Article by: ETO Markets

Gold has edged slightly higher in early European trade but remains capped below the former $3,260–3,265 support zone—now acting as resistance—reflecting a lack of bullish conviction even as the dollar, having paused a three-day rally at a three-week peak, offers support to the non-yielding metal. Optimism over a potential de-escalation in US–China trade tensions—underscored by Beijing’s confirmation of fresh US overtures to negotiate tariffs—has buoyed risk sentiment and lent strength to the greenback, while traders brace for this Friday’s US Nonfarm Payrolls report for further Fed policy clues. Recent US data have fueled dovish Fed expectations: first-quarter GDP unexpectedly contracted for the first time since 2022, the PCE Price Index showed easing inflation, the ADP survey signaled a cooling labor market, initial jobless claims rose to 241,000 (their highest since February), and the ISM Manufacturing PMI held in contraction at 48.7 in April. Against this backdrop, markets price in four quarter-point rate cuts by year-end and anticipate April’s payrolls to rise by 130,000 (down from 228,000 in March), with the unemployment rate steady at 4.2% and average hourly earnings up 0.3%.

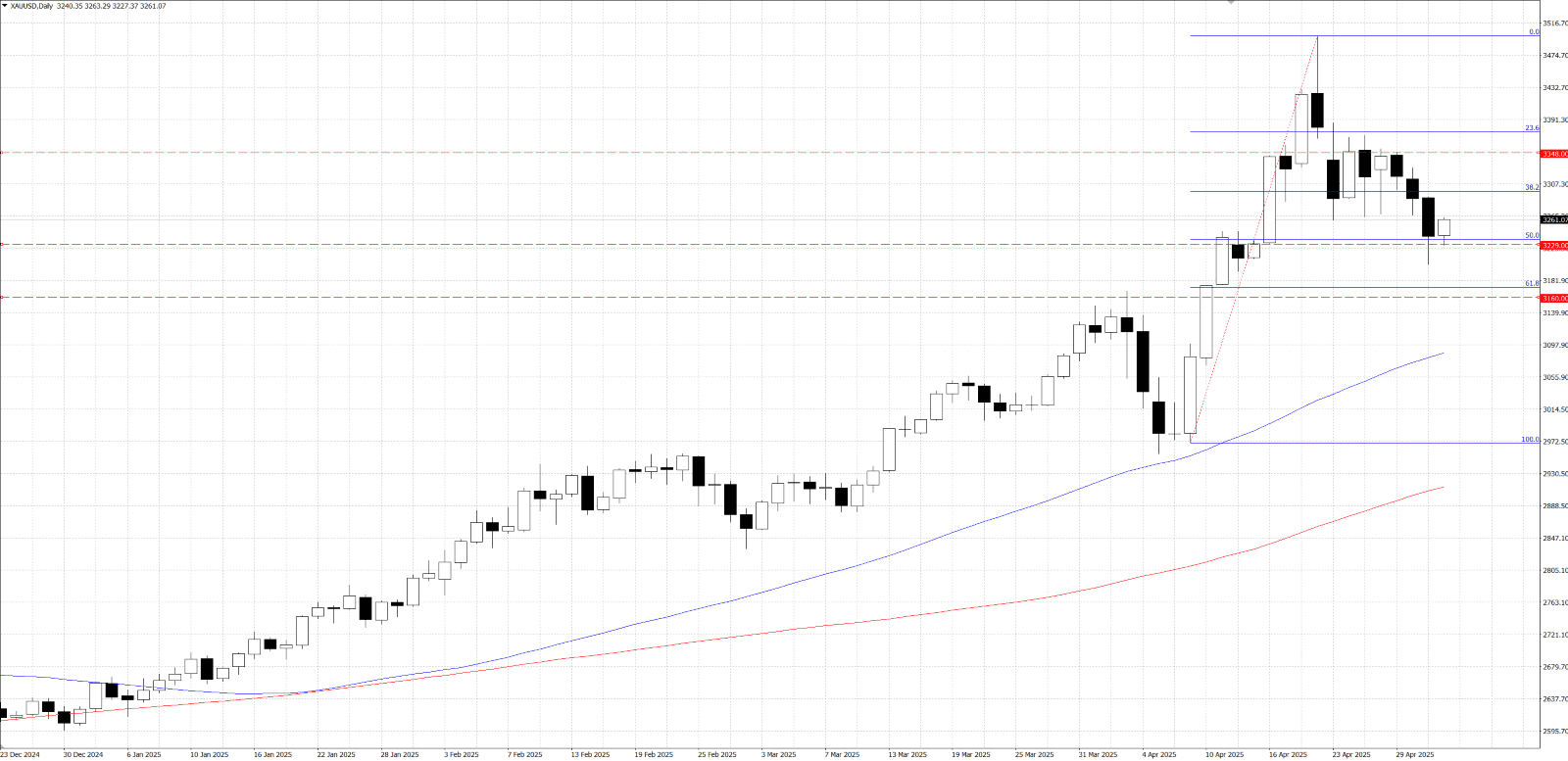

From a technical perspective, yesterday’s failure to hold the $…–… zone—and the 50% retracement of the rally from the mid-$…—provided fresh impetus for bears, yet daily oscillators, while rolling over, have not fully turned negative, prompting short-covering and propping up prices. In the near term, the former support at $…–… now acts as resistance and must be reclaimed before any real upside can materialize; a clear break there would initially target $…, a pivotal level whose breach could open the door to the $…–… supply zone. Further follow-through buying above that area would indicate that the corrective pullback from the all-time high has likely run its course and could drive gold toward $…–… to test $…. Conversely, on the downside, the 50% retracement around $…–… offers initial support ahead of yesterday’s low near $…–…; a decisive break below that swing bottom would reinforce bearish momentum and expose gold to a drop toward the $…round figure and potentially down to the 61.8% retracement near $….