area, indicating that the bulls still have the upper hand. If gold continues to move lower, the $…- $… area will be a key support level, a break below which could lead to a further dip to the psychological $… level and even an extension to the $… support level. However, if gold breaks through the resistance in the $…-… area, it could move further up to challenge the all-time high of $… and could even test the trend channel resistance of $…- $…, thus continuing gold's strong uptrend.